- United States

- /

- Software

- /

- NYSE:NOW

How the Recent ServiceNow AI Update Impacts Its Current Share Price in 2025

Reviewed by Bailey Pemberton

If you’re trying to decide what to do with ServiceNow stock right now, you’re in good company. It’s one of those names that’s hard to ignore, whether you’re watching tech giants reshape their industries or just keeping an eye on cloud trends. After a wild few years, investors have seen ServiceNow surge by over 150% in three years, a pretty spectacular run, only to give some of that back recently. Year-to-date, it’s down more than 14.3%, and the past month saw a nearly 5% dip, but just last week the stock ticked up by about 1.7%. These moves hint at shifting risk appetites across the tech sector and show how sentiment can swing, even when the long-term story stays strong.

With all the noise, including market headlines, news about tech innovation, or bigger-picture shifts in enterprise IT, it’s no surprise many investors are asking if ServiceNow’s current price really reflects its true value. When we break down the numbers, ServiceNow scores just 1 out of 6 possible marks for being undervalued using standard valuation checks. That single point suggests most perspectives see the stock as a bit pricey right now, despite its impressive longer-term returns.

But numbers only tell part of the story. In the next sections, we’ll dig into how different valuation methods assess ServiceNow today. And, if you’re looking for a smarter way to think about value in a fast-moving market, stay tuned for a perspective at the end that goes beyond the usual price tags.

ServiceNow scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ServiceNow Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) method estimates a company’s intrinsic value by projecting its expected future cash flows and then discounting them back to their value today. This approach helps investors focus on future earning power rather than just current profits or book values.

For ServiceNow, the current Free Cash Flow (FCF) is about $3.76 Billion. Analysts expect that FCF will keep growing, reaching close to $9.04 Billion by the end of 2029. The first five years of these projections come from analysts. The following years are extrapolated, reflecting assumptions about how the business might mature over time. These forward-looking estimates all use the U.S. dollar as their basis.

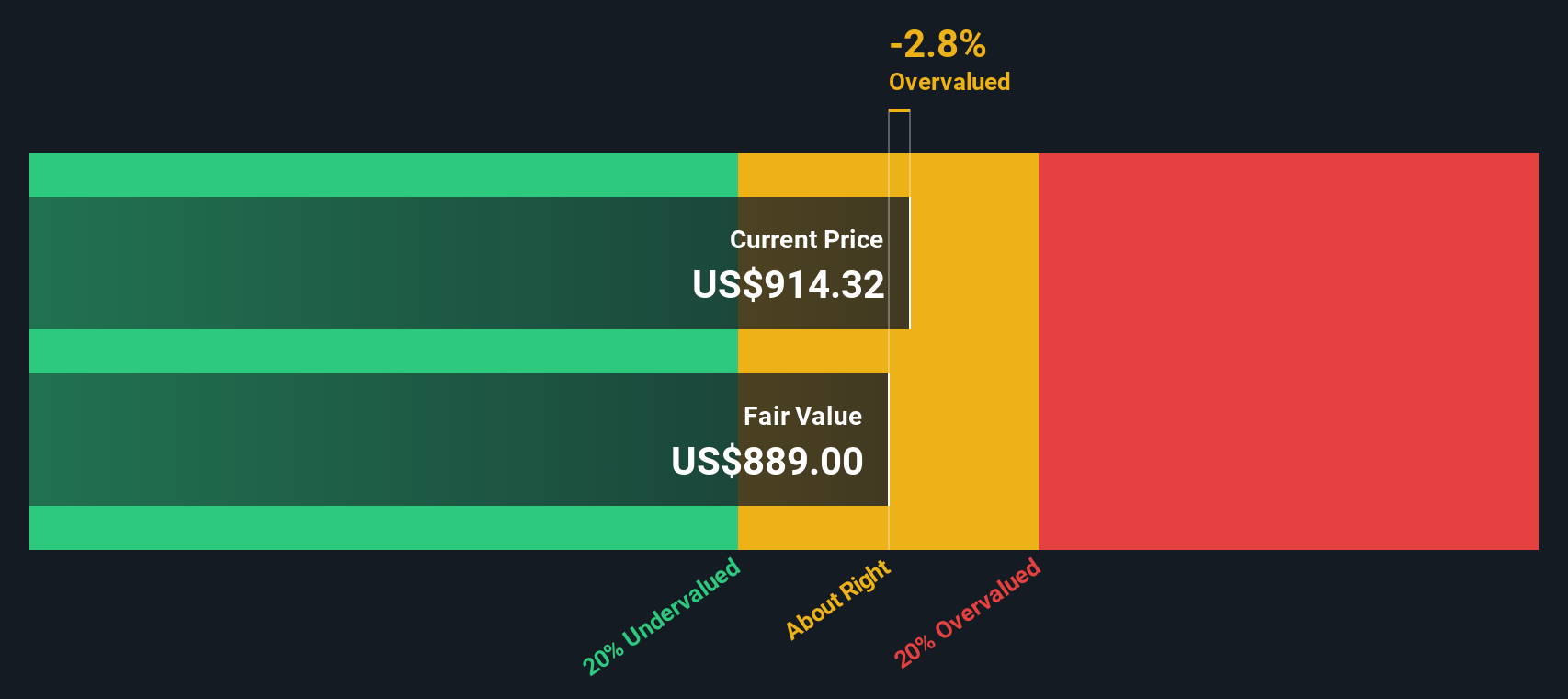

Based on this analysis, the DCF model values ServiceNow at approximately $889 per share. When compared to ServiceNow’s present market price, this suggests the stock is 1.6% above the model’s estimate. In other words, it appears ever so slightly overvalued on these projections.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out ServiceNow's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: ServiceNow Price vs Earnings

For companies like ServiceNow that are consistently profitable, the Price-to-Earnings (PE) ratio is a reliable way to gauge valuation. This metric looks beyond the noise of short-term revenues to compare a company’s share price to its actual earnings. It is especially useful when a business is generating healthy profits.

The “right” PE ratio for a company depends on how quickly it is expected to grow and the risks it faces. Higher growth prospects or lower risks can justify a higher PE, while slower growth or greater uncertainty might warrant a lower one.

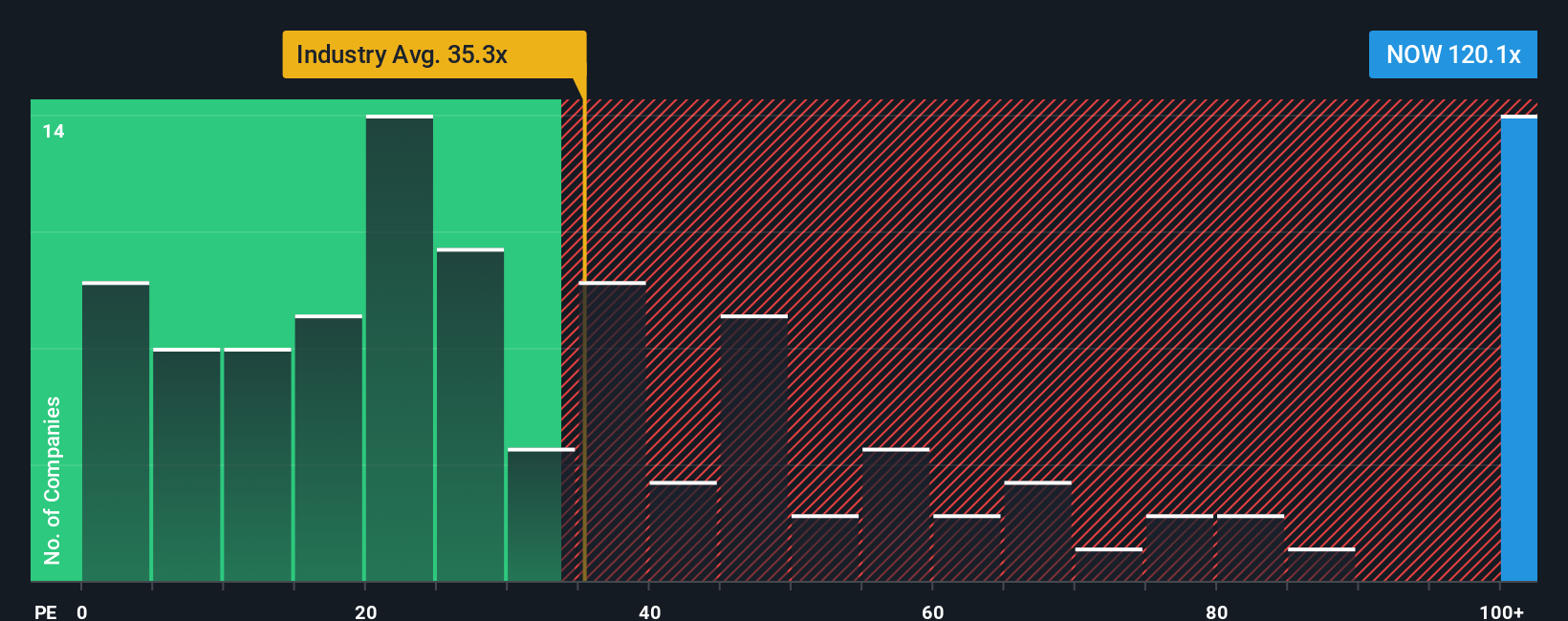

Currently, ServiceNow trades at 112.9 times earnings. This places it well above the software industry's average of 34.9 times and above its peer group average of 61.9 times. At first glance, this could make the stock appear expensive compared to others in its sector.

This is where Simply Wall St’s Fair Ratio becomes relevant. The Fair Ratio estimates what PE multiple is justified for ServiceNow after considering not just industry and peer group medians, but also factors unique to the company such as its earnings growth, risk profile, profit margins, and market capitalization. With a Fair Ratio of 50.1 times, the data suggests a much lower PE multiple would be justified given these fundamentals.

By comparing ServiceNow’s current 112.9 times PE to its Fair Ratio of 50.1 times, the stock appears overvalued on this basis, despite strong underlying business performance.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ServiceNow Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a powerful, yet approachable tool that let you craft and follow your own story behind a stock’s numbers. You can combine your perspective about ServiceNow’s future (or any other company’s) with assumptions for its revenue, margins, and growth, then link those to a fair value estimate. Narratives make it easy to see how forecasts and business catalysts are connected to valuation, and are available for free on Simply Wall St’s Community page, used by millions of investors.

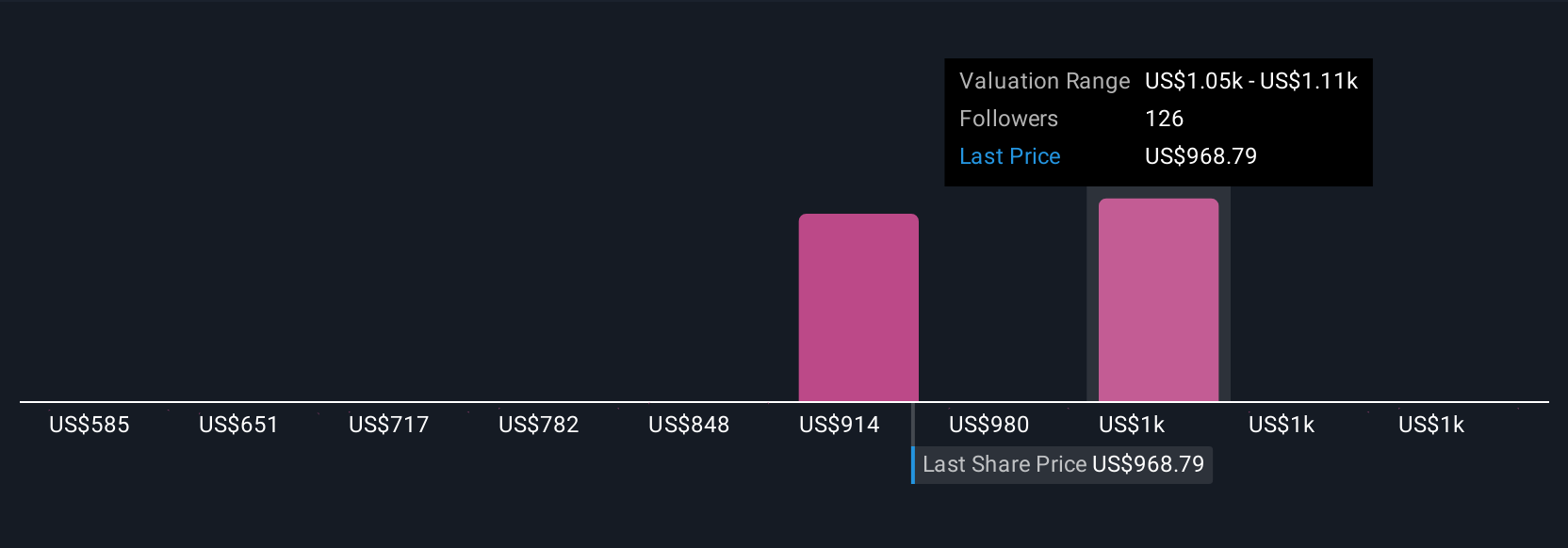

With Narratives, you can compare your Fair Value to the current market price, helping you decide whether it’s time to buy, hold, or sell. Because each Narrative is dynamically updated with new events like earnings or news, your view stays relevant as conditions shift. For example, some investors see the greatest long-term potential for ServiceNow and set a Fair Value as high as $1,243, while others take a more cautious approach and value it closer to $904, all based on their distinct stories and forecasts for the company.

Do you think there's more to the story for ServiceNow? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion