- United States

- /

- Software

- /

- NYSE:NABL

Will N-able’s (NABL) Slowing Profitability Shift Its Competitive Path in 2025?

Reviewed by Sasha Jovanovic

- N-able, Inc. recently reported third-quarter earnings, revealing a year-over-year decline in net income to US$1.38 million and a net loss of US$9.8 million for the first nine months of 2025, compared to net income during the same periods in the prior year.

- The company also issued updated fourth-quarter and full-year 2025 revenue guidance, projecting around 9% growth, while analyst ratings remained generally neutral and insider selling increased.

- We'll examine how the weaker profitability and revised guidance could influence N-able's long-term industry positioning and growth outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

N-able Investment Narrative Recap

To own N-able shares, you need to believe that rising demand for integrated cloud and cybersecurity solutions among managed service providers will outweigh headwinds from industry consolidation and mounting competition in IT management software. The latest news, showing persistent net losses despite healthy projected revenue growth, does little to change the short-term catalyst, execution in cross-selling and mid-market channel expansion, while highlighting the ongoing risk around margin pressure and slowing profitability. The biggest risk remains N-able's exposure to shifts in MSP preferences and its reliance on expanding cross-selling to drive improved earnings.

Among the recent announcements, the revised full-year 2025 revenue guidance, calling for around 9% growth, stands out as most relevant. Despite the company's positive top-line momentum, the back-to-back periods of declining net income and net losses accentuate the challenge of balancing ambitious expansion initiatives with the need to improve operating leverage and profitability.

However, investors should be aware that increased insider selling and ongoing industry shifts could further impact N-able’s earnings profile if...

Read the full narrative on N-able (it's free!)

N-able's outlook forecasts $620.4 million in revenue and $15.9 million in earnings by 2028. This assumes 8.7% annual revenue growth and an increase in earnings of $13 million from the current $2.9 million.

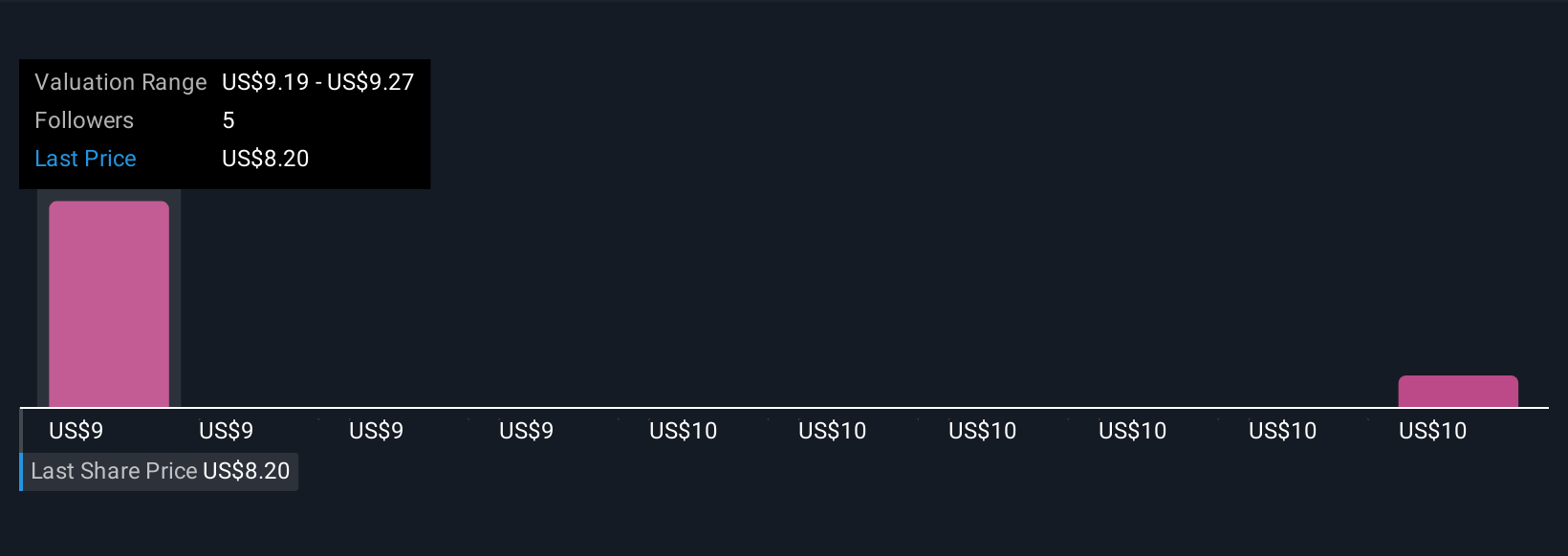

Uncover how N-able's forecasts yield a $9.44 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$9.44 to US$9.98 based on two user forecasts. While many expect N-able to benefit from expanding demand for cyber resilience among MSPs, persistent margin pressure and limited diversification remain a concern for future performance.

Explore 2 other fair value estimates on N-able - why the stock might be worth as much as 30% more than the current price!

Build Your Own N-able Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your N-able research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free N-able research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate N-able's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if N-able might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NABL

N-able

Provides cloud-based security, data protection, and unified endpoint management software solutions for managed service providers in the United States, the United Kingdom, and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives