- United States

- /

- Software

- /

- NYSE:PERF

Perfect Corp.'s (NYSE:PERF) Stock Retreats 26% But Revenues Haven't Escaped The Attention Of Investors

Perfect Corp. (NYSE:PERF) shares have had a horrible month, losing 26% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 60% share price decline.

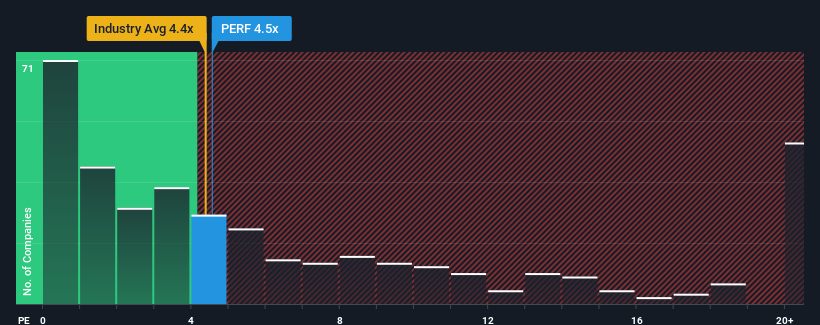

Although its price has dipped substantially, there still wouldn't be many who think Perfect's price-to-sales (or "P/S") ratio of 4.5x is worth a mention when the median P/S in the United States' Software industry is similar at about 4.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Perfect

How Has Perfect Performed Recently?

Recent times haven't been great for Perfect as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Perfect.How Is Perfect's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Perfect's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. This was backed up an excellent period prior to see revenue up by 79% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 14% each year as estimated by the three analysts watching the company. With the industry predicted to deliver 15% growth per annum, the company is positioned for a comparable revenue result.

With this information, we can see why Perfect is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Perfect's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Perfect's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

You always need to take note of risks, for example - Perfect has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PERF

Perfect

An artificial intelligence software as a service company, provides artificial intelligence (AI)- and augmented reality (AR)-powered solutions for beauty, fashion, and skincare industries worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success