- United States

- /

- Software

- /

- NYSE:NOW

ServiceNow (NOW): Evaluating Valuation as New Platform Partnerships Expand Automation and Workplace Intelligence

Reviewed by Simply Wall St

ServiceNow (NOW) recently rolled out new collaborations with Figma and VergeSense, further evolving its platform for enterprise customers. These moves support faster application development and smarter workplace management, aligning with ServiceNow’s strategy to meet changing automation and design needs.

See our latest analysis for ServiceNow.

Following these platform moves and a recent proposed 5-for-1 stock split, ServiceNow's share price has swung lower in 2024, with an 18.05% year-to-date decline. Still, long-term momentum remains strong, as the stock has delivered a 109.62% total return over three years. This signals the company’s growth track record is far from over, even if sentiment has cooled this year.

If you're wondering what other tech innovators are building momentum, it's a great time to explore the possibilities with See the full list for free.

With strong recent innovations and shares trading at a notable discount to analyst price targets, the question for investors is clear: Is ServiceNow currently undervalued, or is the market already pricing in its next phase of growth?

Most Popular Narrative: 25.3% Undervalued

According to the most followed narrative, ServiceNow's fair value is estimated to be about $1,157 per share. This is significantly above the recent close of $864.04, which suggests notable upside, based on robust long-term growth expectations and strategic execution.

ServiceNow's focus on AI platform and business transformation is gaining momentum. This is expected to drive future revenue growth as demand for AI-driven solutions increases. The acquisition of companies like Moveworks and Logik.ai can enhance ServiceNow’s offerings by driving efficiencies and offering more integrated solutions, which may also improve net margins.

Curious about the bullish logic that puts ServiceNow’s value so far above its share price? The narrative reveals ambitious targets for both future growth and profitability. Want to see the full set of projections and assumptions supporting this high valuation? Dive in to unlock the financial roadmap behind ServiceNow’s potential re-rating.

Result: Fair Value of $1,156.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as reliance on U.S. federal contracts and global economic uncertainty could impact ServiceNow’s growth path and shift investor sentiment.

Find out about the key risks to this ServiceNow narrative.

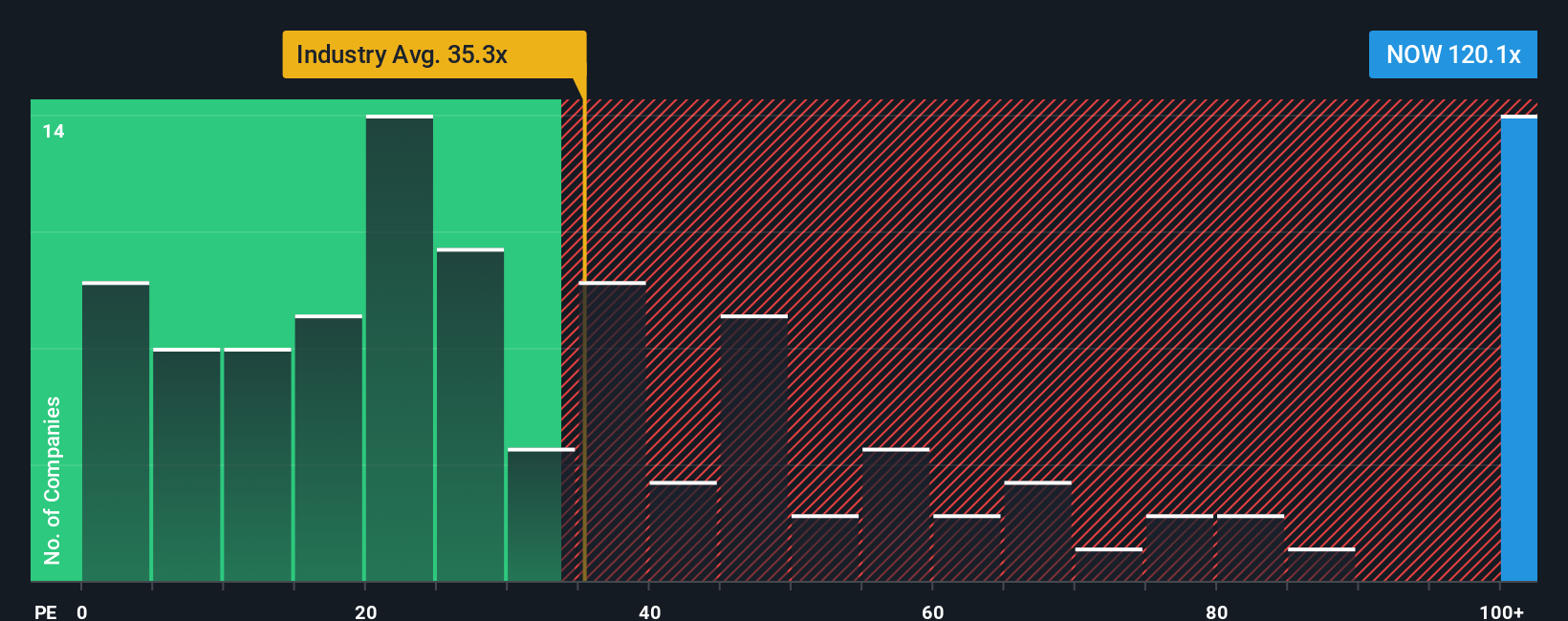

Another View: Market Multiples Signal Caution

While the fair value narrative suggests significant upside, a look at ServiceNow's price-to-earnings ratio tells a more cautious story. The company trades at 103.6 times earnings, much higher than both the industry average (32.1x) and its peer group (57.9x), and also above a fair ratio of 49.8x. This signals investors may be paying a premium for expected growth and innovation, posing real valuation risk if expectations aren’t met. Could the market be overreaching, or does it simply see more in ServiceNow’s story than the multiples suggest?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ServiceNow Narrative

If you see ServiceNow's story differently or want to chart your own path, you can build your personal view in just minutes. Do it your way

A great starting point for your ServiceNow research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let great opportunities pass you by. Use Simply Wall Street’s powerful screener tools to target the ideas shaping tomorrow’s market winners, right now.

- Boost your portfolio with reliable passive income when you scan these 14 dividend stocks with yields > 3%, offering yields over 3% and rock-solid stability.

- Capitalize on the surge in artificial intelligence by checking out these 27 AI penny stocks, driving disruptive breakthroughs and rapid growth in this hot sector.

- Spot value plays instantly with these 878 undervalued stocks based on cash flows so you never miss companies trading below their true worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives