- United States

- /

- IT

- /

- NYSE:SNOW

The Correction in Snowflake’s (NYSE:SNOW) Price has Brought the Valuation back to a Reasonable Level

Snowflake Inc’s ( NYSE:SNOW ) share price has shown relative strength over the last week, so we decided to revisit the valuation, which we last looked at in August . Snowflake has become a popular stock in the cloud data industry, and is notable because it’s one of very few tech companies held by Berkshire Hathaway ( NYSE: BRK.A ). The share price fell more than 40% between November and late January, but has since gained nearly 25%, outpacing the Nasdaq index.

Check out our latest analysis for Snowflake

What is Snowflake worth?

Our DCF model puts the estimate of Snowflake’s value at $402, and implies the share is about 27% undervalued. This estimate is based on analyst forecasts - so it’s only as accurate as those forecasts and the discount rate used in the calculation. Nevertheless it gives us a reference point to work with.

Back in August when we ran the calculation it suggested a fair value of $128, when the stock was trading at more than double that value, at $266. Since then analyst forecasts have risen significantly following the last two earnings releases. Analysts are also expecting Snowflake’s to report positive EPS sooner. These adjustments have resulted in our fair value estimate rising 200% in six months, implying that investors were correct to pay up in early 2021.

Can we expect growth from Snowflake?

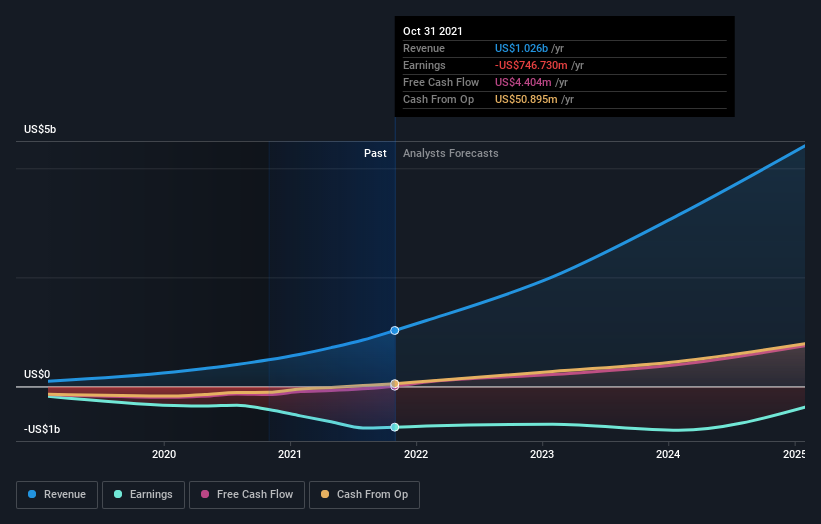

As the chart illustrates, Snowflake is now cash flow neutral, although the company is still reporting a net loss. The difference between the cash flow and net income figures is mostly the result of stock based compensation.

Snowflake’s revenue growth is expected to slow gradually over the next few years, with modest estimates when compared to growth rates of 173%, 123% and 109% over the last three years. Earnings are expected to grow at 27%, but will probably be very sensitive to non-cash items.

What this means for you:

Snowflake appears to be reasonably priced, with fairly modest growth forecasts. Revenue growth has been well ahead of consensus estimates in the last two quarters which has resulted in forecasts being raised.

The company is due to report results for the fourth quarter results on 2nd March, with YoY revenue growth of 95% expected. Another beat or strong guidance could result in further upgrades from analysts. However, any sign of a faster than expected deceleration of growth could spook the market.

Shareholders, and potential investors, should also be aware that the high level of stock based compensation is likely to result in shareholder dilution. Shareholders have been diluted by 8% in the past year.

Keep in mind, when it comes to analyzing a stock it's worth noting all the risks involved. Every company has risks, and we've spotted a few more warning signs for Snowflake you should know about.

If you are no longer interested in Snowflake, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives