- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Square, Inc. is continuing to Grow and Expand their Business Model

Square, Inc. ( NYSE:SQ ) is transforming into an integrated service that aims to take-over how businesses process payments, develop eCommerce and transfer funds.

They are providing effective and low cost software and equipment for business payment processing.

Square also owns the Cash App, allowing people to easily transfer money.

Recently, Square has been involved with the development of Weebly, a website builder with blended payment processing functionality backed by Square. This aims to give small businesses and entrepreneurs a better option to develop their own eCommerce store or platform. The concept looks great, as businesses use Square to create their own site, the payment processing will be handled from the company.

Now lets dive into the current performance of Square and see the direction of progress.

On last quarter’s results, revenues beat expectations by 51%, and quarterly sales of US$5.1b generated a statutory profit of US$0.08 - a pleasant surprise given that the analysts were forecasting a loss!

Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual.

Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Square after the latest results.

See our latest analysis for Square

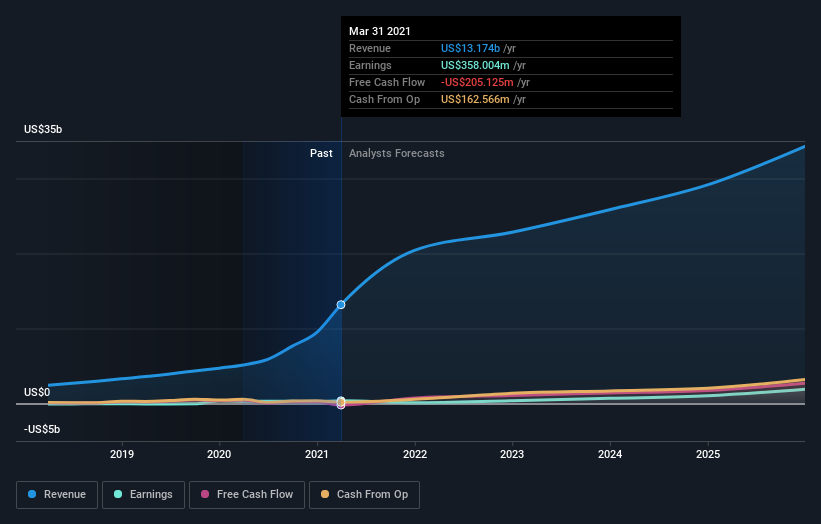

NYSE:SQ Earnings and Revenue Growth, June 2021

NYSE:SQ Earnings and Revenue Growth, June 2021Following the latest results, Square's 34 analysts are now forecasting revenues of US$20.4b in 2021. This would be a substantial 55% improvement in sales compared to the last 12 months.

There's been no major changes to the average price target of US$274, suggesting that the improved earnings per share outlook is not enough to have a long-term positive impact on the stock's valuation.

It is always more revealing for investors to look at the range of estimates to see if there are any diverging opinions on the company's valuation.

Currently, the most bullish analyst prices Square at US$380 per share, while the most bearish puts it at US$89.

With such a wide range in price targets, analysts are almost certainly betting on widely divergent outcomes in the underlying business.

It's clear from the latest estimates that Square's rate of growth is expected to accelerate meaningfully, with the forecast 79% annualized revenue growth to the end of 2021 noticeably faster than its historical growth of 42% per year, over the past five years.

By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 14% per year.

It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Square to grow faster than the wider industry.

Key Takeaways

Square is currently in the high growth phase of the business. The company is still integrating its business model and will have the opportunity to test out massive market adaptation of their current and new services in the future.

They seem to be making smart business decisions and powering through growth without excesses in risk.

Fortunately, they also reconfirmed their revenue numbers, suggesting sales are tracking in line with expectations - and our data suggests that revenues are expected to grow faster than the wider industry.

The statutory profit of US$0.08 per share is too volatile to provide a meaningful trend for investors.

With no real change to the average price target, the intrinsic value of the business has not undergone any major changes.

However, before you get too enthused, we've discovered 4 warning signs for Square (2 are potentially serious!) that you should be aware of.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)