- United States

- /

- IT

- /

- NYSE:SNOW

Why Snowflake (SNOW) Is Down 8.9% After Expanding Its Anthropic AI Partnership And Enterprise Push

Reviewed by Sasha Jovanovic

- In early December 2025, Snowflake reported third-quarter fiscal 2026 results with US$1.21 billion in sales, narrower net losses, and new AI-focused collaborations with Accenture, Anthropic, and Safe Software to deepen enterprise data and generative AI adoption on its AI Data Cloud platform.

- The expanded US$200 million Anthropic partnership, which brings Claude models deeper into Snowflake’s governed environment, aims to accelerate production-grade AI agents for highly regulated industries by combining advanced reasoning with secure access to sensitive enterprise data.

- Next, we’ll examine how Snowflake’s expanded Anthropic collaboration may reshape its investment narrative around enterprise AI demand and monetization.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Snowflake Investment Narrative Recap

To own Snowflake, you need to believe its AI Data Cloud can turn growing enterprise AI and analytics demand into durable, usage based revenue despite intense competition and ongoing losses. The latest results and expanded Anthropic partnership reinforce AI as the key near term catalyst, while the biggest risk remains whether Snowflake can convert its many AI features into broad, profitable monetization rather than one off migration and pilot spikes.

The US$200 million Anthropic expansion looks especially relevant, because it positions Claude at the core of Snowflake Intelligence and Cortex AI, directly targeting enterprise AI agents and regulated industry workloads that underpin the current AI driven growth story.

Yet for investors, the real concern is how quickly these AI agents translate into sustainable product revenue before...

Read the full narrative on Snowflake (it's free!)

Snowflake's narrative projects $7.8 billion revenue and $497.5 million earnings by 2028. This requires 23.8% yearly revenue growth and about a $1.9 billion earnings increase from -$1.4 billion today.

Uncover how Snowflake's forecasts yield a $272.69 fair value, a 19% upside to its current price.

Exploring Other Perspectives

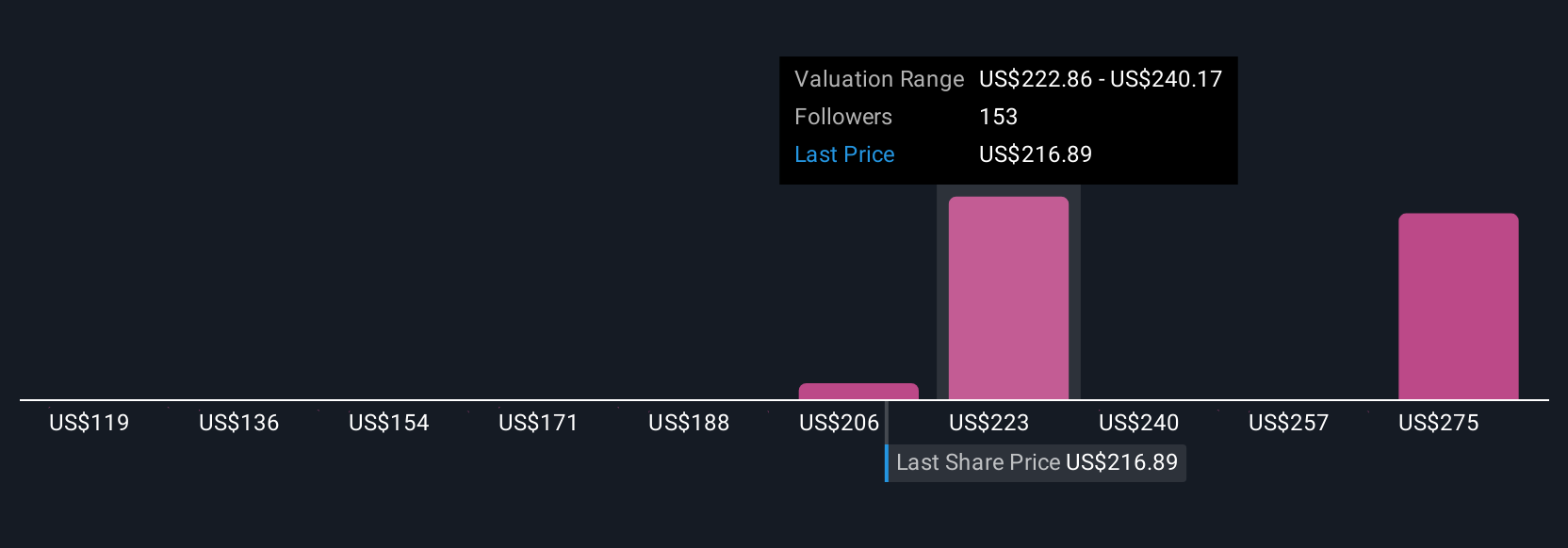

Thirteen Simply Wall St Community valuations for Snowflake span about US$114 to US$273 per share, showing how far apart individual views can be. You are weighing those opinions against a business where AI monetization is still early and competition from hyperscalers and specialists could affect how much of that projected revenue growth actually materializes.

Explore 13 other fair value estimates on Snowflake - why the stock might be worth as much as 19% more than the current price!

Build Your Own Snowflake Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Snowflake research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Snowflake research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Snowflake's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026