- United States

- /

- Software

- /

- NYSE:PD

PagerDuty (PD): Assessing Valuation After First GAAP Profit and Mixed Forward Guidance

Reviewed by Simply Wall St

If you follow PagerDuty (PD), you know the stock has delivered a fair share of surprises, but the latest quarterly update may leave even seasoned investors pondering their next move. The company just posted its first quarter of GAAP profitability, a milestone that shows operational discipline is paying off. Profits surged above Wall Street estimates and PagerDuty added more large enterprise customers. However, not every headline was upbeat. Forward guidance for revenue and earnings per share signaled a more cautious outlook, and billings growth appeared softer than some had hoped, clouding the picture for what comes next.

This blend of strong bottom-line performance and tempered projections has kept the stock’s momentum in check. While shares climbed over the past month, bouncing back roughly 11%, they are still down around 3% year to date and remain below their levels from a year ago. The recent executive shake-up, with a new Chief Revenue Officer taking the reins, adds another layer of anticipation. It has not sparked a clear trend shift yet. Investors are now trying to sort out whether the latest profitability milestone is just a bright spot or a new chapter altogether.

Is the market underappreciating PagerDuty’s improving fundamentals, or has the cautious tone from management fully reset expectations for the path ahead?

Most Popular Narrative: 10% Undervalued

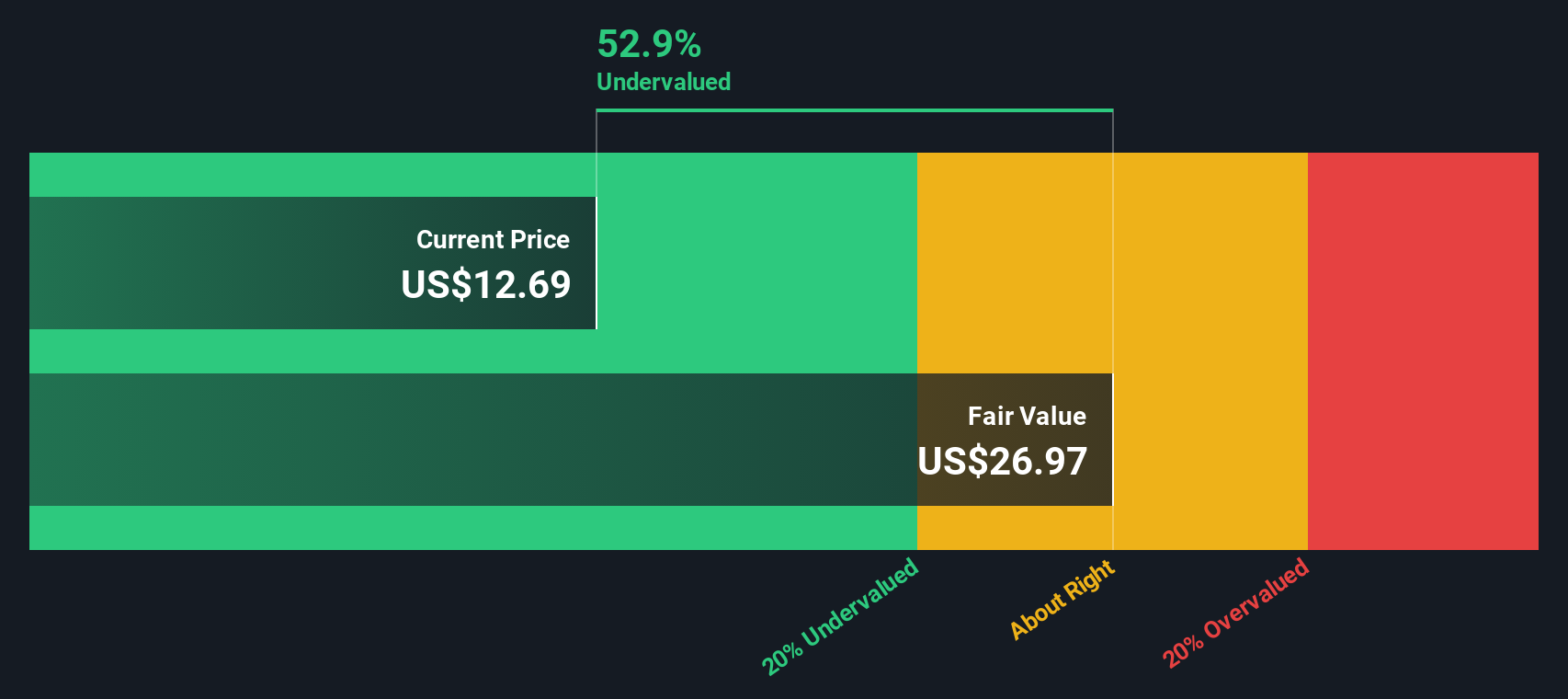

The current consensus is that PagerDuty is trading below its estimated fair value, reflecting optimism that recent operational milestones and industry shifts could unlock future upside.

The rapid growth in usage and complexity of digital infrastructure, especially within AI-native and large enterprise customers, along with record platform utilization (over 25% year-over-year growth), points to rising demand for PagerDuty's core incident management and automation offerings. This can drive strong future recurring revenue as digital transformation accelerates globally.

Curious what’s propelling this bullish outlook? It all hinges on PagerDuty’s potential to capitalize on surging demand and a significant shift in its business model. But what exactly are analysts betting on, and which surprising numbers shape their fair value call? Read on to unravel the core assumptions that separate PagerDuty from its rivals in the eyes of market-watchers.

Result: Fair Value of $19.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensified customer downgrades and volatility from the shift to usage-based pricing could limit PagerDuty’s recurring revenue and disrupt its expected growth trajectory.

Find out about the key risks to this PagerDuty narrative.Another View: DCF Model Tells a Deeper Story

Looking beyond market optimism, the SWS DCF model suggests PagerDuty’s true value could be further from the current share price than consensus believes. This could signal an opportunity that multiples overlook, or it may highlight hidden risks.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PagerDuty for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PagerDuty Narrative

If you have a different take or want to investigate the numbers for yourself, it only takes a few minutes to craft your own narrative. Do it your way.

A great starting point for your PagerDuty research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Staying ahead means seizing unique opportunities before others spot them. Take advantage of curated strategies designed to match your financial goals and fuel your portfolio growth.

- Uncover high-growth upstarts by reviewing penny stocks with strong financials. These companies are shaking up their industries with impressive fundamentals.

- Enhance your returns with dividend stocks with yields > 3% for access to companies delivering generously above-average yields.

- Catch the latest breakthroughs by tapping into quantum computing stocks to see which innovators are propelling the future of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:PD

PagerDuty

Engages in the operation of a digital operations management platform in the United States and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success