- United States

- /

- Software

- /

- NYSE:PATH

Assessing UiPath (PATH) Valuation: Is the Recent Share Price Volatility Signaling Opportunity or Caution?

Reviewed by Simply Wall St

UiPath (PATH) shares have seen some movement recently, drawing attention from investors interested in automation and software trends. The stock's performance over the past month suggests shifting sentiment surrounding the company and its outlook.

See our latest analysis for UiPath.

UiPath's share price has been on a rollercoaster ride lately, with a sharp 10% decline in just the last day following earlier gains through the month. Even with this volatility, the stock has managed a 10.6% 1-month share price return and a solid 13.8% total shareholder return over the past year, suggesting investor confidence is shifting but not evaporating. While momentum has taken a hit in the very short term, the bigger picture hints at lingering optimism around its automation story.

If the activity around UiPath has you scanning for the next breakout, it's a good time to explore fresh opportunities among tech and AI leaders. See the full list for free.

With shares swinging between gains and losses, the key question is whether UiPath’s current valuation reflects untapped upside or if investors have already factored in the company’s future prospects. This could leave little room for surprise growth.

Most Popular Narrative: 4% Overvalued

Compared to UiPath’s last close of $14.27, the most-followed narrative places fair value at $13.71. This puts the company just above what analysts project and sets the tone for a subtle debate about whether market optimism has gone a step too far.

New product launches such as Agent Builder and Agentic Orchestration, along with strategic partnerships like with Microsoft and Deloitte, are positioned to expand market opportunities, potentially increasing earnings through higher-value deals. UiPath's commitment to cloud offerings, with over $975 million in cloud ARR, positions the company to capitalize on AI-driven products and services, which could contribute to revenue growth and improved gross margins.

What powers this seemingly modest premium? The narrative’s math relies on a projected surge in profitability and a bold step up in future profit multiples. There is real intrigue behind the numbers and assumptions influencing this valuation. Explore now before the story shifts.

Result: Fair Value of $13.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing geopolitical uncertainty and currency fluctuations could disrupt revenue expectations. This may test UiPath's ability to deliver on these bullish projections.

Find out about the key risks to this UiPath narrative.

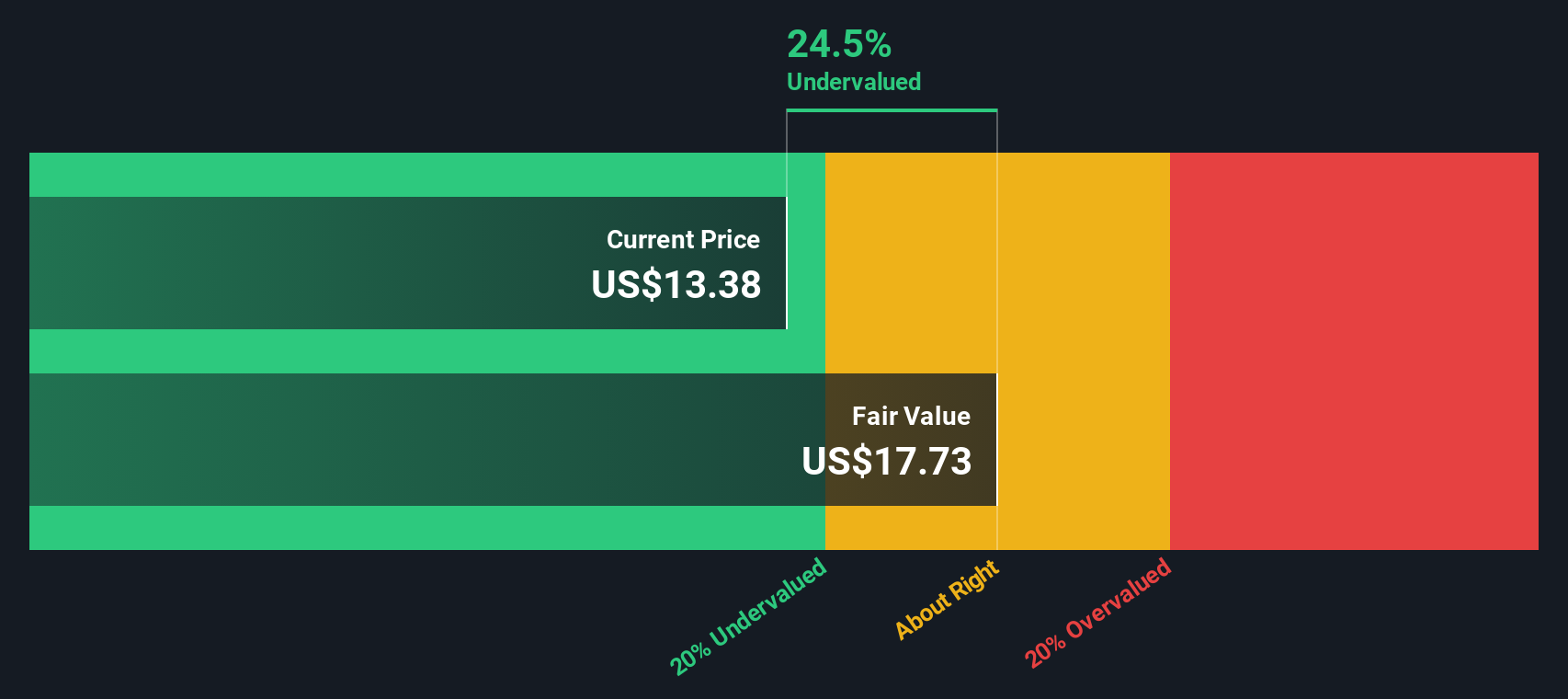

Another View: Discounted Cash Flow Hints at Hidden Value

Looking from another angle, our DCF model offers a different perspective. It puts UiPath’s fair value at $18.38, which is 22.4% higher than its current price. While the earlier market-based valuation signaled caution, this method suggests the potential for undervaluation. Which take fits the fundamentals better?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own UiPath Narrative

If the numbers or outlooks shared above do not align with your views, you can quickly dig into the details and craft your own perspective. Do it your way.

A great starting point for your UiPath research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't wait on the sidelines while the smartest investors move first. Seize your chance to uncover fresh opportunities and unique themes beyond UiPath with these handpicked stock ideas:

- Capitalize on high yields by targeting top-performing companies delivering reliable income using these 20 dividend stocks with yields > 3%.

- Get ahead of market trends and tap into the rapid evolution of artificial intelligence by checking out these 26 AI penny stocks.

- Snap up businesses trading below their intrinsic value to give your portfolio an edge with these 840 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives