- United States

- /

- Software

- /

- NYSE:PATH

A Look at UiPath (PATH) Valuation Following Strong Q2 Results, AI Partnerships, and Upbeat Analyst Upgrade

Reviewed by Simply Wall St

UiPath (PATH) just delivered Q2 FY2026 results showing both revenue gains and GAAP profitability, which led management to boost their full-year outlook. Updates at its user conference included partnerships in AI with industry leaders, bringing the stock into the spotlight.

See our latest analysis for UiPath.

UiPath’s recent flurry of AI partnerships and positive earnings have sparked a wave of investor enthusiasm, sending the stock up 35% over the past month and 27% year-to-date based on share price returns. Momentum appears to be building, with the past year’s total shareholder return now topping 32%. Longer-term three-year returns have also remained strong as the company pivots deeper into intelligent automation.

If UiPath's strategic AI moves have you curious about what's next in the tech sector, this is a perfect time to discover See the full list for free.

But after such a strong run, is UiPath now undervalued relative to its future potential or has the market already priced in the optimism around its AI and automation strategy? Could there still be a real buying opportunity?

Most Popular Narrative: 20% Overvalued

UiPath’s most widely followed narrative sets a fair value of $13.71, compared to the latest close at $16.48, flagging a notable premium at current prices. With the narrative consensus leaning cautious, the gap has grown as shares continue to climb.

Strategic partnerships and innovation in automation aim to boost growth through deeper customer relationships and expanded market opportunities. Go-to-market restructuring and focus on AI-driven cloud products seek to enhance efficiency, customer engagement, and revenue growth.

Want to unravel the financial formula behind this high-stakes valuation call? This narrative is packed with ambitious growth assumptions, bold profit forecasts, and a confidence in margin expansion usually reserved for industry leaders. Ready to see the exact projections that underpin such a big call?

Result: Fair Value of $13.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic uncertainty and deal delays due to geopolitical shifts could easily disrupt UiPath’s growth momentum in the quarters ahead.

Find out about the key risks to this UiPath narrative.

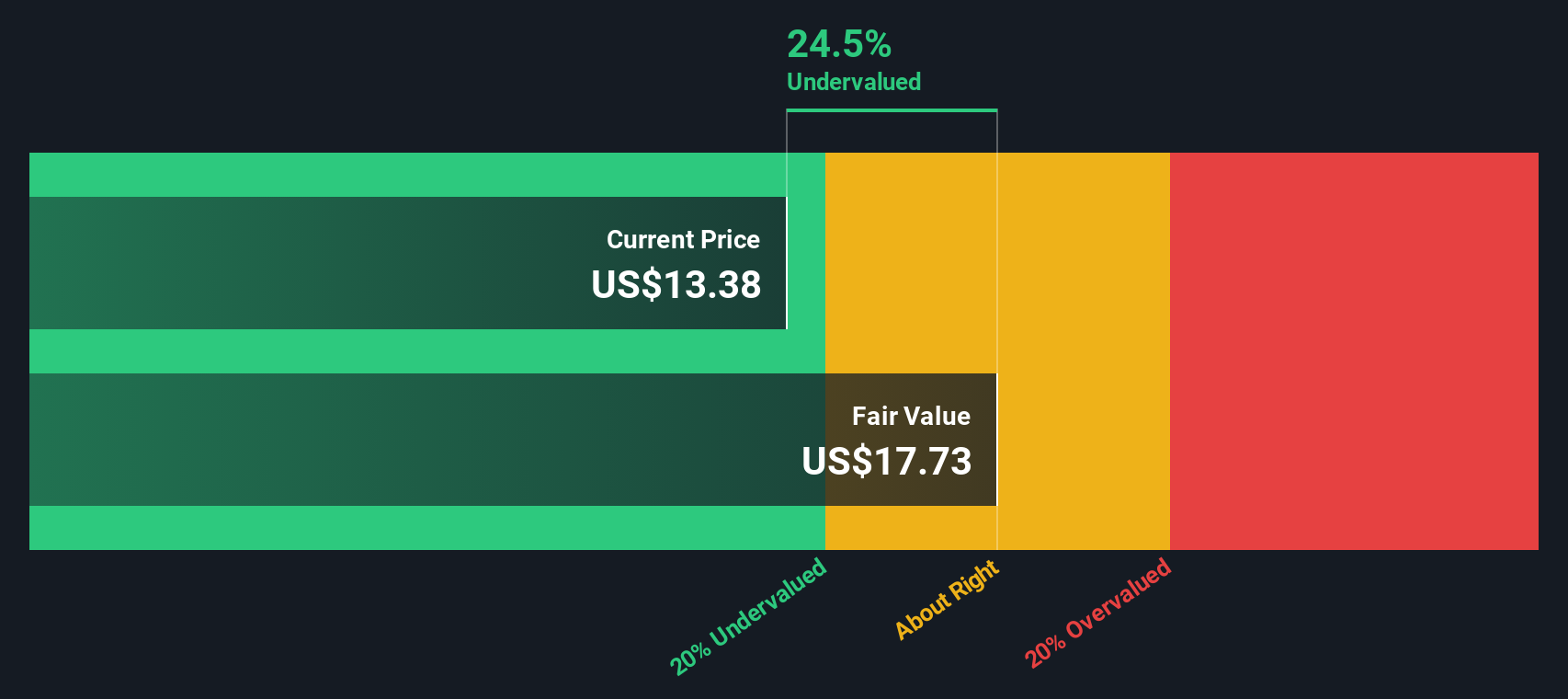

Another View: Discounted Cash Flow Suggests Undervaluation

While the most-followed narrative sees UiPath as overvalued, our DCF model offers a different perspective. It estimates fair value at $17.87, about 7.8% above the current share price. This suggests potential undervaluation. Could the market be missing something in its skepticism, or is this optimism unwarranted?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own UiPath Narrative

Keep in mind, if you have a different perspective or want to analyze the numbers for yourself, you can build your own narrative in just a few minutes with Do it your way.

A great starting point for your UiPath research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Angles?

If you want an edge, don’t stop at UiPath. Some of the market’s most exciting opportunities await if you use the right tools to search them out.

- Tap into future breakthroughs by scanning these 28 quantum computing stocks which powers innovation in fields like computing, security, and new tech frontiers.

- Unlock growing income streams from these 17 dividend stocks with yields > 3% featuring robust yields designed to withstand market swings.

- Spot early-stage disruptors using these 27 AI penny stocks as they shape tomorrow’s AI landscape and set the pace for the next wave of digital leaders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives