- United States

- /

- Software

- /

- NYSE:NEWR

Investors might be losing patience for New Relic's (NYSE:NEWR) increasing losses, as stock sheds 3.3% over the past week

Low-cost index funds make it easy to achieve average market returns. But across the board there are plenty of stocks that underperform the market. Unfortunately for shareholders, while the New Relic, Inc. (NYSE:NEWR) share price is up 41% in the last three years, that falls short of the market return. In the last year the stock price gained, albeit only 3.5%.

While this past week has detracted from the company's three-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

Check out our latest analysis for New Relic

New Relic wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years New Relic saw its revenue grow at 14% per year. That's a very respectable growth rate. The annual gain of 12% over three years is better than nothing, but hardly impresses. So it's possible that expectations were elevated in the past, muting returns over three years. However, if you can reasonably expect profits in the next few years, this stock might belong on your watchlist.

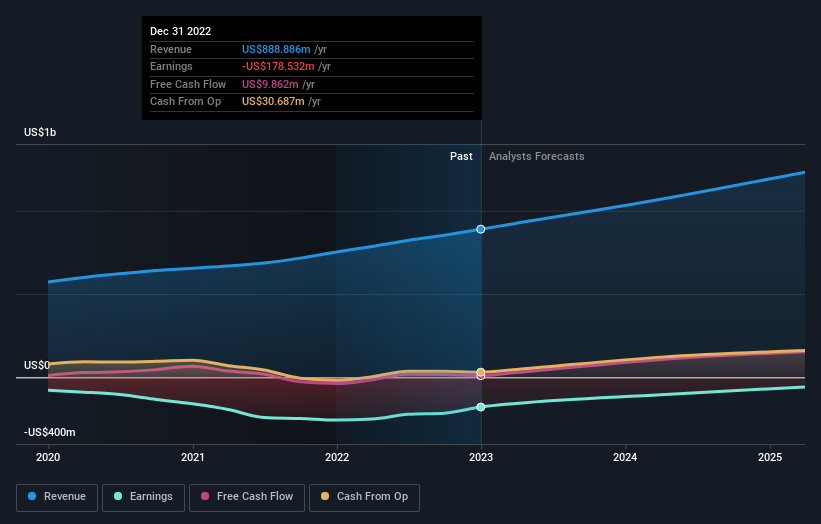

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

New Relic is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for New Relic in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that New Relic shareholders have received a total shareholder return of 3.5% over the last year. There's no doubt those recent returns are much better than the TSR loss of 1.1% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for New Relic you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if New Relic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NEWR

New Relic

New Relic, Inc., a software-as-a-service company, delivers a software platform for customers to collect telemetry data and derive insights from that data in a unified front-end application.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026