- United States

- /

- Software

- /

- NYSE:NOW

Does ServiceNow’s AI Partnerships and Strong Q2 Results Signal a New Growth Era for NOW?

Reviewed by Simply Wall St

- On July 23, 2025, ServiceNow reported strong second-quarter results, surpassing its guidance with revenue of US$3.22 billion and announcing innovations such as agentic workforce management and several new partnerships, including with Ferrari and CapZone Impact Investments.

- ServiceNow’s agentic workforce management showcases the company’s push for AI-driven enterprise automation, potentially redefining how employees and AI collaborate across multiple business functions.

- We'll explore how ServiceNow’s AI-driven automation platform expansion could influence its future growth and analyst assumptions.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

ServiceNow Investment Narrative Recap

To be a shareholder in ServiceNow, you need to believe that its AI-driven platform and product innovation can deliver sustainable growth and efficiency gains for customers. The latest strong Q2 results, with US$3.22 billion revenue and an expanded customer base, support the key short-term catalyst, growing enterprise adoption of AI and automation solutions. Although the news reinforces the company’s market leadership, it does not materially change the current primary risk: execution challenges in scaling AI, especially amid intensifying competition.

Among the latest developments, the launch of Agentic Workforce Management stands out. By enabling direct collaboration between employees and AI agents, ServiceNow’s platform seeks to extend automation across IT operations, security, and customer support. This announcement closely aligns with the main catalyst driving optimism around ServiceNow: growing demand for integrated AI tools that can transform business processes and drive productivity improvements at scale.

By contrast, investors should watch for unexpected cost pressures arising from rapid investment in AI capabilities and global expansion, as these factors may...

Read the full narrative on ServiceNow (it's free!)

ServiceNow's outlook projects $19.3 billion in revenue and $3.2 billion in earnings by 2028. This is based on an annual revenue growth rate of 18.9% and represents a $1.7 billion increase in earnings from the current $1.5 billion.

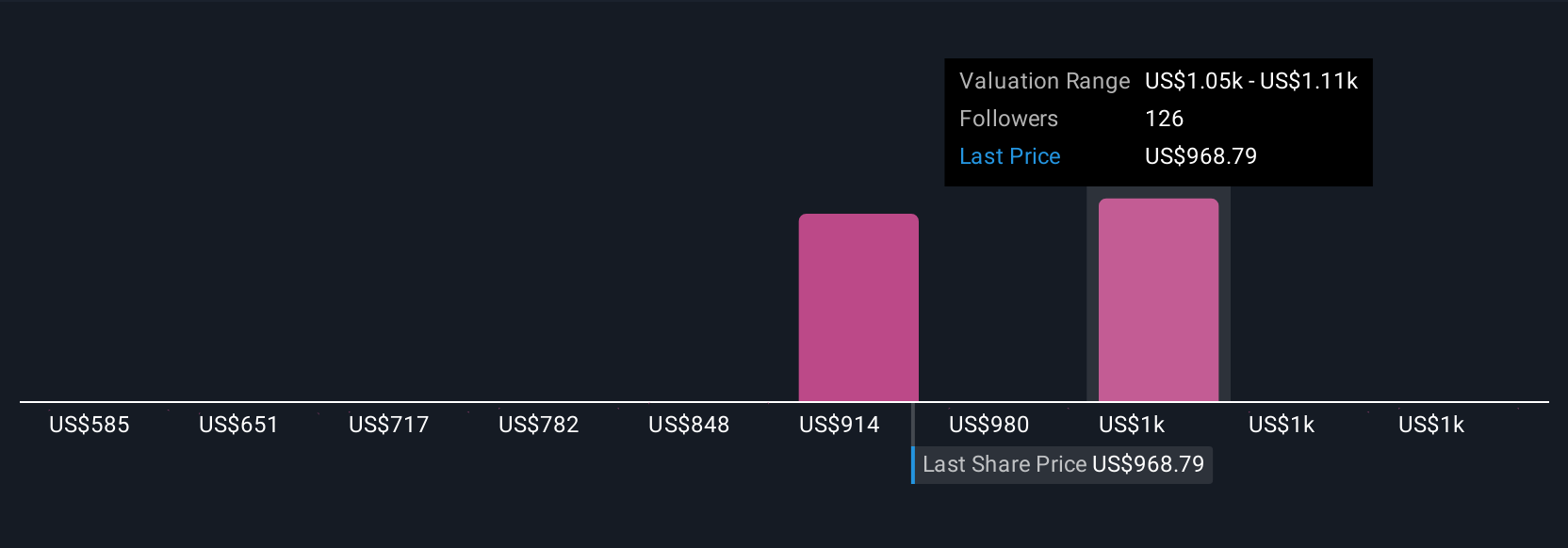

Uncover how ServiceNow's forecasts yield a $1099 fair value, a 11% upside to its current price.

Exploring Other Perspectives

While some analysts saw ServiceNow reaching over US$20 billion in annual revenue by 2028 and forecasted profit margins approaching 21 percent, others highlight that ambitious AI pricing models and expansion plans bring higher operational risks. These most optimistic estimates show just how different your own assumptions might be, especially as new developments, like the recent Q2 results and product launches, could shape future outlooks.

Explore 14 other fair value estimates on ServiceNow - why the stock might be worth 41% less than the current price!

Build Your Own ServiceNow Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ServiceNow research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free ServiceNow research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ServiceNow's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOW

ServiceNow

Provides cloud-based solution for digital workflows in the North America, Europe, the Middle East and Africa, Asia Pacific, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives