- United States

- /

- IT

- /

- OTCPK:URLO.F

Maris-Tech And 2 Other US Penny Stocks To Watch In Your Portfolio

Reviewed by Simply Wall St

U.S. stocks have shown mixed performance recently as investors navigate the implications of newly enacted tariffs on steel and aluminum imports, along with ongoing economic indicators like Treasury yields and Federal Reserve policies. Despite market fluctuations, penny stocks remain an intriguing area for investors due to their potential for growth when backed by robust financials. While often associated with smaller or newer companies, these stocks can offer a blend of affordability and growth potential, making them worth a closer look in today's diverse investment landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.896 | $6.46M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $125.23M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.25 | $10.23M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.95 | $89.18M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.42 | $46.86M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.78 | $46.67M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.44 | $25.01M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8975 | $79.45M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.64 | $384.4M | ★★★★☆☆ |

Click here to see the full list of 712 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Maris-Tech (NasdaqCM:MTEK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Maris-Tech Ltd. designs and manufactures digital video and audio hardware and software solutions for various security markets globally, with a market cap of $24.58 million.

Operations: The company generates revenue of $6.97 million from its audio and video product offerings.

Market Cap: $24.58M

Maris-Tech Ltd., with a market cap of US$24.58 million and revenue of US$6.97 million, has recently expanded its presence in the defense sector through significant orders for its Jupiter Nano system and Uranus-Drones technology. Despite being unprofitable with a negative return on equity, the company maintains more cash than debt and covers both short- and long-term liabilities with its assets. Maris-Tech's strategic moves into Eastern Europe and the U.S. highlight its growing influence in video and AI edge computing solutions, although it faces challenges such as high share price volatility and an inexperienced board of directors.

- Unlock comprehensive insights into our analysis of Maris-Tech stock in this financial health report.

- Examine Maris-Tech's past performance report to understand how it has performed in prior years.

Perfect (NYSE:PERF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perfect Corp. is an artificial intelligence software as a service company offering AI and AR-powered solutions for the beauty, fashion, and skincare industries globally, with a market cap of $208.79 million.

Operations: The company generates $58.45 million in revenue from its Internet Software & Services segment.

Market Cap: $208.79M

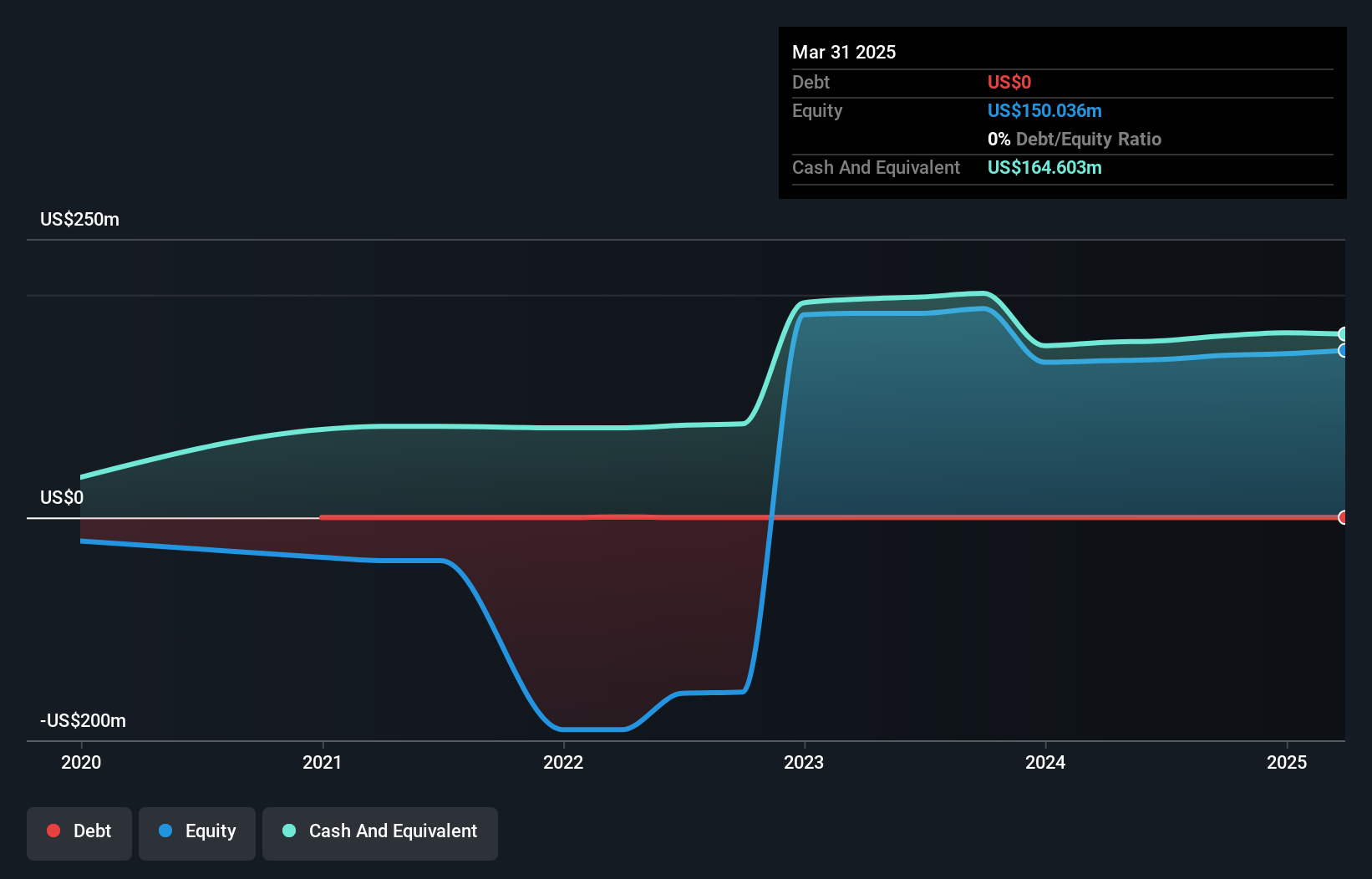

Perfect Corp., with a market cap of US$208.79 million and revenue of US$58.45 million, has recently advanced its AI-driven offerings in the beauty sector, including partnerships like RenewMD Wellness adopting its Skincare Pro Software. The company is debt-free and has become profitable over the past year, though it exhibits high share price volatility and low return on equity at 3.7%. Despite an inexperienced board, Perfect Corp.'s innovative product launches such as the AI Frizzy Hair Analyzer position it well for growth in personalized beauty solutions, although challenges remain with maintaining stable earnings growth compared to industry standards.

- Click here and access our complete financial health analysis report to understand the dynamics of Perfect.

- Explore Perfect's analyst forecasts in our growth report.

NameSilo Technologies (OTCPK:URLO.F)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NameSilo Technologies Corp. operates internationally through its subsidiaries, offering domain name registration services across various regions including Canada, the United States, and Asia, with a market cap of $36.58 million.

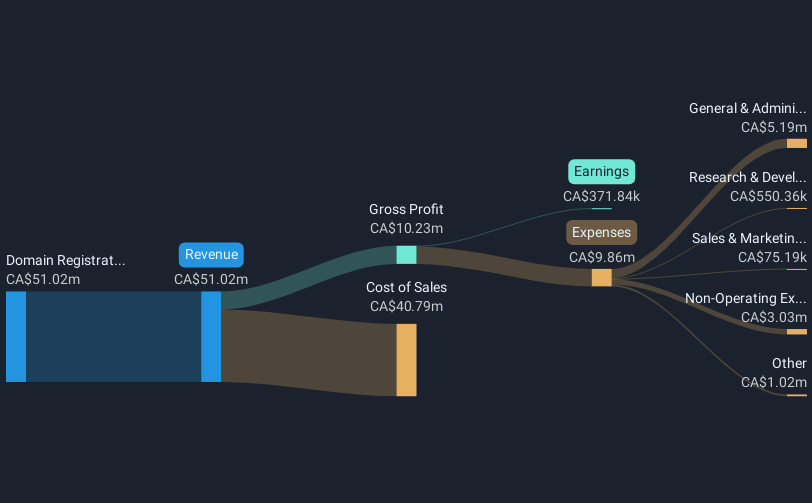

Operations: The company generates CA$52.92 million from its domain registration and related services segment.

Market Cap: $36.58M

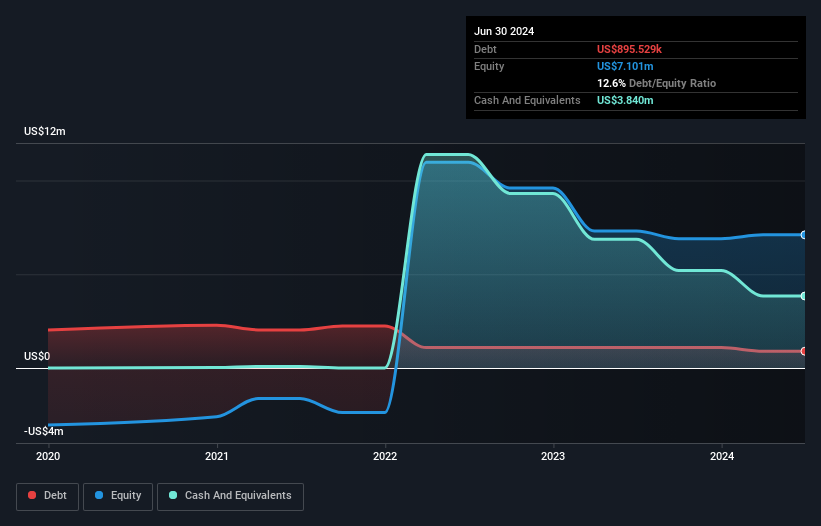

NameSilo Technologies Corp., with a market cap of CA$36.58 million, has shown financial improvement by becoming profitable over the past year, reporting net income of CA$1.22 million for the first nine months of 2024 compared to a loss previously. The company's revenue from domain registration services reached CA$40.33 million during this period, indicating growth from the prior year. Despite its outstanding return on equity at 50.5%, this figure is influenced by high debt levels, though debt is well-covered by operating cash flow and interest payments are adequately managed with EBIT coverage at 5.4 times interest expenses.

- Get an in-depth perspective on NameSilo Technologies' performance by reading our balance sheet health report here.

- Gain insights into NameSilo Technologies' historical outcomes by reviewing our past performance report.

Taking Advantage

- Take a closer look at our US Penny Stocks list of 712 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NameSilo Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:URLO.F

NameSilo Technologies

Through its subsidiaries, provides domain name registration services in the United States, East and South Asia, South East Asia, Australasia, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion