- United States

- /

- Software

- /

- NYSE:PERF

Perfect Corp (NYSE:PERF) Valuation Check After New AI Holiday Shopping Trend Report

Reviewed by Simply Wall St

Perfect (NYSE:PERF) just released a new trend report on how AI is reshaping holiday shopping, showing that nearly 90% of consumers already lean on AI tools to discover products and personalize their experience.

See our latest analysis for Perfect.

The upbeat reaction to this latest AI shopping report adds a modest boost to Perfect’s recent momentum, with a 1 month share price return of 4.02 percent. However, that sits against a much weaker year to date share price return and a still heavily negative 3 year total shareholder return, suggesting investors remain cautious about how quickly growth will translate into sustained value.

If this shift toward AI driven shopping has your attention, it might be worth exploring other innovators via our curated list of high growth tech and AI stocks as potential additions to your watchlist.

Yet with revenue and earnings still growing while the share price languishes near two dollars, is Perfect a quietly mispriced beneficiary of AI driven shopping, or has the market already nailed its future growth story?

Most Popular Narrative: 55.2% Undervalued

With Perfect closing at $1.81 against a narrative fair value above four dollars, the implied upside hangs on ambitious growth and profitability assumptions.

The global expansion efforts, especially with the AI powered skin diagnostics solution launched with a major U.S. beauty retailer, provide new channels for international growth, likely increasing Perfect Corp's customer base and sales volume, which could enhance revenue.

Curious how recurring subscriptions, fatter margins, and a richer earnings profile could all converge into that valuation jump? The narrative lays out a bold, numbers driven roadmap. Want to see what kind of future profit engine it is betting on?

Result: Fair Value of $4.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering subscriber churn and contract losses among key enterprise customers could easily derail the upbeat AI growth and valuation story.

Find out about the key risks to this Perfect narrative.

Another Way to Look at Value

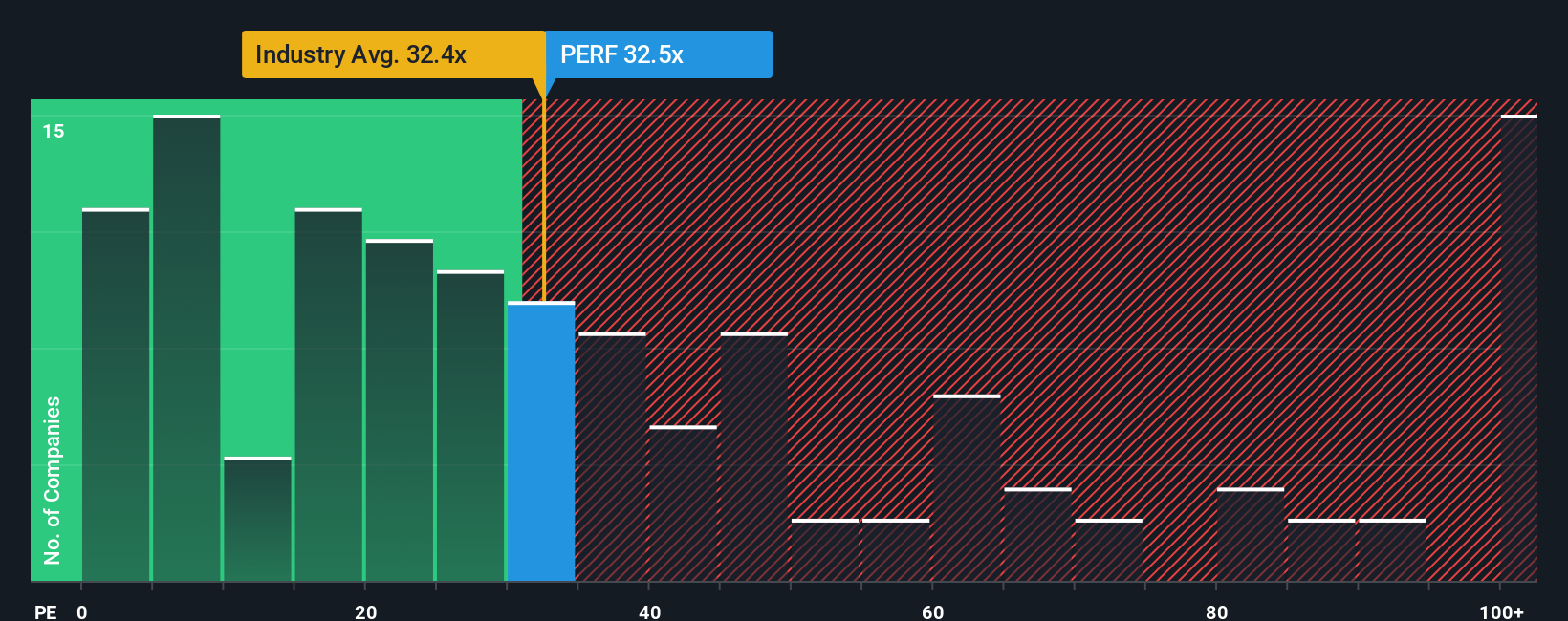

Step away from narratives and the numbers look tighter. Perfect trades at about 31.8 times earnings, slightly richer than the US software average at 31.2 times, but cheaper than peers at 52.8 times and close to a 33.2 times fair ratio. Is that a small premium worth paying for its growth story, or a sign the margin for error is shrinking?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Perfect Narrative

If this take does not quite match your view, or you prefer digging into the numbers yourself, you can build a fresh narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Perfect.

Ready for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover focused shortlists that can sharpen your next move and keep you ahead.

- Target income first and let compounding work in your favor by scanning for established businesses through these 13 dividend stocks with yields > 3% with sustainable yields above three percent.

- Catch the next wave of innovation early by zeroing in on affordable innovators using these 3616 penny stocks with strong financials that already show strong financial footing.

- Position your portfolio for structural shifts in medicine by filtering cutting edge names with these 29 healthcare AI stocks powering diagnostics, treatment predictions, and workflow automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PERF

Perfect

An artificial intelligence software as a service company, provides artificial intelligence (AI)- and augmented reality (AR)-powered solutions for beauty, fashion, and skincare industries worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion