- United States

- /

- Software

- /

- NYSE:RBRK

A Look at Rubrik's Valuation Following New Partnerships and AI Security Launches

Reviewed by Simply Wall St

Rubrik (NYSE:RBRK) is drawing fresh attention after expanding its partnership with Cognizant to deliver Business Resilience-as-a-Service, as well as launching its new Agent Cloud offering for managing enterprise AI agents.

See our latest analysis for Rubrik.

Momentum around Rubrik is building after these ambitious moves, with the share price returning 14.2% year-to-date and a striking 82.6% in total shareholder return over the past year. Recent headline partnerships and product launches are putting the company firmly on investors’ radar, even as the stock cools a bit from its earlier highs.

If these trends in enterprise software catch your attention, you might want to see what’s next for the AI and tech sector by checking out See the full list for free.

With investor enthusiasm still high after Rubrik’s partnership and product updates, the key question now is whether the current price reflects all future growth or if there is still an opportunity for investors to buy in at a value.

Most Popular Narrative: 34.2% Undervalued

Rubrik’s most widely followed narrative suggests its fair value sits well above the recent closing price. This reflects analyst optimism that the rally is only halfway done.

Rubrik's innovations and strategic cybersecurity focus enhance market share, revenue growth, and competitive positioning. At the same time, these efforts expand their total addressable market. Partnerships and enhanced recovery capabilities leverage enterprise needs, improving customer retention and profitability, which fuels earnings growth and extends their data security footprint.

Want to know what’s driving this bullish view? The forecast relies on explosive revenue acceleration and a profit trajectory that only bold software disruptors are expected to maintain. Find out which surprising future profit assumptions power analyst optimism in the full narrative.

Result: Fair Value of $115.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Rubrik’s growth relies on bold AI adoption and execution. As a result, tougher competition or slower enterprise cloud uptake could quickly challenge bullish forecasts.

Find out about the key risks to this Rubrik narrative.

Another View: Looking at Price-to-Sales

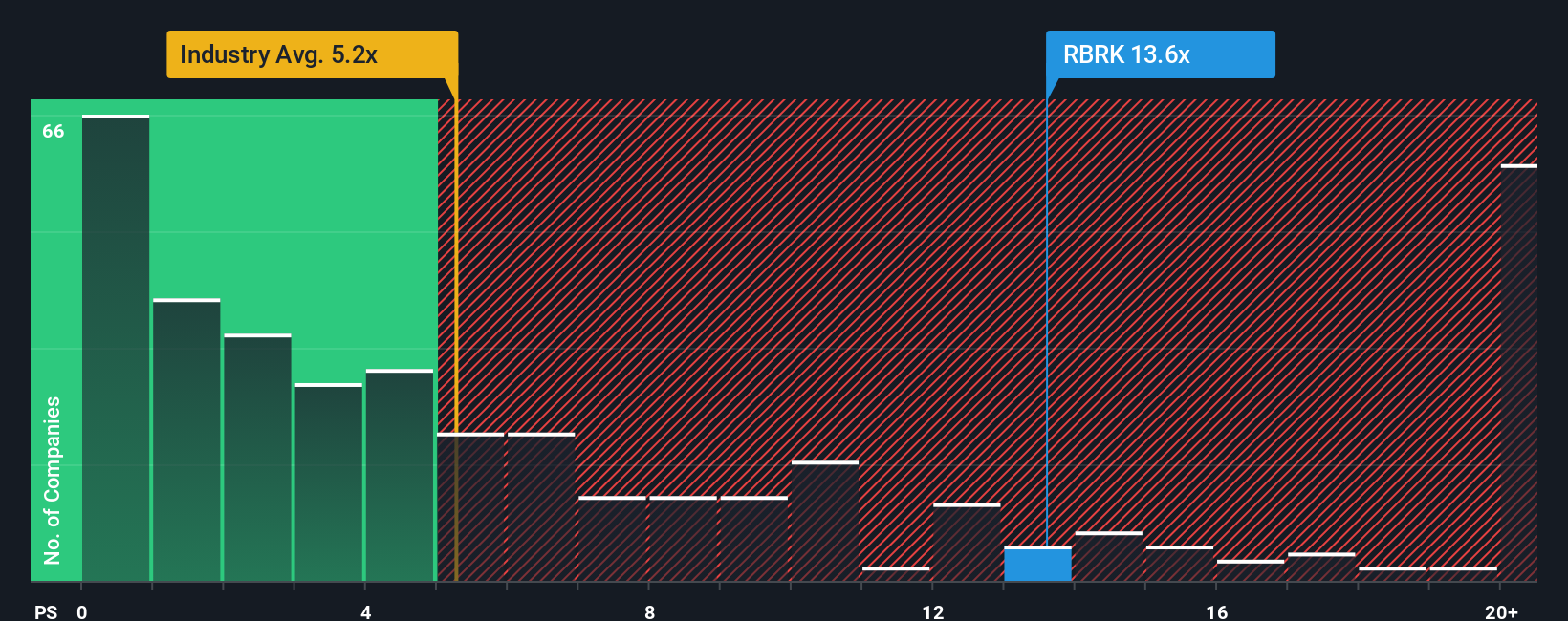

While analysts see Rubrik as undervalued given its high growth story, looking at its price-to-sales ratio tells a different tale. Shares trade at 13.8 times sales, which is much higher than peers at 9.1x and the broader software industry at 5.3x. Even compared to its fair ratio of 12x, Rubrik looks expensive, which could mean higher risk if growth stumbles. Are investors paying too much for future potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rubrik Narrative

If you want to go beyond the consensus or prefer a hands-on approach, it takes just minutes to analyze the data and develop your own perspective. Do it your way

A great starting point for your Rubrik research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready to Find Your Next Big Opportunity?

Expand your portfolio with ideas that others might overlook. Don’t let these handpicked opportunities pass you by. Let the Simply Wall Street Screener guide your next move.

- Uncover standout companies offering robust returns and income by starting with these 18 dividend stocks with yields > 3%.

- Capitalize on cutting-edge advancements by checking out these 27 AI penny stocks setting the pace in artificial intelligence innovation.

- Seize overlooked value by searching through these 841 undervalued stocks based on cash flows for stocks trading below their intrinsic worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBRK

Rubrik

Provides data security solutions to individuals and businesses worldwide.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives