- United States

- /

- Software

- /

- NYSE:SEMR

Semrush Holdings, Inc. (NYSE:SEMR) Looks Just Right With A 26% Price Jump

Semrush Holdings, Inc. (NYSE:SEMR) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 34%.

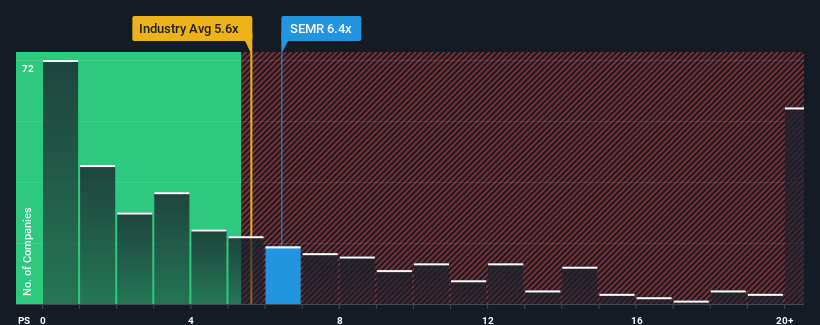

Although its price has surged higher, it's still not a stretch to say that Semrush Holdings' price-to-sales (or "P/S") ratio of 6.4x right now seems quite "middle-of-the-road" compared to the Software industry in the United States, where the median P/S ratio is around 5.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Semrush Holdings

How Semrush Holdings Has Been Performing

Recent times have been advantageous for Semrush Holdings as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Semrush Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Semrush Holdings' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. Pleasingly, revenue has also lifted 109% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 19% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 20% per annum, which is not materially different.

In light of this, it's understandable that Semrush Holdings' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Semrush Holdings' P/S Mean For Investors?

Semrush Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at Semrush Holdings' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Semrush Holdings, and understanding should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SEMR

Semrush Holdings

Develops an online visibility management software-as-a-service platform in the United States, the United Kingdom, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026