- United States

- /

- Software

- /

- NYSE:PRO

PROS Holdings, Inc.'s (NYSE:PRO) Shareholders Might Be Looking For Exit

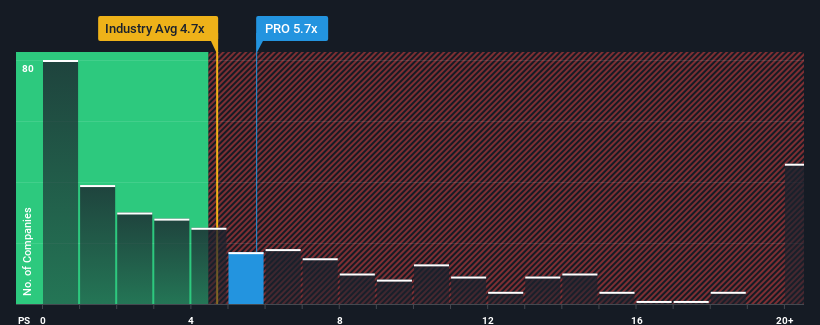

PROS Holdings, Inc.'s (NYSE:PRO) price-to-sales (or "P/S") ratio of 5.7x might make it look like a sell right now compared to the Software industry in the United States, where around half of the companies have P/S ratios below 4.7x and even P/S below 1.8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for PROS Holdings

How Has PROS Holdings Performed Recently?

PROS Holdings could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PROS Holdings.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, PROS Holdings would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 10.0% last year. The solid recent performance means it was also able to grow revenue by 15% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 11% during the coming year according to the ten analysts following the company. With the industry predicted to deliver 15% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that PROS Holdings' P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for PROS Holdings, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

There are also other vital risk factors to consider and we've discovered 3 warning signs for PROS Holdings (1 is a bit concerning!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PRO

PROS Holdings

Provides software solutions that optimize the processes of selling and shopping in the digital economy in Europe, the Asia Pacific, the Middle East, Africa, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives