- United States

- /

- Software

- /

- NYSE:NOW

ServiceNow (NOW): Evaluating Valuation After Acquisition of Work4Flow’s AI Readiness Solution

Reviewed by Simply Wall St

ServiceNow (NOW) has acquired the Now Assist Readiness Evaluation solution from Work4Flow Inc., aiming to accelerate the rollout of enterprise AI and automation for its customers. This development highlights ServiceNow’s ongoing focus on practical AI adoption.

See our latest analysis for ServiceNow.

ServiceNow’s latest acquisition comes as the company continues to make headlines at major industry events, such as ITAP in Singapore and ITC Vegas. This signals its commitment to expanding enterprise automation and AI globally. Despite that momentum, the stock’s year-to-date share price return stands at -12.97%, while its one-year total shareholder return is flat. This reflects a pause after several strong years of longer-term outperformance. Still, a three-year total shareholder return of 144% highlights how much value ServiceNow has created for patient investors.

If this wave of enterprise AI activity has you watching the broader tech landscape, it could be the perfect moment to explore See the full list for free..

With shares down this year but trading at a double-digit discount to analyst targets, investors must weigh whether ServiceNow represents an undervalued AI play or if the market has already anticipated future growth potential.

Most Popular Narrative: 19.7% Undervalued

With ServiceNow's closing price sitting notably below the widely tracked narrative fair value, investors are facing a valuation gap that cannot be ignored. The difference sparks debate on whether market expectations are too conservative compared to consensus projections.

ServiceNow's focus on AI platform and business transformation is gaining momentum. This is expected to drive future revenue growth as demand for AI-driven solutions increases. The acquisition of companies like Moveworks and Logik.ai can enhance ServiceNow’s offerings, potentially improving net margins by driving efficiencies and offering more integrated solutions.

Curious about which bold growth levers analysts are betting on this time? The earnings trajectory, margin uplift, and future profit multiples driving these price targets might surprise even the most seasoned investors. Click to uncover the full financial blueprint behind this major valuation call.

Result: Fair Value of $1,142.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in U.S. federal spending or setbacks in integrating acquired AI technologies could quickly challenge even the most optimistic expectations for ServiceNow’s growth.

Find out about the key risks to this ServiceNow narrative.

Another View: High Multiples, Steep Expectations

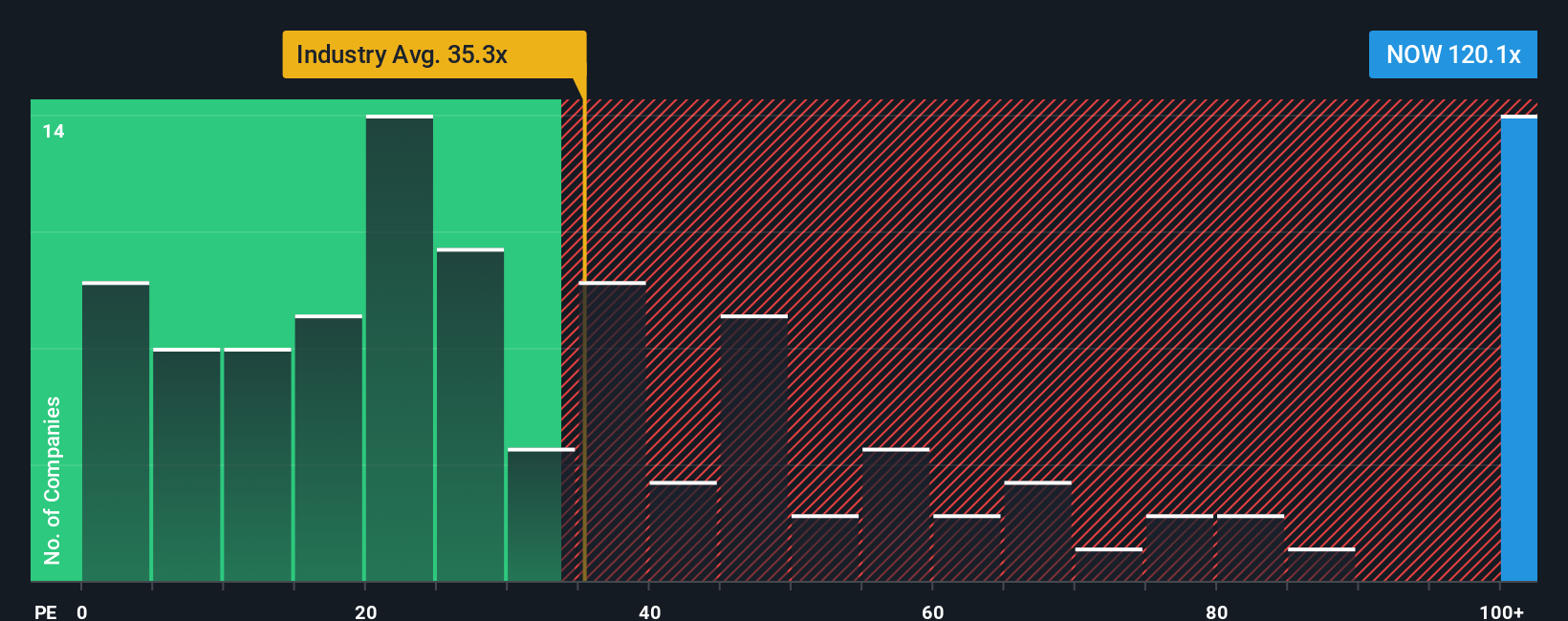

Looking at valuation from a price-to-earnings angle reveals a different story. ServiceNow trades at 114.6x earnings, much higher than its peer average of 61.9x and the broader US software industry's 35.3x. This is also more than double its fair ratio of 50.2x, which reflects where the market could eventually settle. Such a steep gap could mean big rewards if growth surges, but it might also signal increased risk if the business underdelivers. Is the market expecting too much?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ServiceNow Narrative

If you see the numbers differently or want an independent angle, you can dig into the details and build your own story in minutes with Do it your way.

A great starting point for your ServiceNow research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss out on other high-potential opportunities. Smart investors regularly check the market for fresh angles and sector-breaking momentum using our unique screeners.

- Tap into the AI boom and spot tomorrow’s leaders faster with these 24 AI penny stocks.

- Secure passive income with stable yields by scanning these 17 dividend stocks with yields > 3% offering robust payouts above 3%.

- Ride the blockchain wave and get early exposure by tracking these 79 cryptocurrency and blockchain stocks changing the face of digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion