- United States

- /

- Software

- /

- NYSE:PATH

Assessing UiPath’s 8.8% Pullback After AI News and Industry Automation Momentum

Reviewed by Bailey Pemberton

- Ever wondered if UiPath is a hidden gem or just another stock along for the automation ride? Let’s dig into what’s driving its value and whether you might be looking at a unique opportunity.

- UiPath’s price has bounced around lately, sliding 8.8% this week after an impressive 22.9% surge over the last month. It is up 28.7% in the past year, so investors are clearly wrestling with growth potential versus changing risks.

- Recent headlines have centered on AI adoption accelerating across industries and UiPath’s product updates making waves in the automation space. These stories have fueled optimism, but they also bring the competitive landscape into sharper focus for investors.

- The company clocks a valuation score of 3 out of 6. This tells a story that is intriguing but not conclusive yet. We will break down how analysts arrive at this score using different methods and reveal a better way to look at value by the end of this article.

Approach 1: UiPath Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a method that estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. This approach attempts to answer what UiPath stock is worth today, based on expectations of how much cash the business can generate going forward.

For UiPath, the current Free Cash Flow stands at $318.9 Million. Analysts provide projections for the next several years, expecting this to grow steadily. By 2028, estimates suggest Free Cash Flow could reach $472.8 Million. Looking further out, extended forecasts project Free Cash Flow approaching $700.8 Million by 2035. It is important to note that estimates beyond 2028 involve more uncertainty and are extrapolated beyond analyst consensus.

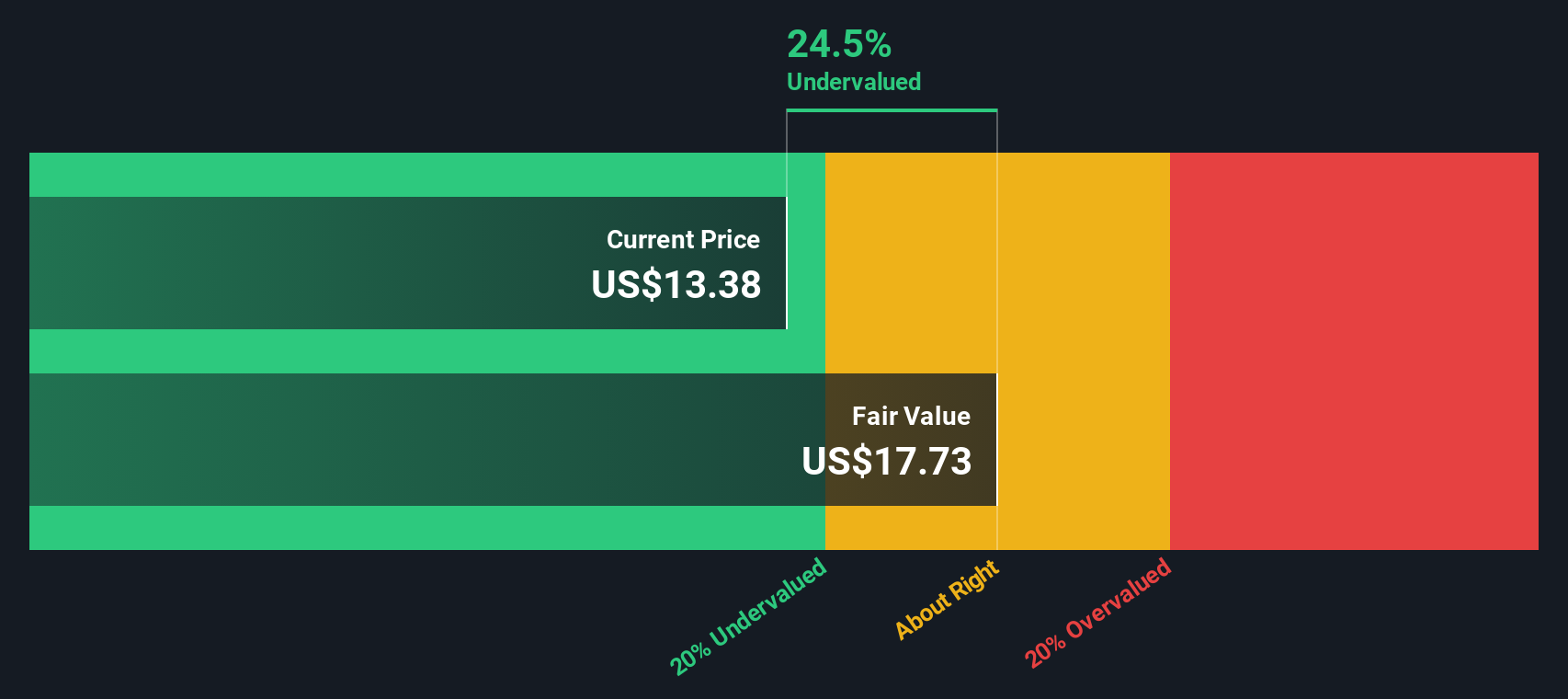

By discounting these future cash flows back to the present, the DCF model calculates an intrinsic value of $17.85 per share. This is about 11.1% higher than the current share price, which indicates that UiPath may be undervalued by the market using this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests UiPath is undervalued by 11.1%. Track this in your watchlist or portfolio, or discover 845 more undervalued stocks based on cash flows.

Approach 2: UiPath Price vs Sales

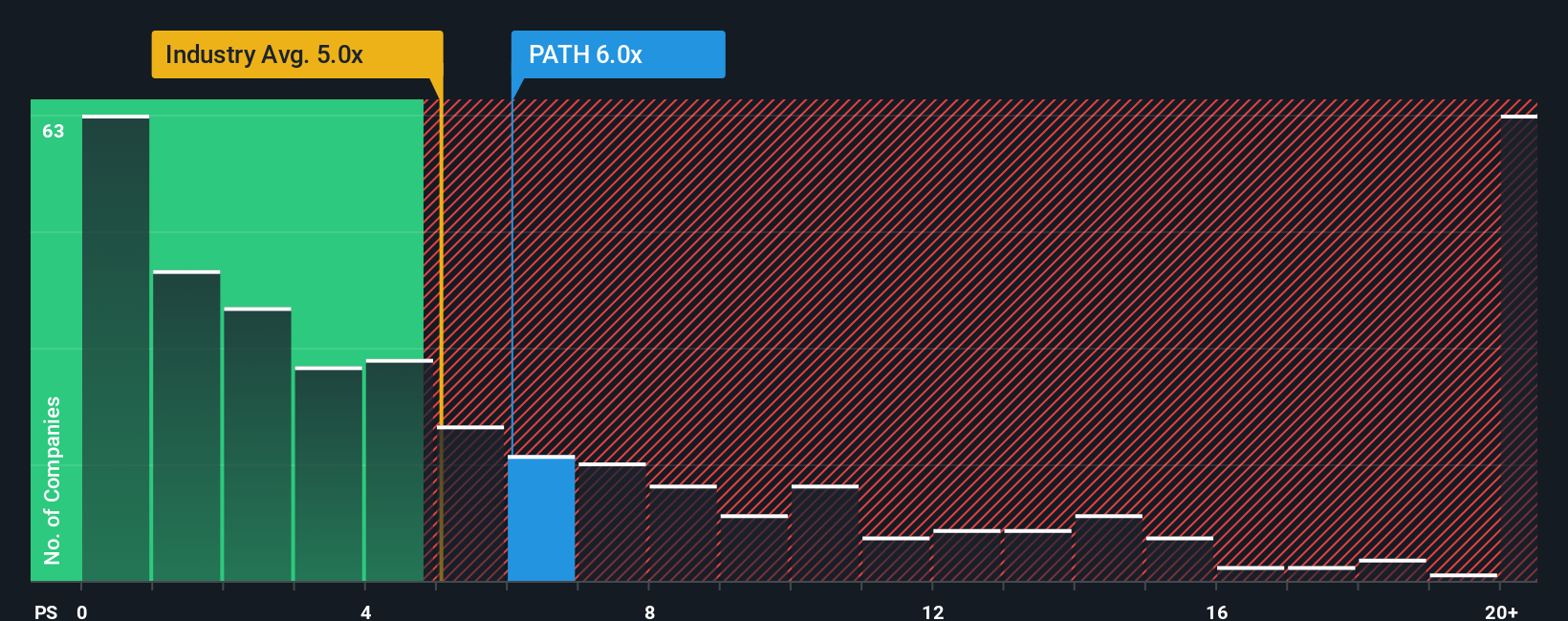

For companies like UiPath that are not yet consistently profitable, the Price-to-Sales (P/S) ratio is often the best way to assess valuation. The P/S ratio allows investors to compare how much the market is willing to pay for each dollar of the company’s revenue. This is especially useful when earnings are volatile or negative.

It is important to remember that growth expectations and risk play a big role in what is considered a “normal” or “fair” multiple for any company. Higher growth and strong market position might justify a higher multiple, while higher risks or lower margins can pull it down.

Currently, UiPath trades at a P/S ratio of 5.6x. This is just slightly above the software industry average of 5.3x and well below the peer group average of 8.6x. This suggests the market is more reserved about UiPath’s revenue profile compared to its fastest-growing competitors, but broadly in line with the sector as a whole.

To help cut through the noise, Simply Wall St’s proprietary "Fair Ratio" stands at 7.0x for UiPath. Unlike basic peer or industry comparisons, the Fair Ratio blends in factors such as UiPath's projected growth, profitability, risk profile, its market cap, and industry trends. This delivers a more precise benchmark that reflects the company’s unique situation.

With UiPath trading below its Fair Ratio, the numbers imply the stock could be undervalued on a sales multiple basis right now.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1412 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UiPath Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter, more dynamic approach to investing that starts with your own perspective on the story behind a company’s numbers.

A Narrative connects what you believe about UiPath’s business, industry trends, and growth prospects to your estimate of its future financials and what you think is a fair value for the stock. This allows you to move beyond ratios and models by articulating the “why” behind your expectations, whether you see a company poised to outpace its industry or facing challenges others might miss.

On the Simply Wall St platform, Narratives are accessible on the Community page, making it easy for anyone to build, update, and share their investment thesis with millions of other investors. They also help guide you on when to buy or sell by clearly laying out the gap between your calculated Fair Value and today’s Price based on up-to-the-minute financials, news, or earnings reports.

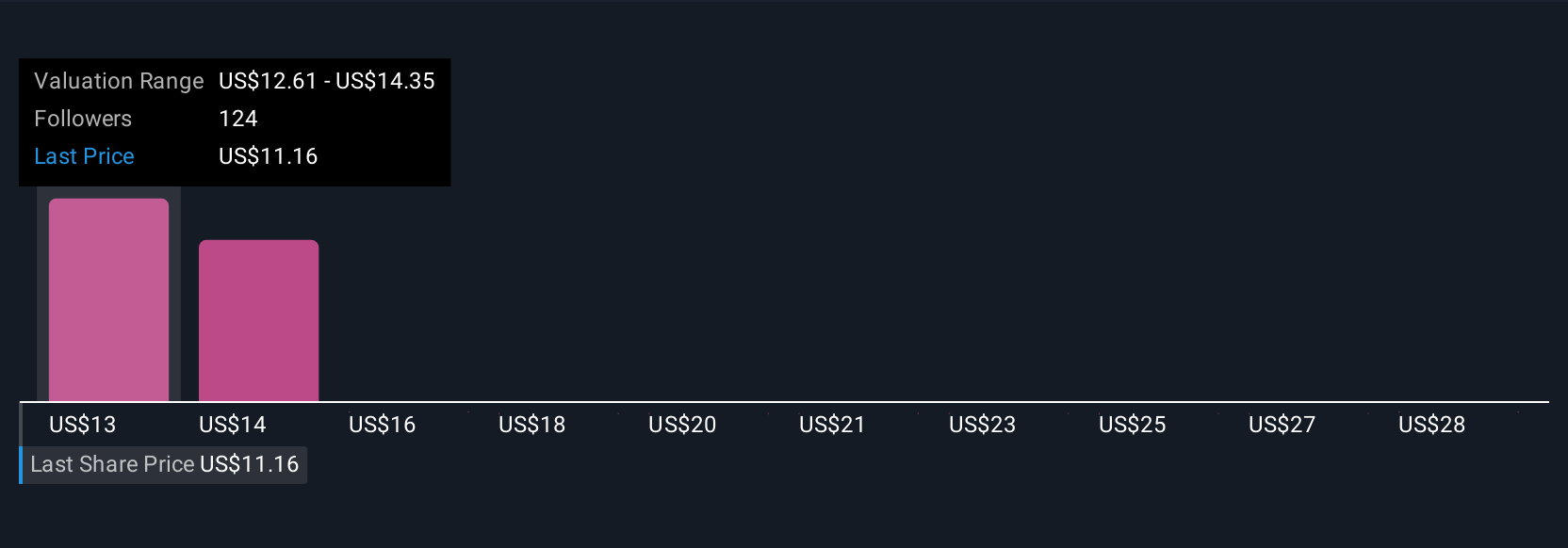

For example, right now some UiPath Narratives are highly optimistic, targeting a fair value of $17.00, while more cautious investors are setting fair values as low as $11.71. This shows just how personal and dynamic investment decisions can be when backed by your own story and assumptions.

Do you think there's more to the story for UiPath? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives