- United States

- /

- Software

- /

- NYSE:RAMP

LiveRamp (RAMP) Margin Expansion Reinforces Bull Case Despite Premium Valuation Concerns

Reviewed by Simply Wall St

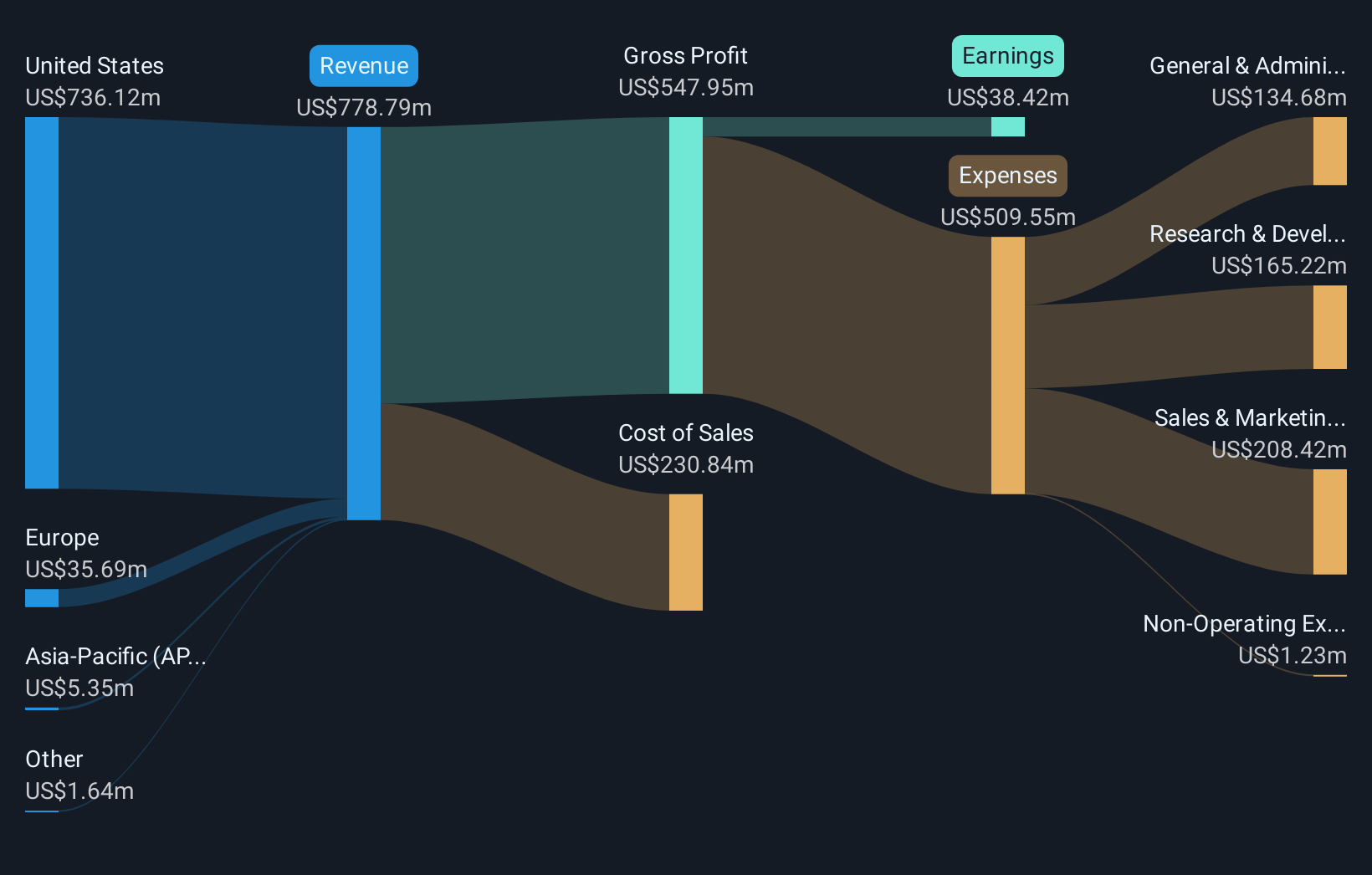

LiveRamp Holdings (RAMP) delivered standout earnings growth, with net profit margins jumping to 4.9% from just 0.2% last year and annual earnings growth topping an eye-catching 2,560.8%. Revenue is forecast to rise by 8.9% per year, just trailing the US market’s average, while profits are set to climb an impressive 36.8% each year, more than double the national pace. For investors, a rapid jump in profitability and widened margins reinforce a positive outlook, though a lofty 49.9x PE ratio versus industry peers may keep valuation in focus.

See our full analysis for LiveRamp Holdings.Let’s dive in and see how these results mesh with the broader narratives investors are building. In some cases, the story gets stronger, and in others, it might surprise you.

See what the community is saying about LiveRamp Holdings

Profit Margin Expansion Points to Quality Upside

- Net profit margins climbed to 4.9%, a notable improvement from 0.2%, reinforcing that LiveRamp is generating higher quality, more sustainable profits across its platform.

- According to the analysts' consensus view, operational streamlining and a shift to usage-based pricing are credited with boosting both client accessibility and margins.

- Ongoing margin gains are expected to drive better free cash flow and support increased shareholder returns.

- The company’s investment in privacy-centric data solutions is anticipated to retain clients and expand recurring revenue despite rising regulatory demands.

Consensus expectations for continued margin improvement show investors are betting on LiveRamp’s business model reinvention. See how this story stacks up in the full Consensus Narrative for a sharper view of where profits might head next. 📊 Read the full LiveRamp Holdings Consensus Narrative.

DCF Fair Value Implies Strong Upside

- With shares changing hands at $29.25 and a DCF fair value estimated at $47.87, LiveRamp currently trades at a substantial discount of 39%, suggesting strong upside potential should profit and margin forecasts materialize.

- The analysts' consensus view argues this discount is rooted in investors’ skepticism about meeting ambitious 2028 earnings targets of $154 million and expanding profit margins to 15.9%.

- At the same time, the company's recent acceleration in profitability and high-quality earnings challenge that caution.

- This indicates that if LiveRamp continues to execute, there is meaningful room for valuation to catch up with fundamentals.

Premium PE Ratio Sparks Debate

- LiveRamp’s price-to-earnings ratio of 49.9x is materially above both the software industry average (35.2x) and peer group average (29.1x), putting a spotlight on whether premium multiples are justified as profit growth materializes.

- Analysts' consensus narrative maintains that demand tailwinds from AI-driven marketing and regulatory changes support enduring growth.

- However, the narrative also flags concerns about revenue concentration and costs, as recent high-profile client churn underscores the risk of depending on a few large enterprise customers.

- There is a possibility that intensifying competition and slower revenue guidance could limit further multiple expansion unless LiveRamp accelerates client diversification and sustains margin gains.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for LiveRamp Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Thinking about these results from a unique angle? Take just a few minutes to craft and share your perspective with the community. Do it your way

A great starting point for your LiveRamp Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

LiveRamp’s premium valuation and reliance on a small number of major customers raise concerns about revenue concentration and the risk of disappointing future growth.

If broad-based growth and a more reliable earnings track record matter to you, seek out stable growth stocks screener (2079 results) to spot companies that consistently deliver strong results during different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RAMP

LiveRamp Holdings

A technology company, operates a data collaboration platform in the United States, Europe, the Asia-Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives