- United States

- /

- Software

- /

- NYSE:PCOR

Assessing Procore Technologies (PCOR) Valuation Following Strategic AI Partnership With Amazon Web Services

Procore Technologies (PCOR) just announced a multi-year strategic collaboration agreement with Amazon Web Services, sending a clear signal that the company is aiming to level up its presence across the global construction industry. This partnership means more than just a handshake, as the two firms are teaming up to invest in new go-to-market initiatives and innovative product development, with an emphasis on AI, data operations, and analytics. Making Procore’s platform available on AWS Marketplace could simplify access for customers, and using AWS’s cloud capabilities might sharpen Procore's competitive edge in a rapidly evolving market.

This development comes at a time when Procore’s stock has generated a solid 31% return over the past year, rebounding from a comparatively muted start to the year. While the past month has seen a 14% gain, reflecting renewed momentum, the company’s year-to-date performance remains in negative territory. Recent progress on major partnerships and expanding international reach hints at a broader strategy to capture long-term growth, though markets seem to be weighing both the upside and ongoing risk factors.

With momentum picking up and a fresh collaboration raising the stakes, some may wonder whether there is a genuine buying opportunity or if the market is already factoring in Procore’s next wave of growth.

Most Popular Narrative: 13.7% Undervalued

The most widely followed narrative suggests Procore Technologies is trading below its estimated fair value. Market optimism is anchored to accelerating innovation and international traction.

Accelerating adoption of AI-powered solutions in construction, particularly Procore Helix and Agent Builder, is driving increased customer automation, data unification, and workflow efficiency. This positions Procore as an indispensable platform and is likely to boost future revenue growth and support higher pricing, positively impacting both top-line and margins.

Curious how bullish revenue growth and margin improvement play into Procore’s sky-high valuation? The narrative is built on some eye-opening future forecasts, including a bold profit transformation that could rival tech giants. Want to know which projections could justify such an ambitious price? The full narrative reveals all the numbers that make this target tick.

Result: Fair Value of $82.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent macro uncertainty and Procore’s continued dependence on North America could slow its expansion story.

Find out about the key risks to this Procore Technologies narrative.Another View: Are the Market’s Expectations Steep?

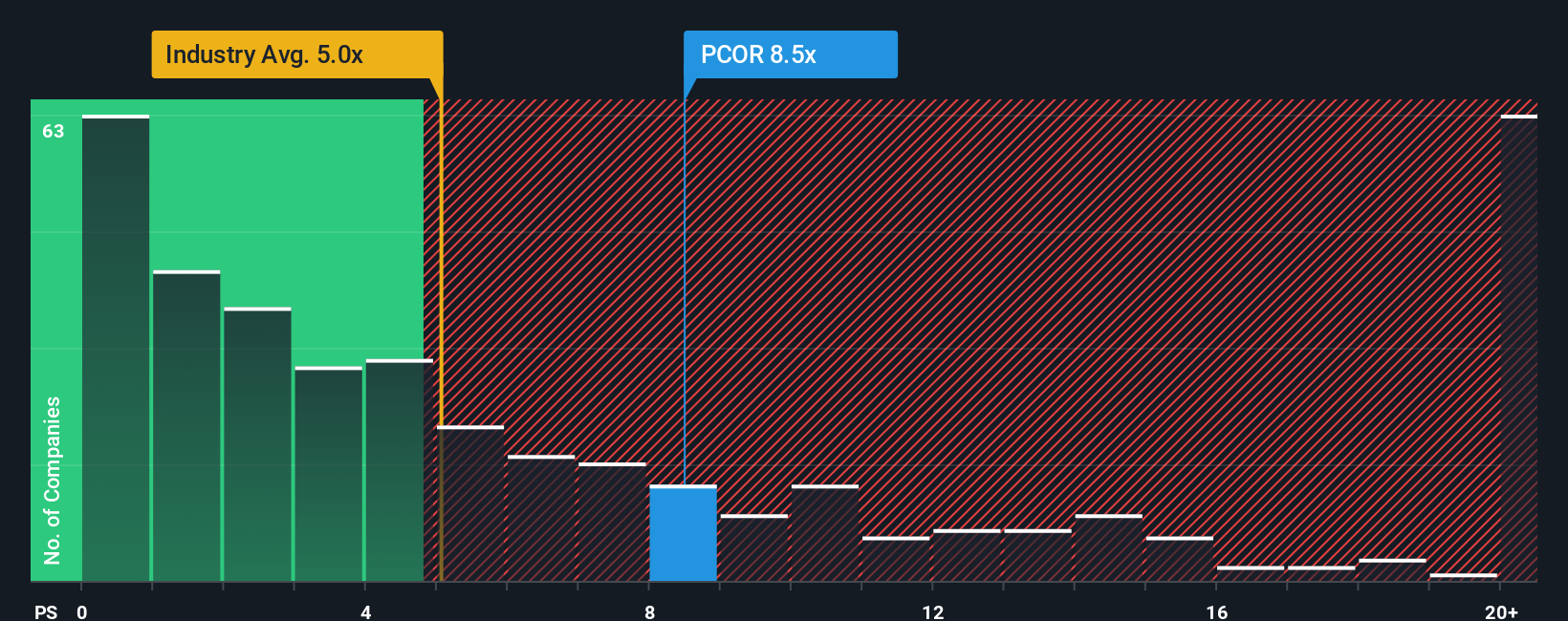

Looked at through the lens of market ratios, Procore currently trades at a higher price relative to sales than its industry average. This suggests the stock is priced for strong future growth. Does this premium carry too much optimism, or is it justified by execution ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Procore Technologies Narrative

If you would rather investigate the numbers yourself or craft a different take, you can assemble your own narrative in just a few minutes. Do it your way.

A great starting point for your Procore Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve by actively seeking out stocks with the qualities you value most. There are opportunities waiting in every corner of the market. Do not let them pass you by.

- Uncover hidden gems aiming for outsized returns by using penny stocks with strong financials to pinpoint well-capitalized contenders among lower-priced shares with strong fundamentals.

- Target consistent cash flow and reliability when you use dividend stocks with yields > 3% to track down companies offering robust yields above 3%.

- Position yourself at the forefront of healthcare’s digital transformation by checking out healthcare AI stocks to identify innovators blending medical expertise with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:PCOR

Procore Technologies

Provides a cloud-based construction management platform and related products and services in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

This strategic transformation of TTE? Significant re-rating potential

Q3 Outlook modestly optimistic

Okamoto Machine Tool Works focus on profitability

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.