- United States

- /

- Software

- /

- NYSE:NOW

ServiceNow (NYSE:NOW) Expands AI Capabilities Through New Partnerships With Kura Labs And Deloitte

Reviewed by Simply Wall St

ServiceNow (NYSE:NOW) recently experienced a decline of 10% over the past week. This price movement comes despite two major developments: a partnership with Kura Labs to enhance AI-powered workflows and an expanded alliance with Deloitte and Google Cloud to bolster AI capabilities. These initiatives, aimed at increasing automation and operational efficiency, may not have countered broader market trends amidst a volatile period marked by substantial market declines, where the S&P 500 and tech-heavy indices faced heightened pressure due to escalating tariffs and associated economic uncertainties. ServiceNow's performance, therefore, aligns with the broader negative sentiment affecting the tech sector.

The recent announcements involving ServiceNow's partnerships with Kura Labs, Deloitte, and Google Cloud underscore the company's commitment to integrating AI into its operations. While these initiatives are geared towards enhancing automation and efficiency, the recent 10% decline in share price suggests that investors are weighing these developments against broader market volatility and existing sector dynamics. Over the past five years, ServiceNow's total return, including share price and dividends, has been 140.86%, highlighting significant longer-term growth despite recent setbacks.

Over the past year, ServiceNow's shares have underperformed compared to the US Market, which experienced a 5.8% decline, and the US Software industry, which saw a 10.5% decline. This underperformance raises questions about short-term challenges, particularly as the company shifts towards a hybrid consumption and subscription model that could initially impact revenue growth and compress profit margins. The market's cautious reaction suggests investors may be concerned about potential increases in operational costs associated with aggressive AI adoption.

Analysts suggest that ServiceNow's current share price at US$727.6 is approximately 24.5% lower than the bearish price target of US$963.82, indicating room for upward movement if the company successfully implements its AI initiatives. This price movement relative to the target reflects investor uncertainty about the pace at which AI-driven revenue and earnings improvements will materialize. While the revenue target of $17.8 billion by 2028 indicates ambitious growth, meeting these objectives will necessitate overcoming customer adaptation challenges and sustaining competitive pressures within the industry.

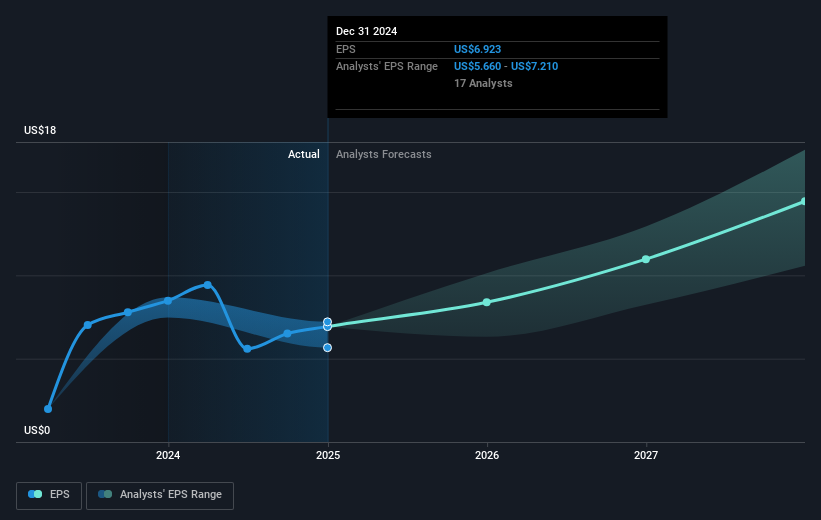

Examine ServiceNow's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion