- United States

- /

- Software

- /

- NYSE:QBTS

D-Wave Quantum (QBTS): Evaluating Valuation Following Asia-Pacific Surge and Growing Commercial Momentum

Reviewed by Kshitija Bhandaru

If you have been watching D-Wave Quantum (NYSE:QBTS), the sudden surge in the stock’s price may have caught your attention. The catalyst? D-Wave’s first-ever user conference in Tokyo, where the company reported an 83% jump in Asia-Pacific bookings and demonstrated commercial wins with major names like Japan Tobacco and NTT DOCOMO. This event sent a message that D-Wave’s quantum computing technology is gaining traction beyond the hype, especially in practical, real-world settings.

This fresh momentum comes at a time when D-Wave shares have already racked up a 28% gain over the past year and have more than doubled year-to-date. It has not been just a single event. D-Wave also benefited from broader investor enthusiasm after a Federal Reserve rate cut and speculation about new U.S. policy support for quantum initiatives. Still, the recent Tokyo conference seems to have tipped investor sentiment further, breaking the stock out of a multi-month trading range and sparking talk of a shifting risk-reward balance.

So, with this year’s impressive run fueled by both business wins and macro tailwinds, is D-Wave Quantum stock now a window of opportunity for buyers, or is the market already factoring in all that future potential?

Price-to-Book of 12.6x: Is it justified?

By comparing D-Wave Quantum’s current price-to-book ratio of 12.6x to peers, the stock appears expensive. The average for its peer group is 12.3x, while the broader US Software industry averages just 4x. This suggests that the market is pricing in significant future potential rather than current fundamentals.

The price-to-book ratio measures how much investors are willing to pay for each dollar of company net assets. For growth-oriented technology firms, this metric can sometimes trade at higher multiples if investors expect strong future expansion.

In D-Wave Quantum’s case, the premium valuation is likely a reflection of its expected rapid revenue growth and position at the frontier of commercial quantum computing. Still, the elevated ratio highlights that much of the company’s opportunity is already being factored into the share price. This raises questions about the sustainability of this premium if those growth expectations are not met.

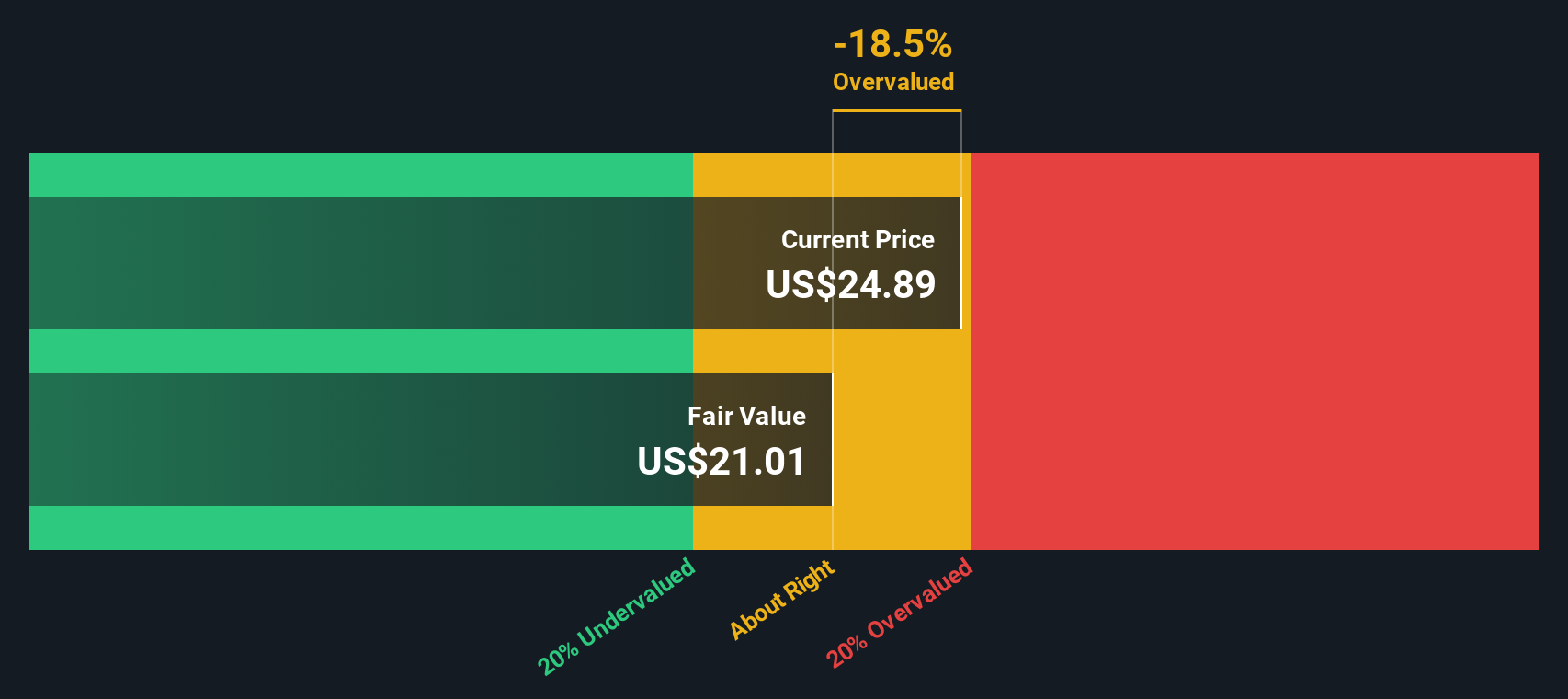

Result: Fair Value of $23.30 (OVERVALUED)

See our latest analysis for D-Wave Quantum.However, continued net losses and a heavily discounted price target highlight real risks if revenue growth does not accelerate as expected.

Find out about the key risks to this D-Wave Quantum narrative.Another View: SWS DCF Model Lacks Support

For another perspective, our SWS DCF model cannot produce a valuation for D-Wave Quantum due to limited available data. This raises different questions about how reliable any current growth forecasts might be. Is it too early to put a number on the company's future?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own D-Wave Quantum Narrative

If you have your own angle on D-Wave Quantum or would rather do a quick, hands-on review of the numbers, you can construct a narrative yourself in just a few minutes: Do it your way.

A great starting point for your D-Wave Quantum research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

You do not want to sit out the next wave of market winners. Get ahead of the curve with tools that spot unique trends and undervalued potential that others might miss.

- Unlock hidden value by scanning for companies that may be overlooked yet undervalued, using our set of undervalued stocks based on cash flows.

- Supercharge your portfolio with exposure to next-generation computing by targeting quantum computing stocks, which is leading the charge in real-world tech breakthroughs.

- Boost your passive income with strong yields and financial stability by checking out dividend stocks with yields > 3%, delivering more than just capital gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QBTS

D-Wave Quantum

Develops and delivers quantum computing systems, software, and services worldwide.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion