- United States

- /

- IT

- /

- NYSE:NET

Cloudflare (NET): Evaluating Valuation After Breakthrough Integrations With Leading Enterprise AI Tools

Cloudflare (NET) just made a move that could grab the attention of anyone tracking how technology secures the modern workplace. By becoming the first Cloud Access Security Broker to integrate directly with ChatGPT Enterprise, Claude by Anthropic, and Google Gemini, Cloudflare is stepping out front on one of the hottest trends in business tech. For investors, the news is more than just a product update; it is a direct response to surging enterprise demand for tools that combine generative AI with airtight data protection and compliance.

This announcement builds on a wave of momentum for Cloudflare, both in terms of customer adoption and market expectations. Over the past year, the stock has climbed by 186%, with a 22% jump in the past three months alone. While there have been several product releases and partnership expansions in recent months, the newly revealed integrations give Cloudflare a tangible, first-mover advantage as AI becomes deeply embedded in everyday business operations.

So after such a rapid run-up, is Cloudflare now undervalued as a leader in AI security, or is the market fully pricing in its next phase of growth?

Price-to-Sales of 40.4x: Is it justified?

Cloudflare is currently trading at a price-to-sales ratio of 40.4 times, significantly higher than both its industry’s average and its peer group. This figure indicates that the market is valuing Cloudflare’s sales at a substantial premium compared to other companies in the US IT sector. The industry average is 2.3 times sales, and the peer average is 15.8 times sales.

The price-to-sales ratio is an important metric for companies that are not yet profitable, like Cloudflare, as it shows how much investors are willing to pay for each dollar of revenue. In fast-growing technology companies, investors may justify higher price-to-sales ratios if they expect rapid top-line growth or future profitability. However, such a premium also reflects a high level of expectation for future performance.

Given that Cloudflare's ratio is well above industry norms, it suggests that investors are betting on significant future growth. It also means there is little margin for error if that growth does not materialize as anticipated.

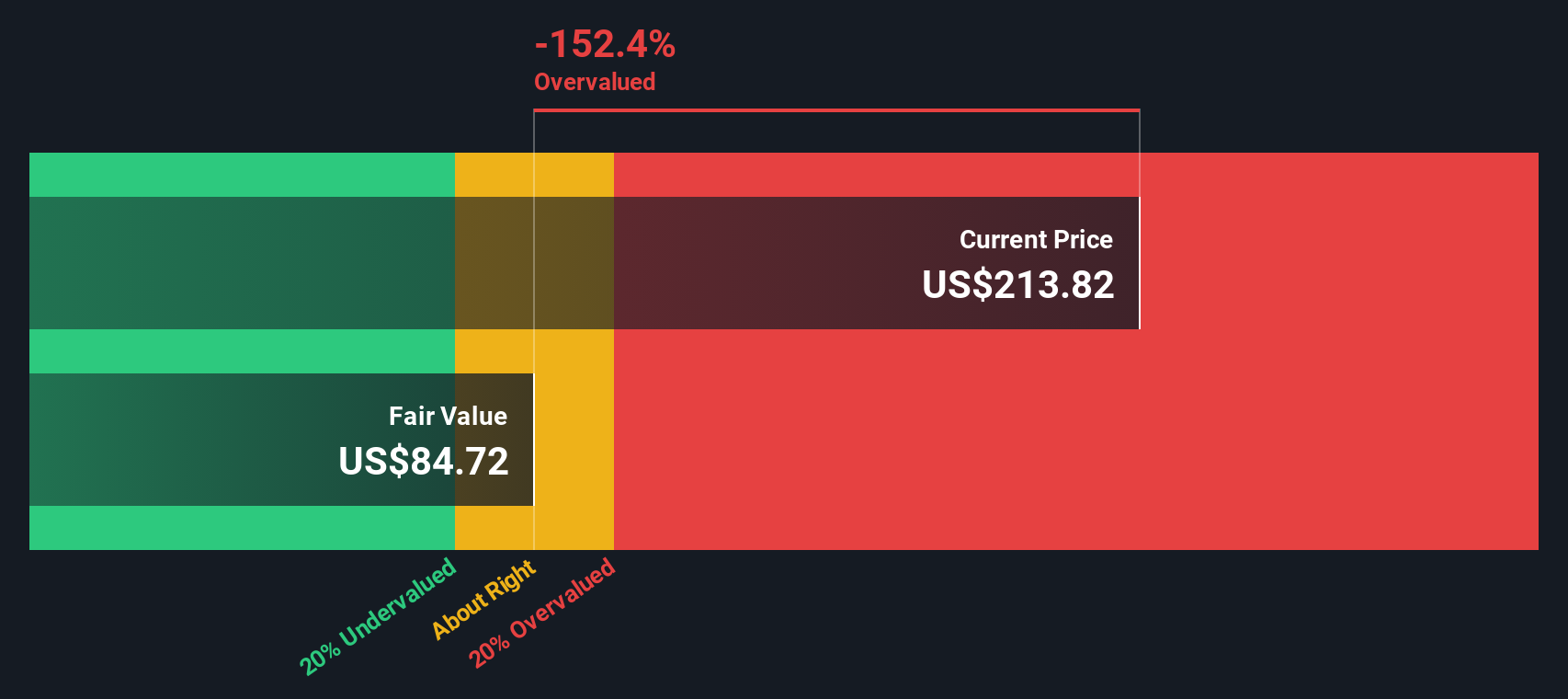

Result: Fair Value of $83.44 (OVERVALUED)

See our latest analysis for Cloudflare.However, slowing revenue growth or continued net losses could quickly shift sentiment if Cloudflare’s execution or market adoption falls short of high expectations.

Find out about the key risks to this Cloudflare narrative.Another View: What About the SWS DCF Model?

While market multiples suggest Cloudflare is trading at a steep premium, the SWS DCF model offers a different lens. This approach looks at future cash flows and also points to a stock trading ahead of its fundamentals. Could reality catch up to the price, or do expectations need a reset?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cloudflare Narrative

If you see things differently or want to dig into the numbers for yourself, you can explore the data and craft your own story in just a few minutes. Do it your way

A great starting point for your Cloudflare research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t stop with Cloudflare. If you’re serious about smarter investing, now’s your moment to unlock new opportunities other investors might be missing.

- Uncover hidden growth stories by tapping into AI penny stocks leading the way in artificial intelligence breakthroughs that are powering tomorrow's smartest businesses.

- Grab the edge with steady income potential by zeroing in on dividend stocks with yields > 3% offering attractive yields above 3% for your portfolio’s staying power.

- Catch the next wave of undervalued gems by scanning undervalued stocks based on cash flows identified by their strong cash flow prospects and overlooked upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Q3 Outlook modestly optimistic

Okamoto Machine Tool Works focus on profitability

Storytel’s Second Act: From Market Land Grab to High Margin Ecosystem

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.