- United States

- /

- Software

- /

- NYSE:PD

PagerDuty (PD) Profit Margin Surges to 32%, Defying Bearish Forecasts of Earnings Decline

Reviewed by Simply Wall St

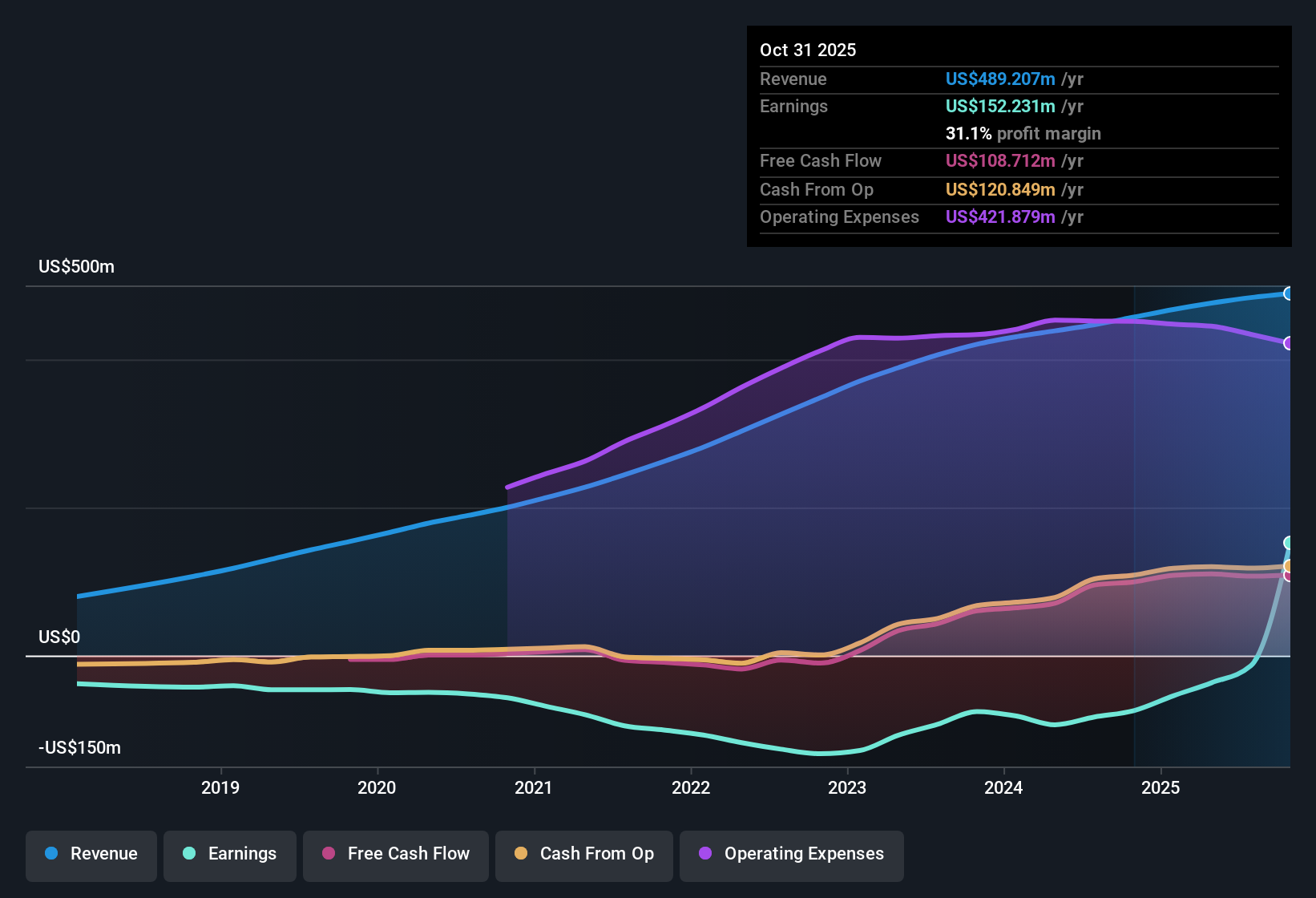

PagerDuty (PD) just released its Q3 2026 results, reporting revenue of $124.5 million and basic EPS of $1.72, with net income for the quarter hitting $159.6 million. Looking back, revenue has climbed steadily from $118.9 million in Q3 2025, while EPS improved from a loss of $0.07 per share in the same quarter last year. These latest figures mark a notable turnaround in margins, as investors weigh what sustained profitability might mean going forward.

See our full analysis for PagerDuty.Next up, we measure these results against the current market narratives, examining where the facts challenge consensus and where the story may evolve.

See what the community is saying about PagerDuty

Profit Margin Flips from -16% to 32%

- Trailing twelve month net profit margin shifted from -16.3% last year to a positive 31.1%, with net income rising to $152.2 million compared to a prior TTM loss of $74.5 million.

- Analysts' consensus view notes that this move to profitability is in sharp contrast with predictions of future earnings declines averaging 56.5% per year. This raises questions about whether the margin improvement is sustainable for PagerDuty’s long-term investors.

- Consensus forecasts point out that declining revenue growth, projected at 4% annually versus the 10.5% US market average, could put pressure on margins in the future.

- Profitability gains support the positive narrative, but the consensus notes that this may be a cyclical instead of structural change. Careful scrutiny of the repeatability of these results is suggested.

- Curious whether this margin turnaround really changes the PagerDuty story in the long run? 📊 Read the full PagerDuty Consensus Narrative.

Price-To-Earnings at 7.1x: Deep Discount

- PagerDuty’s current P/E ratio of 7.1x is well below both its software industry peers and the S&P 500. This means that shares are trading at a significant discount compared to sector averages.

- Consensus narrative describes this valuation as having both advantages and risks. The market’s discount reflects concerns about declining profits, as well as the potential for future price recovery.

- With the share price at $11.64, it is roughly 33% below the nearest allowed analyst target price of $17.43 and more than 57% below the DCF fair value of $27.45.

- Although analysts generally agree that there is substantial upside potential, the low multiple is partly due to the subdued revenue growth outlook and high non-cash earnings components. Both factors could limit the stock's progress, even with current profitability.

Revenue Slows Despite Automation Growth

- Annualized revenue growth for the past twelve months is 7.0%, but forward expectations indicate a slowdown to only 4% per year. This is below the broader US market’s average of 10.5%.

- Consensus narrative highlights that adoption of automation and AI products is increasing platform usage. However, the shift to usage-based pricing and rising competition create obstacles to sustained top-line growth.

- Platform usage lines grew by more than 25% year over year, but total company revenue rose only 6.9% from Q3 2025 to Q3 2026.

- This contrast between strong product adoption and modest revenue growth is central to concerns that overall growth may not keep pace with industry averages, despite operational achievements.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PagerDuty on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something others might have missed? Now is your chance to share your insights. Craft your personal view in just a few clicks. Do it your way

A great starting point for your PagerDuty research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

PagerDuty’s muted revenue growth, which is lagging industry averages despite product adoption, raises concerns about whether its recent profitability is truly sustainable.

If you would rather back companies consistently expanding revenue and earnings, uncover steady performers with stable growth stocks screener (2075 results) and sidestep the volatility holding PagerDuty back.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PD

PagerDuty

Engages in the operation of a digital operations management platform in the United States and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success