- United States

- /

- IT

- /

- NYSE:NET

Cloudflare (NET) Reports Increased Revenue Amid Higher Losses and Updated Earnings Guidance

Reviewed by Simply Wall St

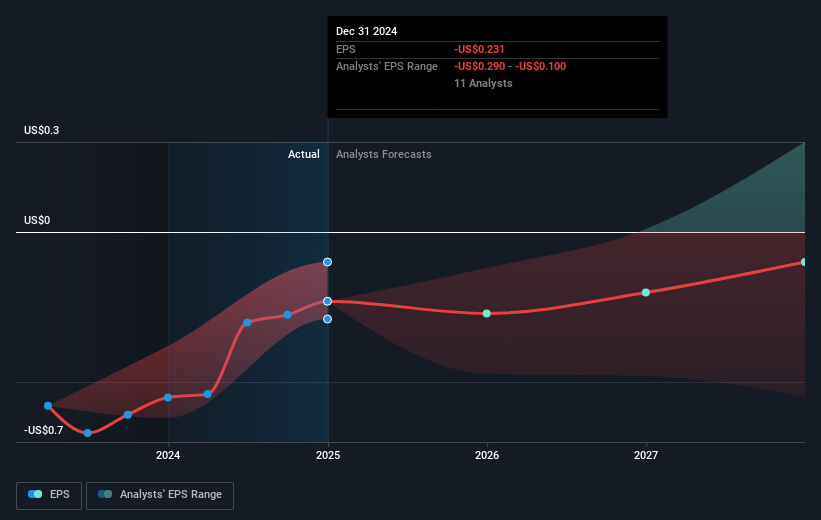

Cloudflare (NET) recently announced significant updates, including a revenue guidance for Q3 and full year 2025, as well as its second-quarter earnings reflecting a year-over-year growth in sales but widening net losses. While the company's stock surged 67% last quarter, likely boosted by these developments, it occurred alongside a broader market uptrend, with the S&P 500 seeing solid gains despite economic uncertainties like tariffs and a weak jobs report. Cloudflare’s innovative product launches and expanded partnerships, such as with TD SYNNEX, may have further reinforced investor confidence amid the generally positive market sentiment.

You should learn about the 1 possible red flag we've spotted with Cloudflare.

Over the past five years, Cloudflare's shares have achieved an impressive total return of over 400%, showcasing strong performance compared to many peers, despite its current unprofitability. In the past year alone, the company outperformed the US IT industry, which returned 24.5%, and also exceeded the US Market's return of 16.8%.

The recent news updates and product developments could potentially impact Cloudflare’s future revenue and earnings forecasts positively. However, the company's revenue growth is forecasted to slow, at 19.6% annually, compared to a more rapid growth in the broader market. Furthermore, despite the recent share price movement, Cloudflare's stock is currently trading above current analyst consensus targets of US$177.28. This indicates that the market may already be pricing in much of the anticipated growth and positive developments.

Examine Cloudflare's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives