- United States

- /

- Software

- /

- NYSE:PERF

Evaluating Perfect Corp (PERF): Is There Value in the Recent Share Price Recovery?

Reviewed by Simply Wall St

Perfect (PERF) has seen modest movement over the past month, continuing a gradual trend that has caught the attention of investors looking for stable software sector plays. The company’s year-to-date return remains negative, but recent data provides some reasons to revisit its outlook.

See our latest analysis for Perfect.

Perfect’s share price has struggled this year, down nearly 34% year-to-date, but a 3.8% climb over the past three months hints at shifting momentum. Despite short-term volatility, its 1-year total shareholder return of 3.2% stands in contrast to longer-term losses, suggesting cautious optimism is beginning to return around future growth potential.

If you’re searching for more interesting opportunities in tech, now’s an ideal time to explore the full lineup of innovators via our focused screener: See the full list for free.

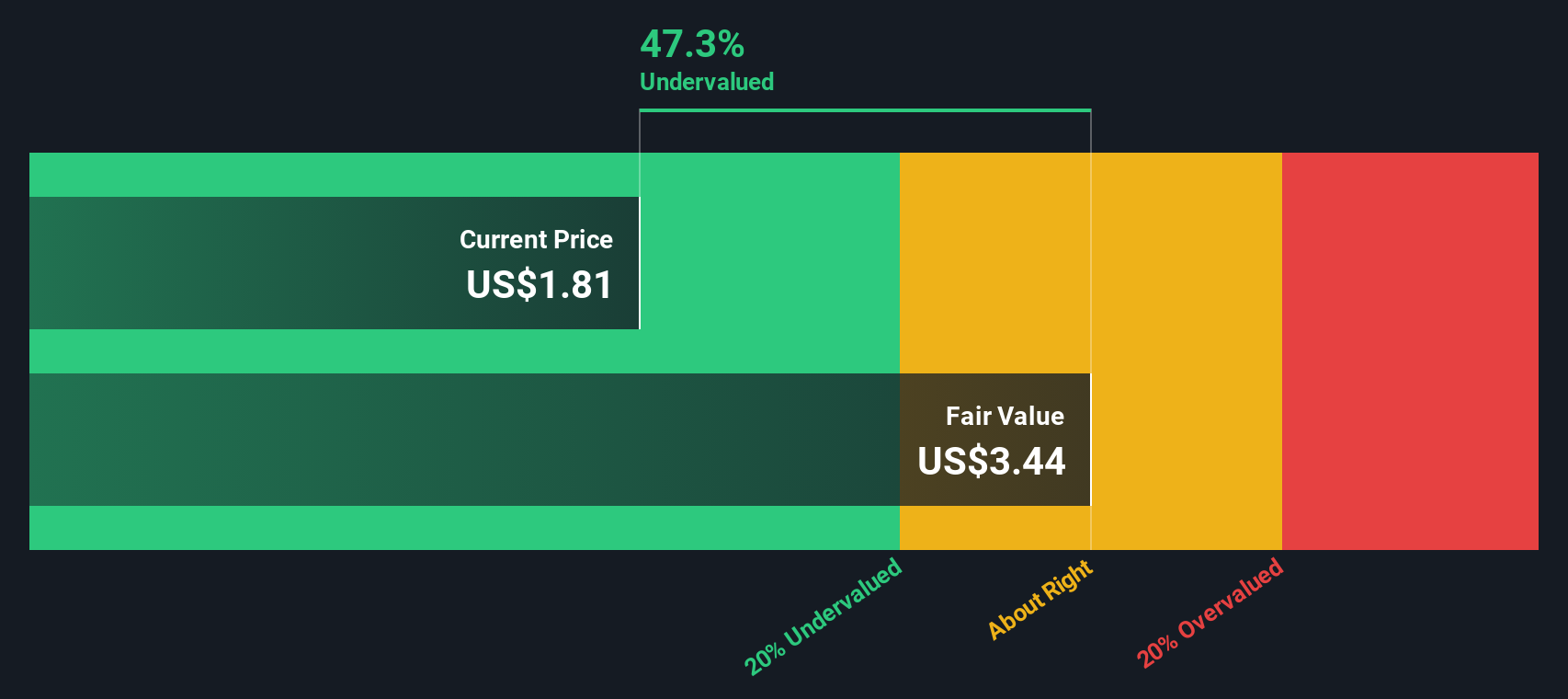

But with shares trading more than 50% below analysts' price targets, and recent growth in both revenue and net income, is Perfect undervalued at recent levels, or is the market already factoring in future growth?

Most Popular Narrative: 52% Undervalued

Perfect’s latest share price sits far below the collective fair value estimate of $4.04, creating a dramatic disconnect between the market and analyst narrative. This difference frames the narrative’s bullish thesis, driven by expansion and new technology, as a key lens for investors.

The acquisition and integration of Wanna into Perfect Corp are opening new growth opportunities, particularly in the shoes and handbags verticals. This strategic expansion into new product lines and geographies is expected to diversify revenue streams and bolster sales, potentially raising earnings.

Wondering which numbers justify such a bold upside? There is a high-stakes assumption at play in this narrative: a future leap in profit margins and revenue growth that very few stocks ever achieve. Unpack the exact projections and find out what sets this valuation apart from the status quo.

Result: Fair Value of $4.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a declining subscriber base and contract churn among key customers create uncertainties that could challenge Perfect’s ambitious growth and margin projections.

Find out about the key risks to this Perfect narrative.

Another View: Is the Market Right After All?

Looking through the lens of our DCF model, a different story emerges. This method places Perfect’s fair value close to $3.96 per share, which is still substantially above today’s price but falls short of the bullish analyst targets. Could the true upside be more modest than the narrative suggests?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Perfect Narrative

If you want to examine the numbers, check different angles, or piece together your own outlook, you can shape your own view in just minutes: Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Perfect.

Looking for More Investment Ideas?

Don’t miss your chance to spot the next big winner. Expand your watchlist with curated stock ideas uniquely tailored for forward-thinking investors like you.

- Maximize potential returns by tracking these 832 undervalued stocks based on cash flows, uncovered by cash flow fundamentals and strong upside signals.

- Earn income while you invest with these 22 dividend stocks with yields > 3%, packed with robust yields over 3% for steady portfolio growth.

- Catalyze your portfolio’s innovation factor and tap opportunities in machine learning with these 26 AI penny stocks, pushing technology boundaries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PERF

Perfect

An artificial intelligence software as a service company, provides artificial intelligence (AI)- and augmented reality (AR)-powered solutions for beauty, fashion, and skincare industries worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion