- United States

- /

- IT

- /

- NYSE:NET

Is Cloudflare’s (NET) Edge Computing Momentum Shifting Its Competitive Position in Cybersecurity and AI?

- Cloudflare was recently spotlighted for its strong quarterly performance and expanding presence in cybersecurity and serverless edge computing, as well as its growing relevance in AI-driven sectors.

- While the company’s innovations have attracted investor attention, questions remain about its high valuation and the sustainability of its rapid growth amid intense competition.

- We'll explore how Cloudflare’s momentum in serverless computing and AI reshapes its overall investment narrative in today’s market.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

What Is Cloudflare's Investment Narrative?

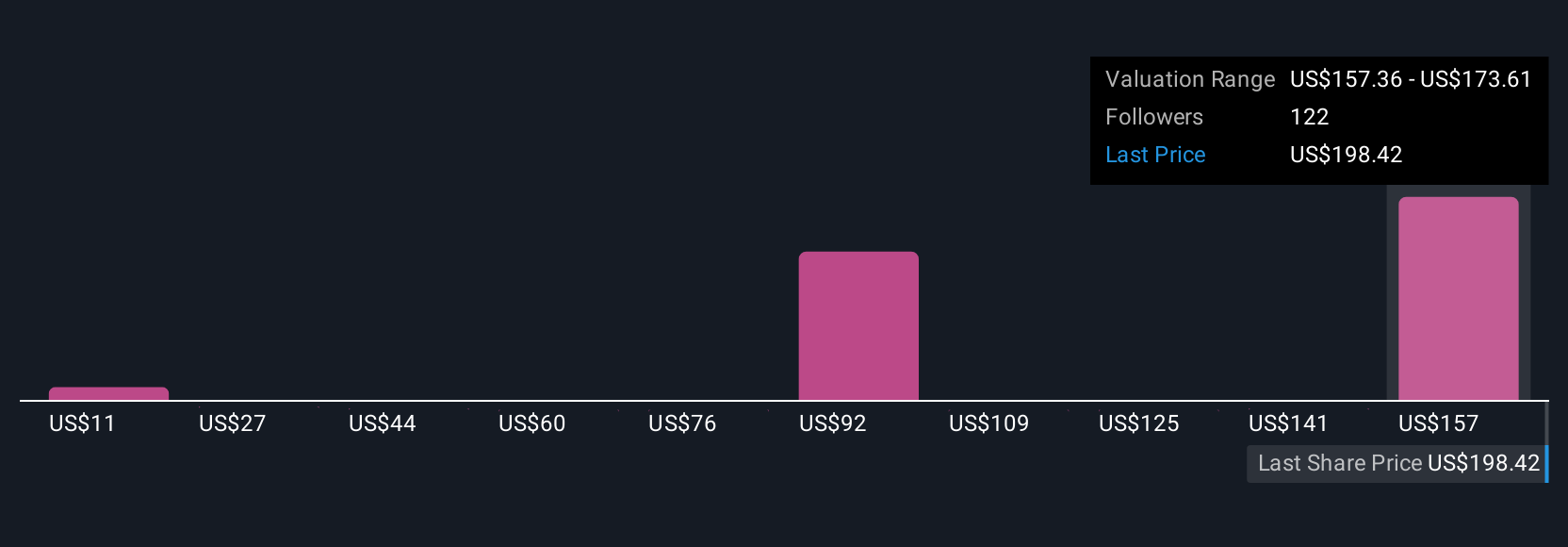

To be a shareholder in Cloudflare today, you have to believe in its ability to capture long-term demand from the digital shift towards AI, cybersecurity, and serverless applications. The recent news highlights Cloudflare’s integration with major generative AI platforms and continued expansion in Zero Trust security, which positions the company at the core of critical technology trends. These product updates serve as catalysts, reinforcing the company’s relevance, but the market reaction, driven by AI momentum and rapid stock appreciation, has not significantly altered near-term risks. Cloudflare’s biggest challenges remain its steep valuation compared to peers and ongoing net losses, setting expectations high for future profitability. While the product news supports short-term optimism and momentum, it does not materially reduce risks related to competition, high revenue multiples, or the need to deliver consistent financial results over time. On the other hand, competition from larger rivals could erode Cloudflare’s pricing power.

Cloudflare's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 30 other fair value estimates on Cloudflare - why the stock might be worth as much as $209.01!

Build Your Own Cloudflare Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cloudflare research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Cloudflare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cloudflare's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Micron's New Supercycle: Riding the High-Bandwidth Memory Wave

IREN's Trump Card: How Federal Policy Could Unlock Massive Value in AI Infrastructure

Insert Coin to Continue: The Investment Case for Capcom

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion

Looks interesting, I am jumping into the finances now. Your 15% margin seems high for a conservative model, can't just ignore the years they need to invest. You didnt seem to mention that they had to dilute the sharebase by issuing ~40mil shares. raising ~8 mil. should be enough if mouse does OK. If not they will need to raise more to suvive. Losing 20m a year, 14m after there 6m cutbacks. Am I reading it right that they have no debt. have they any history of raising debt? First look it is too dependant on the mouse and GoT games. they do well stock will 2-3x, poorly and it will drop. I am not sure I agree with your work for hire backstop. Unlikely meta horizons will continue with the same size contract going forward. say 10% margins and 15x multiple on 30m. that is 45m, which with the new sharecount is 10c. It is a backstop but maybe not that strong. Mouse fails and devs could start jumping ship and outside contracts could dry up. Hmm on top of all that AI could be disrupting the work for hire model. I think I have mostly talked myself out of it. Although Mouse looks good and does seem like the type of game that could go viral on twitch for a few months. If it does you will likly get a great return 5x plus. crap maybe I am talking myself back in.