- United States

- /

- IT

- /

- NYSE:SNOW

Snowflake (NYSE:SNOW) is Stable and with Plenty of Cash to Drive Growth. Current Valuation may be a bit High

When looking at younger companies, we need to let them grow before analyzing their profit. And for a business to grow, it needs cash to fund operations and investments. That is why, it is crucial to see if Snowflake (NYSE:SNOW) has enough cash to fund multiple money losing years. By their own estimates, the company is expected to have 10% EBIT profitability by 2029, and we will evaluate their financial capacity until then.

In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Snowflake

When Might Snowflake Run Out Of Money?

A company's cash runway is calculated by dividing its cash hoard by its cash burn.

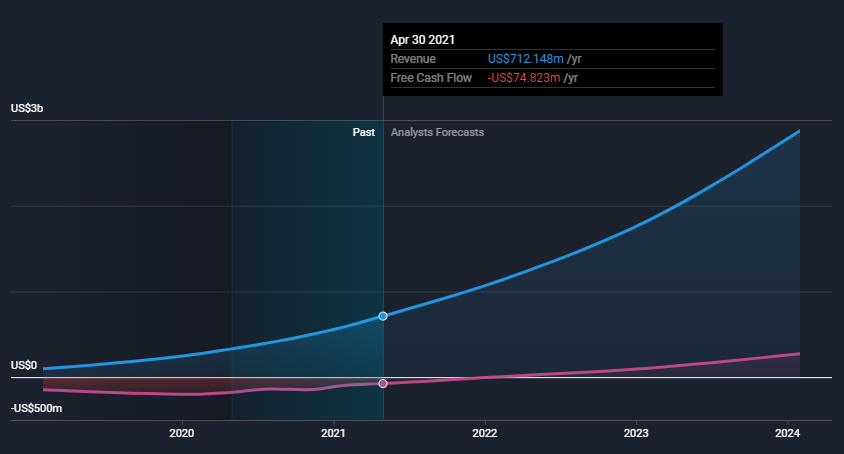

As of April 2021, Snowflake had cash of US$3.9b and no debt.

In the last year, its cash burn was US$75m.

That means it had a cash runway of very many years as of April 2021.

Notably, however, analysts think that Snowflake will break even (at a free cash flow level) before then. If that happens, then the length of its cash runway, today, would become a moot point.

You can see how its cash balance has changed over time in the image below.

It is very good to see that investors have been generous to Snowflake and by giving them more than US$3b in cash shows that they are willing to back Snowflake's business model. This should give the company plenty of flexibility to invest and develop in the future.

How Well Is Snowflake Growing?

Snowflake managed to reduce its cash burn by 58% over the last twelve months, which suggests that it decided to stabilize a bit.

It is also great to see that the revenue is up 116% in the same time period. Considering these factors, we're fairly impressed by its growth trajectory.

Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Snowflake To Raise More Cash For Growth?

Snowflake has made clear progress over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth.

Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth.

By looking at a company's cash burn relative to its market capitalization, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Snowflake has a market capitalization of US$81b and burnt through US$75m last year, which is 0.09% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

There may be a problem to consider with the company's valuation. Such a large Market Cap may be justified for companies that have US$5-10b in profits. However, currently Snowflake is on the path to reach US$10b in revenue by 2029 (page 17) - That is the top line, not profits. A five-year span can bring massive changes to an industry, including pressure from competition and reduction of margins.

It is somewhat risky to give a business way more credit than their intrinsic value, and some investors might be betting a bit early on Snowflake.

Key Takeaways

As you can probably tell by now, we're not too worried about Snowflake's cash burn.

For example, we think its revenue growth suggests that the company is on a good path, and it seems that the company is just starting its high-growth phase.

But it's fair to say that its cash burn reduction was also very reassuring, and we hope to see more of Snowflake operations being funded by organic growth.

There is however one dilemma concerning Snowflake. As with all good businesses, they garner a lot of attention from investors and their price can be somewhat inflated. In the case of Snowflake, it needs to deliver a few positive surprises in growth in order to justify the current market valuation, otherwise investors will need to wait longer to see their stock appreciate in value.

There's no doubt that shareholders can take a lot of heart from the fact that analysts are forecasting it will reach breakeven before too long. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. An in-depth examination of risks revealed 3 warning signs for Snowflake that readers should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:SNOW

Snowflake

Provides a cloud-based data platform for various organizations in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion