- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Beneath the Surface of Square Inc’s (NYSE:SQ) Huge Revenue Beat Last Week

Square Inc ( NYSE:SQ ) has been a talking point in the investment universe lately and it’s not hard to see why. The stock price is up more than five-fold from its March lows of around $35 to more than $175 recently, and the last few months have been particularly volatile for the stock. Considering the majority of the company’s offering is focused on helping small businesses with their operations, Square has done well to not only survive the turbulent year so far but actually thrive. We can attribute a lot of the recent success to the fast growth of the consumer-facing side of the business, which is the company’s Cash App, but we will get into that later.

Why is Square’s stock price moving

Square posted its Q3 earnings result on November 5th, and on virtually all fronts, its performance smashed estimates of growth out of the park. Unsurprisingly, the stock price jumped around 13% following the release.

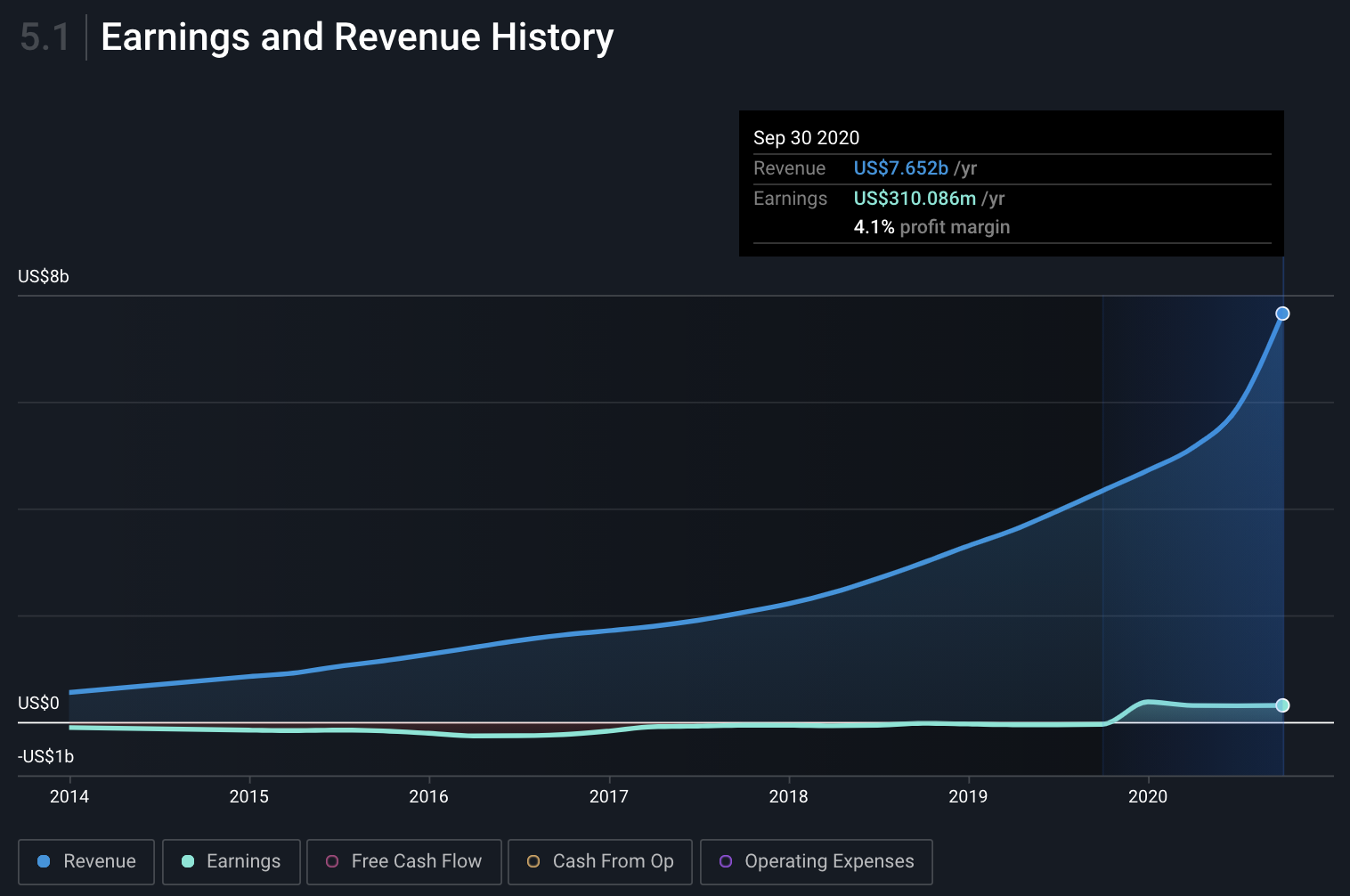

This growth was most notable in Square’s revenue, where the company recorded $3.03bn for the third quarter, which surpassed analysts’ estimates of $2.08bn by around 45%. Below is a chart of Square’s revenue and earnings, including the third-quarter results.

NYSE:SQ Earnings and Revenue history to 30 September 2020. Source Simply Wall St

While this looks impressive, it’s worth delving deeper into the number to get a better picture of how impactful this is to the underlying business and how the company was able to post such impressive revenues.

Check out our latest analysis of Square Inc

Bitcoin was the driving force, but there’s a catch

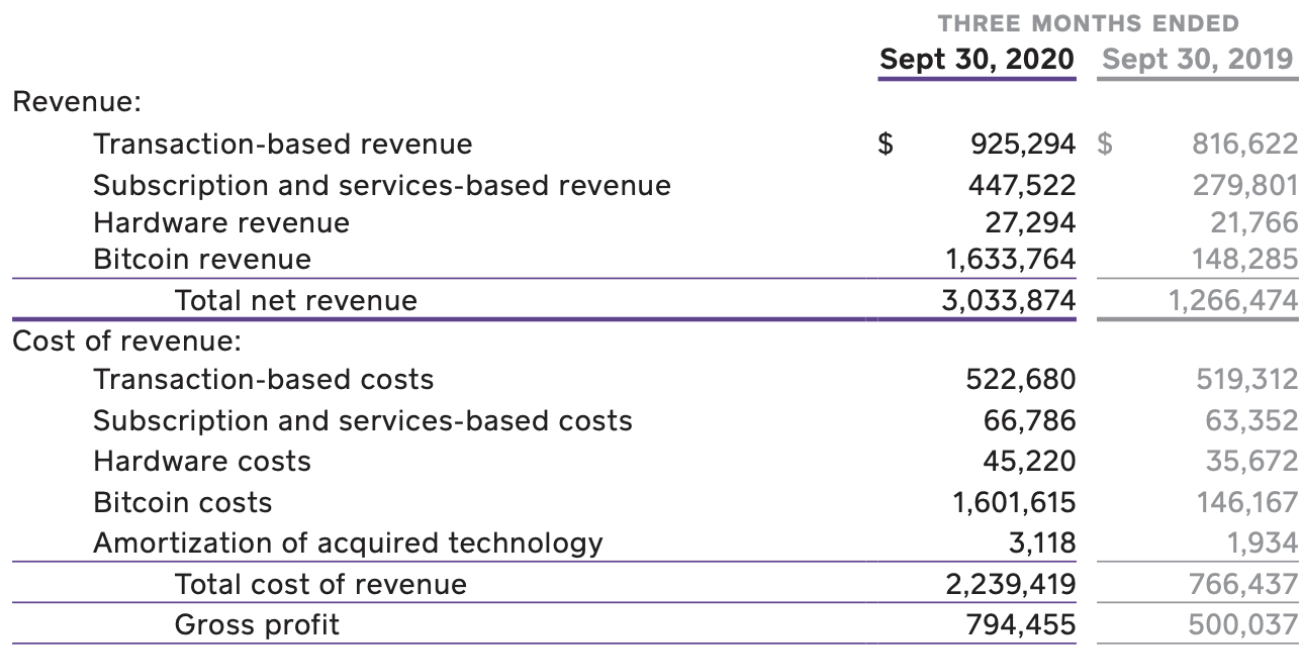

Looking at the results more closely, we can see that bitcoin revenue has surged dramatically from the same quarter last year. At that time, revenue from bitcoin was about US$148m, whereas this quarter it was US$1.63bn, a staggering 1,101% increase in only 12 months. As a result, the quarterly revenue for the company as a whole increased 140% on last year’s figure.

However, despite the astonishing growth, this Bitcoin revenue is not likely to lead to a meaningful increase in Square’s profits. A difference in the accounting treatment for bitcoin revenues compared to the company’s Gross Payment Volume (GPV) has led to the revenue growth looking a lot better than it is.

NYSE:SQ - Consolidated Statements of Operations - Q3 2020

In its quarterly letter to shareholders, Square states that “ bitcoin revenue is the total sale amount of bitcoin to customers. Bitcoin costs are the total amount of bitcoin that we purchase. We purchase bitcoin to facilitate customers’ access to bitcoin ”.

Meaning, rather than acting as a traditional broker and simply providing a platform for the user to buy bitcoin without involving Square, the company actually buys the bitcoin for the user and the user pays Square for the bitcoin, plus any fees associated with the transaction.

Or to put it another way - due to a quirk in accounting policies, Square records the total dollar value of bitcoin sold as revenue, because users are paying the company for the bitcoin. However, for transactions using the Cash App and Seller Ecosystem, Square records only its fee as revenue, rather than the dollar value of total transactions they process. So while Square sold $1.63bn bitcoin (including fees) to users and recorded it as revenue, the GPV on the Cash App and Seller Ecosystem was USD $2.85bn and USD $28.84bn respectively, both of which aren’t recorded as revenue. Simply put; the two types of revenues are not comparable to each other and the reported growth due to bitcoin revenues is a bit illusory in that sense. Thankfully, Square recognizes this and makes an effort to clarify in their reports what their figures are when you include and exclude bitcoin.

Additionally, it’s worth noting that while Square’s revenue from the service has skyrocketed, it consequently means their costs associated with that offering have followed suit. Because as mentioned, Square needs to purchase the coins to facilitate access. To put it in perspective, the section above from the company’s quarterly report shows bitcoin revenue was USD $1.63bn for the quarter, while its bitcoin costs were USD $1.60bn, meaning 2% gross margins, which are very slim on anyone’s account.

Bitcoin vs Square's core business

While the ability to purchase bitcoin through the Cash App is a nice additional feature for users, it isn’t Square’s core business. Nor is it the driving force behind the company’s profitability, since it only contributed USD $32m (or 4%) to the USD $794m gross profit for the third quarter, despite being 53% of total revenue.

When we compare the bitcoin gross profit margins with the rest of Square’s business, it starts to pale in comparison. More specifically, Cash App derives gross profit margins of an amazing 81% and the Seller Ecosystem earns a solid 42%.

If we exclude the bitcoin revenue, the Cash App and the Seller Ecosystem contributed 32% and 68% to the company’s revenue respectively. Importantly, the Cash App is growing revenue hand over fist at 174% year-on-year (YoY) meanwhile, Seller Ecosystem revenue only grew 5%. So if Cash App maintains this growth, this revenue split will likely be very different in a few years.

Interestingly, if you exclude the bitcoin revenue, the company’s revenue only increased by 25% YoY, which is substantially less than the 140% reported in many of the headlines. What we can see here is that while revenue is surging, a large portion of it is this unique bitcoin revenue, which should be interpreted more as GPV than revenue, per see.

The key takeaway

At a product level, Square’s operations appear quite profitable, and in the case of the Cash App, they’re growing very quickly. However, what we’ve learned here is that headline figures can sometimes be deceptive. In Square’s case, we learned that the bitcoin revenue is causing the topline to grow incredibly quickly, but this growth should be taken with a grain of salt because of how little it adds to the bottom line. While the underlying business is still performing well, it’s just worth being aware of these nuances.

If you’re interested in finding other companies that are experiencing high growth, it’s worth knowing Square isn’t alone. We’ve made a list of other popular and high growth US companies that might be worth the hype , which you can check out by clicking the link.

When trading Square Inc or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers . You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.

Neither Simply Wall St analyst Michael Paige nor Simply Wall St hold any position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion