- United States

- /

- IT

- /

- NYSE:NET

Why Cloudflare (NET) Is Up 6.2% After Securing Major AI Security Contracts in Tokyo Summit

Reviewed by Simply Wall St

- Cloudflare recently participated in the Gartner Security & Risk Management Summit in Tokyo, where company leaders highlighted advances in AI-driven enterprise security solutions.

- An interesting aspect is Cloudflare's recent success in securing multiple large enterprise AI contracts, which has played a key role in exceeding its revenue guidance.

- We'll consider how Cloudflare's strong momentum in enterprise AI adoption shapes its investment narrative for long-term growth prospects.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Cloudflare's Investment Narrative?

Cloudflare’s recent surge in enterprise AI contracts, highlighted at the Gartner Security & Risk Management Summit, lands squarely at the center of the company’s growth story. These wins seem to be feeding into the revenue momentum that has already pushed Cloudflare beyond prior guidance and drawn favorable analyst attention, with a noticeable 4.1% jump in the share price. As a shareholder, the belief to anchor on is Cloudflare’s ability to convert rapid innovation, especially in AI-powered security, into lasting top-line expansion despite lack of profitability to date. In the short term, strong enterprise AI adoption could support higher revenue expectations and raise the stakes for the upcoming Q2 earnings, possibly shifting analyst and investor expectations upward. However, the risks remain clear: the company is still unprofitable, its valuation is elevated compared to peers, and the large gains in share price leave little room for error if growth stalls or competition tightens. Recent positive momentum may ease some near-term concerns, but the underlying challenges related to high expectations and execution persist.

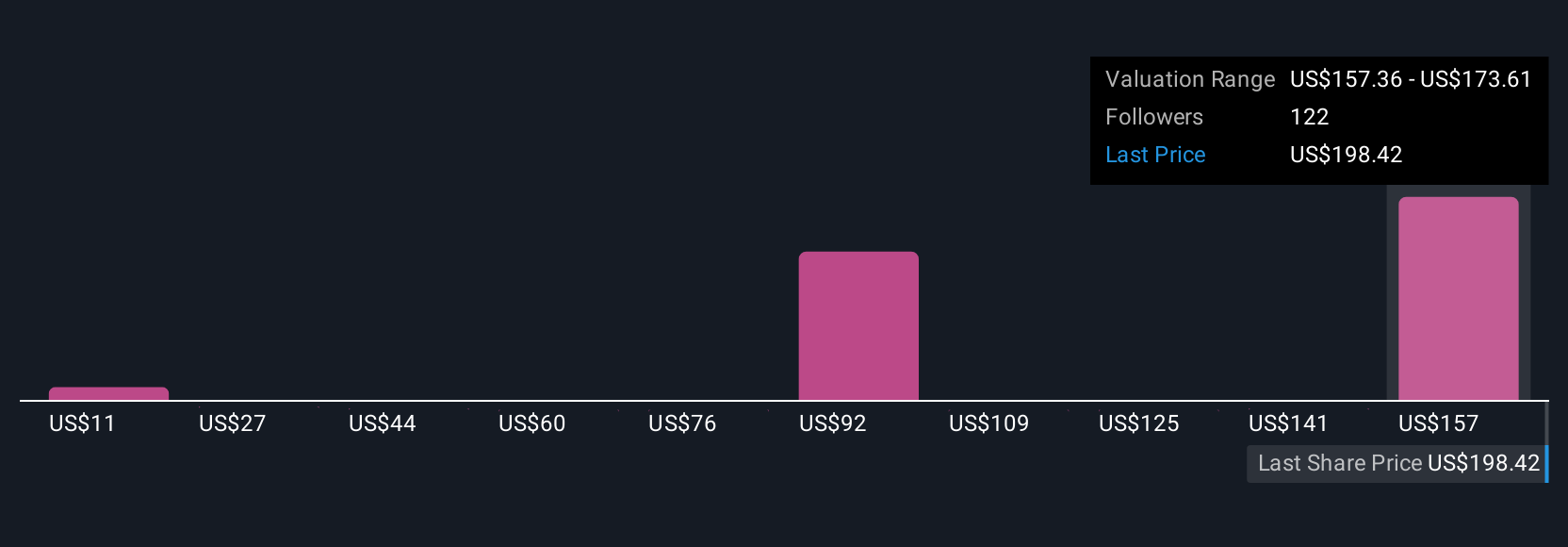

But beneath the upbeat news, Cloudflare’s premium valuation stands out as a key risk. Cloudflare's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 28 other fair value estimates on Cloudflare - why the stock might be worth as much as $177.28!

Build Your Own Cloudflare Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cloudflare research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cloudflare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cloudflare's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives