- United States

- /

- Software

- /

- NYSE:RAMP

LiveRamp (RAMP) Clean Room Integration With Meta Could Be a Game Changer for Growth

Reviewed by Sasha Jovanovic

- Earlier this month, LiveRamp announced expanded measurement capabilities, enabling retail media networks to connect Meta campaign results with their own first-party sales data through the LiveRamp Clean Room for deeper attribution insights.

- This enhancement gives retailers and their partners the ability to demonstrate more accurate campaign performance and make informed budget decisions, underscoring LiveRamp's position as a trusted, neutral data collaborator for publishers.

- We’ll explore how LiveRamp’s integration of Meta campaign attribution could influence its investment appeal and growth narrative.

Find companies with promising cash flow potential yet trading below their fair value.

LiveRamp Holdings Investment Narrative Recap

To be a LiveRamp shareholder, you need to believe in the company’s pivotal role as a privacy-focused data collaboration partner supporting retail media and AI-driven advertising. The newly expanded measurement capabilities with Meta may strengthen LiveRamp’s near-term competitive appeal, but do not materially offset the risk of revenue concentration from large enterprise clients, which remains a key vulnerability for the business.

The October rollout of enhanced attribution for Meta campaigns is especially relevant here, as it builds on earlier efforts like Walgreens Advertising Group’s adoption of LiveRamp’s clean room to offer improved insights for advertisers. These partnerships reinforce LiveRamp’s value proposition in connecting advertisers to actionable retail data, a key catalyst for wider adoption of its platform.

Yet, in contrast to these advances, investors should not overlook the continued risk posed by LiveRamp’s concentrated client base and exposure to potential large customer churn events...

Read the full narrative on LiveRamp Holdings (it's free!)

LiveRamp Holdings is projected to reach $969.7 million in revenue and $154.0 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 8.3% and represents a $141.3 million increase in earnings from current levels of $12.7 million.

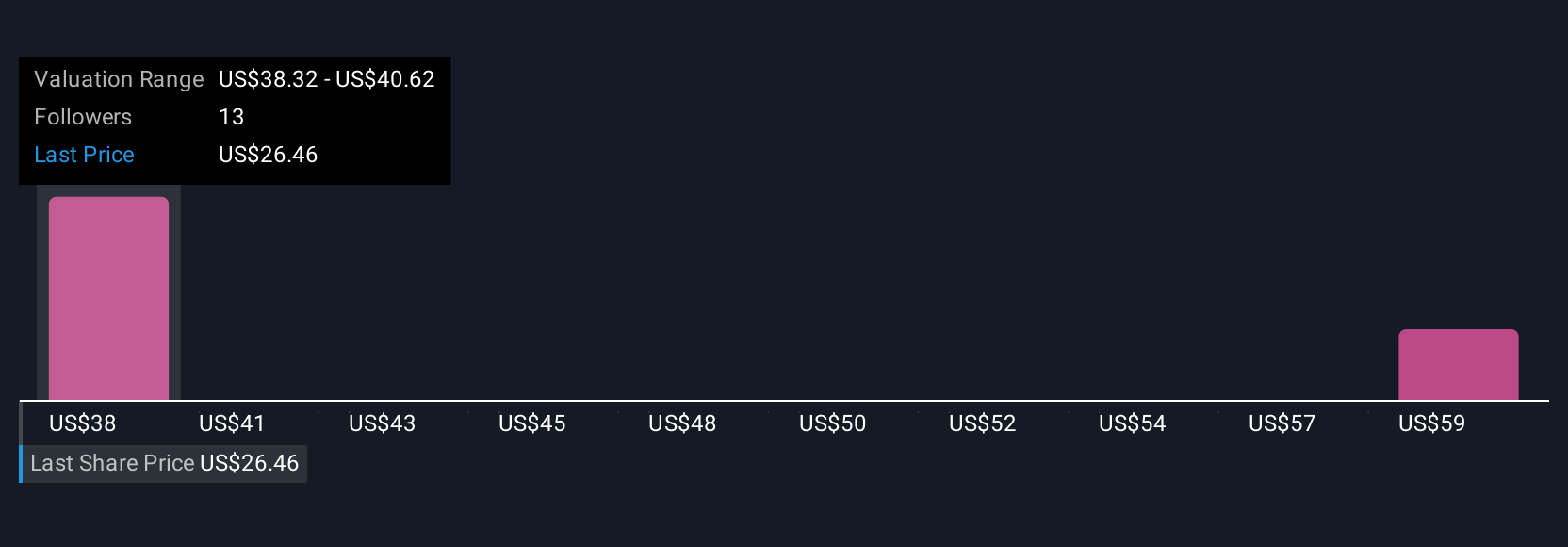

Uncover how LiveRamp Holdings' forecasts yield a $39.62 fair value, a 45% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community estimate LiveRamp’s fair value across a wide band from US$28 to US$52.38 per share. Despite this range, increased competition from tech giants with similar data connectivity tools could weigh on future revenue growth and margin improvement, so reviewing diverse valuations is especially useful here.

Explore 5 other fair value estimates on LiveRamp Holdings - why the stock might be worth as much as 92% more than the current price!

Build Your Own LiveRamp Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LiveRamp Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LiveRamp Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LiveRamp Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RAMP

LiveRamp Holdings

A technology company, operates a data collaboration platform in the United States, Europe, the Asia-Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives