- United States

- /

- Software

- /

- NYSE:S

Is SentinelOne an Opportunity After Shares Drop 35% and Cybersecurity Demand Climbs?

Reviewed by Bailey Pemberton

If you're following SentinelOne, you're probably feeling a mix of curiosity and caution when it comes to what the stock does next. Over the past year, we've watched SentinelOne’s price carve out a tough journey: down 35.4% over twelve months and 25.5% so far this year. Even the last stretch hasn't offered much relief, with a dip of nearly 6% in the past week alone. Yet, with cybersecurity only growing in importance and investors closely eyeing market shifts, there’s good reason to keep SentinelOne on your radar.

So, why all the volatility? A lot of it comes down to shifting market sentiment about growth tech stocks and an evolving risk appetite among investors. After the technology sector’s impressive runs in past years, the market's focus seems to be shifting more toward value and profitability, leaving high-growth names like SentinelOne with steeper hills to climb.

Here's what might surprise you: despite its rough price chart, SentinelOne appears undervalued in 5 out of 6 key valuation checks. That gives it a valuation score of 5, a number that stands out among its peers. Whether this is a genuine bargain or just a value trap is worth some closer inspection.

Let’s walk through the different valuation tools that help us judge if SentinelOne’s current pricing makes sense. Plus, I’ll share a perspective at the end that goes even deeper than the usual methods, so stick around as we dig in.

Why SentinelOne is lagging behind its peers

Approach 1: SentinelOne Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those amounts back to today’s dollars. The idea is simple: what is SentinelOne worth now, based on what it should generate in free cash flow over time?

Currently, SentinelOne’s Free Cash Flow (FCF) sits at $12.27 million. Analysts and forecasting models expect this figure to expand meaningfully, with projections showing FCF could reach $215.94 million by 2028 and, using extrapolated projections, potentially as high as $634.40 million by 2035. All of these amounts are expressed in US dollars and reflect an expectation of substantial annual growth. Most analyst estimates cover only the next five years, with later years modeled by Simply Wall St’s extended methods.

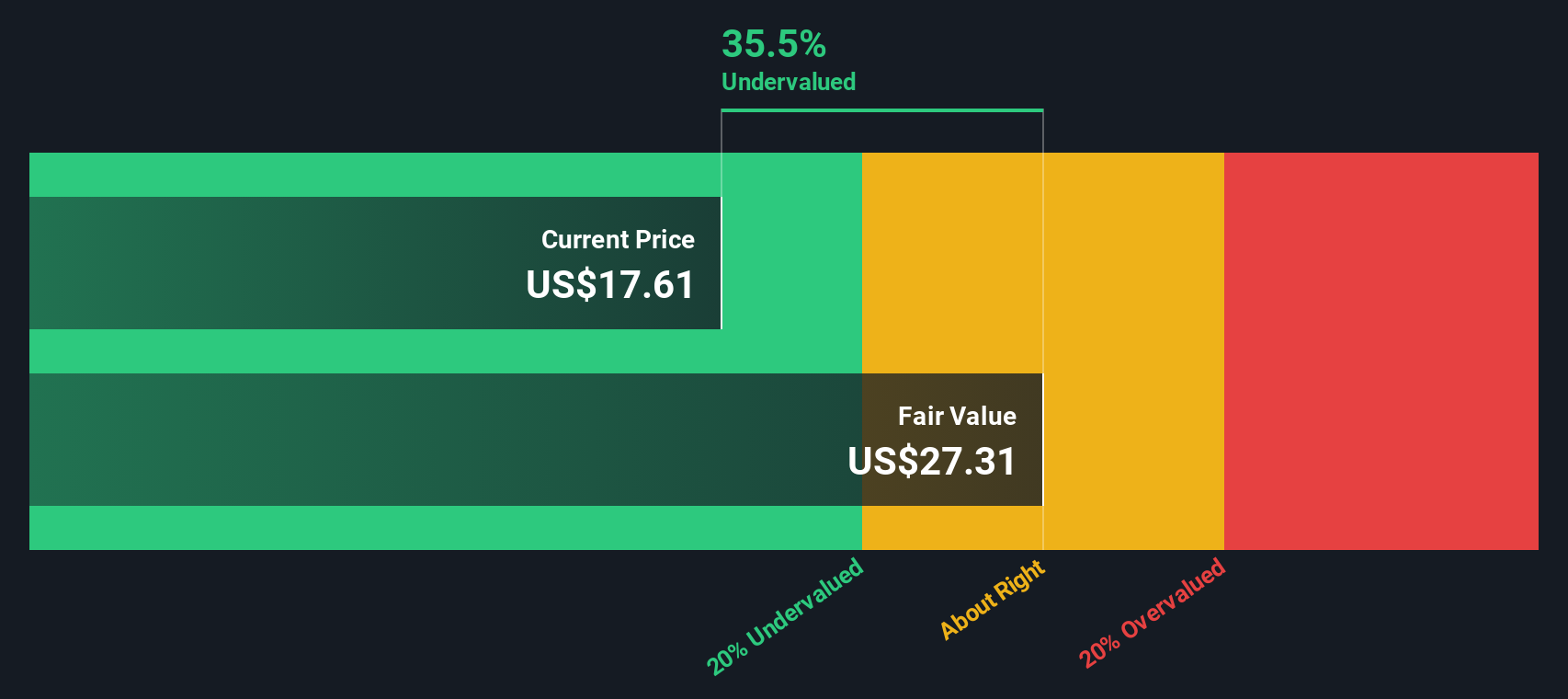

When all those predicted future flows are discounted back to the present, SentinelOne’s estimated intrinsic value comes to $22.79 per share. That is a 26.2% discount compared to its current stock price, implying the shares are significantly undervalued at this time.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SentinelOne is undervalued by 26.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: SentinelOne Price vs Sales

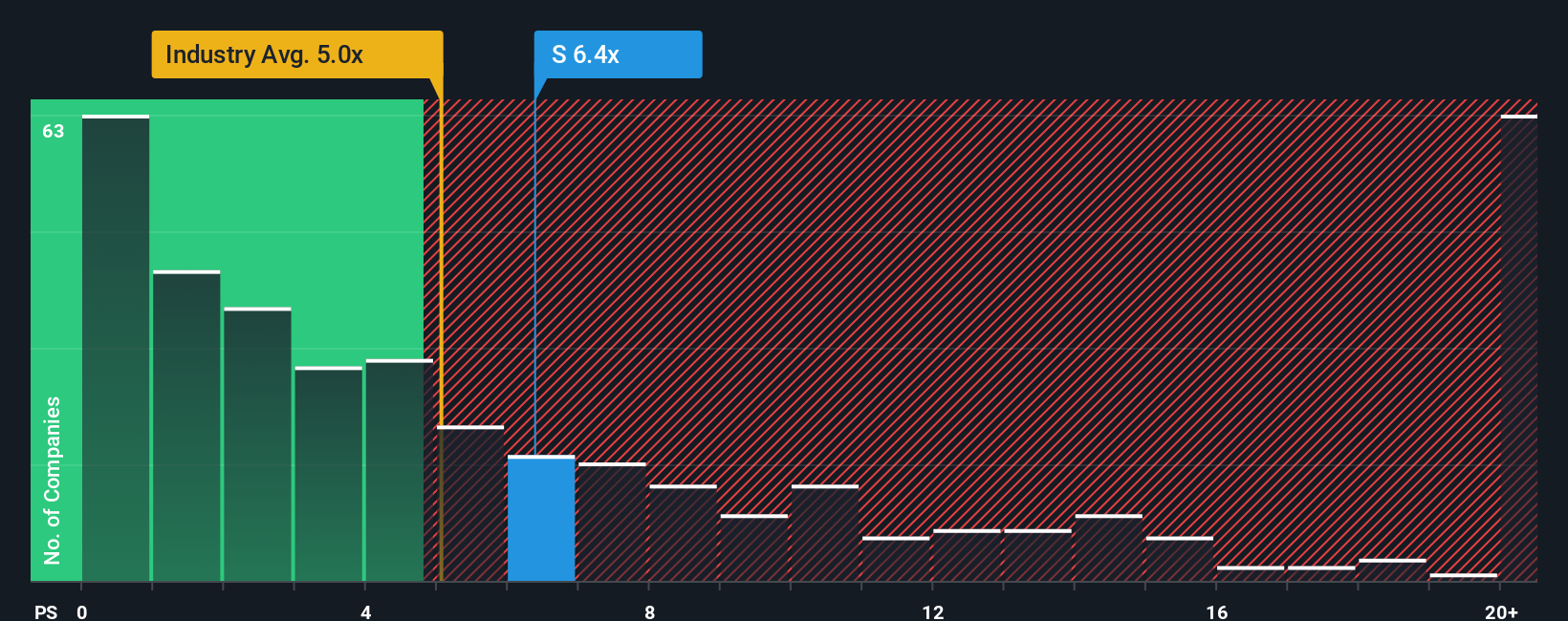

For growth-focused companies like SentinelOne that are not yet consistently profitable, the Price-to-Sales (P/S) ratio serves as a more reliable yardstick than earnings-based metrics. The P/S ratio helps investors gauge how much they are paying for every dollar of revenue, which is especially important when future profits are still uncertain but sales growth is strong.

Generally, a higher P/S ratio is justified when investors expect robust sales growth and lower risk; however, it can also signal over-optimism if expectations run ahead of actual performance. Conversely, a lower P/S might attract value-focused investors or reflect skepticism about a company's prospects.

SentinelOne currently trades at a P/S ratio of 6.2x. For context, the Software industry average sits at 4.9x, while peers average a much higher 10.1x. This highlights that the market still regards SentinelOne as a growth story, but not nearly as aggressively as its closest competitors. To offer a nuanced perspective, Simply Wall St calculates a “Fair Ratio” for SentinelOne of 7.1x, accounting for its growth, market position, risk profile, and other fundamentals. Unlike simple peer or industry comparisons, the Fair Ratio adapts to each company’s unique story and risk/reward balance, offering a more holistic view of value.

With SentinelOne’s P/S just below its Fair Ratio, the stock appears to be modestly undervalued at current levels.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SentinelOne Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful tool for investors to capture their own perspective on a company by telling its story, making key assumptions about future revenue, margins, and what they believe is a fair value. This approach allows investors to go beyond following the numbers blindly by linking them together with reasoning and expectations.

Narratives connect the company’s unique story to a quantified financial forecast and ultimately to a fair value, giving you a complete picture from vision to valuation. Best of all, they are easily accessible to everyone through the Community page on Simply Wall St, a platform trusted by millions of investors.

With Narratives, you can see at a glance whether SentinelOne looks attractively priced by comparing its up-to-date Fair Value (based on your or the community’s view) to the current market price. This can help you recognize opportunities to buy, hold, or sell. Each Narrative is dynamic and updates automatically as new financial results or major news emerge, keeping your analysis relevant.

For example, some SentinelOne Narratives see massive upside and value the company at $30 per share, while others take a much more cautious view and estimate fair value closer to $19, based on different outlooks for AI, competition, and margin improvement.

Do you think there's more to the story for SentinelOne? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:S

SentinelOne

Operates as a cybersecurity provider in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives