- United States

- /

- Software

- /

- NYSE:QBTS

D-Wave Quantum (QBTS) Unveils Quantum AI Toolkit to Transform Machine Learning Innovation

Reviewed by Simply Wall St

D-Wave Quantum (QBTS) has recently made significant strides with the launch of its new quantum AI toolkit, which enhances integration with modern machine learning architectures like PyTorch and showcases quantum processors' capabilities. This development coincides with a remarkable 127% increase in QBTS's share price over the last quarter. The company's partnerships with organizations like Japan Tobacco Inc. and the Julich Supercomputing Centre, as well as strategic moves like the introduction of the Advantage2 Quantum Computing System, likely provided added momentum to its price performance, aligning well with the broader market rebound.

Over the past year, D-Wave Quantum Inc.'s shares have delivered a very large total return of 1803.32%, indicating significant capital gains for shareholders during this period. When compared to the US Software industry, which posted a return of 38.5%, and the broader US Market with a 20.5% return, D-Wave's performance stands out remarkably.

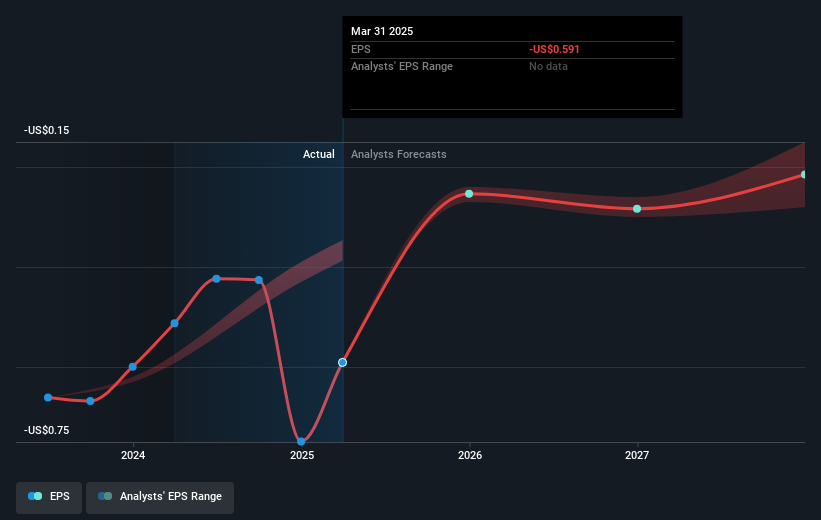

The recent advances detailed in the introduction, such as launching the quantum AI toolkit and partnerships, could positively influence future revenue growth forecasts, which are projected to rise by 35.9% annually. However, the company remains unprofitable and is not expected to achieve profitability in the foreseeable future, affecting earnings forecasts. Despite the recent share price rise, the current price of $16.38 shows a 13.96% discount to the analyst consensus price target of $18.67, highlighting potential expectations of continued growth from the market. Nonetheless, with high volatility and significant insider selling recently, caution might be advisable when evaluating the stock's future trajectory.

Understand D-Wave Quantum's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QBTS

D-Wave Quantum

Develops and delivers quantum computing systems, software, and services worldwide.

Excellent balance sheet slight.

Similar Companies

Market Insights

Community Narratives