- United States

- /

- Software

- /

- NYSE:RBRK

Can Rubrik's (RBRK) Expanded AI Partnerships Deepen Its Edge in Enterprise Cloud Security?

Reviewed by Sasha Jovanovic

- In recent days, Rubrik introduced Intelligent Business Recovery for Microsoft 365 and DevOps Protection for Azure DevOps and GitHub, alongside integrating Rubrik Agent Cloud with Microsoft Copilot Studio and announcing a strategic collaboration agreement with Amazon Web Services.

- These developments mark a significant expansion in Rubrik’s AI-driven data security offerings, enhancing its positioning in enterprise cyber resilience and cloud-based recovery for mission-critical workloads.

- We'll explore how Rubrik's stronger AI-powered recovery and collaboration with AWS and Microsoft may influence its investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Rubrik Investment Narrative Recap

To be a Rubrik shareholder, you likely need confidence in the company’s ability to capture a larger share of enterprise cloud and AI-driven security spending, amid strong competition and ongoing unprofitability. The recent expansion of Rubrik’s AI-powered recovery and key partnerships with AWS and Microsoft could bolster near-term customer adoption, a catalyst that may temper the current risk tied to the early-stage adoption of AI and cloud strategies, though there’s no immediate signal of a material shift in risk profile for now. Of these announcements, the new Rubrik Intelligent Business Recovery for Microsoft 365 and DevOps Protection for Azure DevOps and GitHub stands out as essential to supporting Rubrik’s market catalyst: addressing real enterprise pain points around orchestrated, business-aware recovery, and placing Rubrik’s services front and center for organizations with distributed cloud operations. Such solutions reinforce Rubrik’s proposition as enterprises seek more robust, integrated approaches to operational resilience. However, against these product advances, investors should pay close attention to the risk that Rubrik’s AI and cloud transformation strategies are still early-stage and adoption delays could ...

Read the full narrative on Rubrik (it's free!)

Rubrik's outlook anticipates $2.0 billion in revenue and $257.3 million in earnings by 2028. Achieving this would require a 26.2% annual revenue growth rate and an earnings improvement of $782.1 million from current earnings of -$524.8 million.

Uncover how Rubrik's forecasts yield a $115.20 fair value, a 73% upside to its current price.

Exploring Other Perspectives

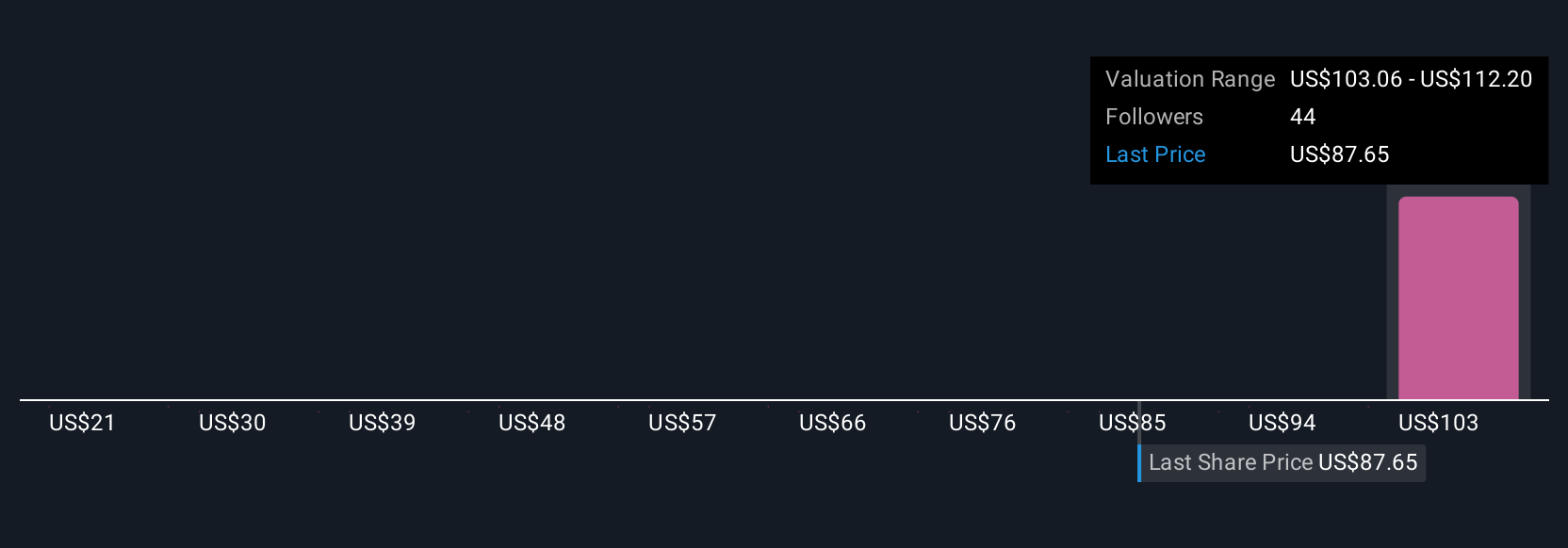

Across 11 Simply Wall St Community fair value estimates, views on Rubrik's future range widely from US$20.80 to US$115.20 per share. With cloud transformation still early, your outlook on adoption speed could shape very different expectations for Rubrik’s performance.

Explore 11 other fair value estimates on Rubrik - why the stock might be worth as much as 73% more than the current price!

Build Your Own Rubrik Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rubrik research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Rubrik research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rubrik's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBRK

Rubrik

Provides data security solutions to individuals and businesses worldwide.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives