- United States

- /

- Software

- /

- NYSE:LAW

Investors Aren't Entirely Convinced By CS Disco, Inc.'s (NYSE:LAW) Revenues

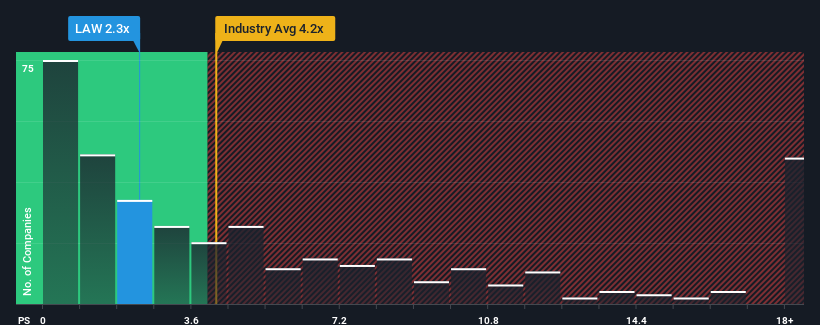

You may think that with a price-to-sales (or "P/S") ratio of 2.3x CS Disco, Inc. (NYSE:LAW) is a stock worth checking out, seeing as almost half of all the Software companies in the United States have P/S ratios greater than 4.2x and even P/S higher than 10x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for CS Disco

How Has CS Disco Performed Recently?

CS Disco could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CS Disco.How Is CS Disco's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like CS Disco's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.2%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 97% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 14% each year over the next three years. With the industry predicted to deliver 16% growth per year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that CS Disco's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does CS Disco's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like the P/S figures for CS Disco remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for CS Disco you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LAW

CS Disco

Provides cloud-native and artificial intelligence-powered legal products for legal hold, legal request, ediscovery, legal document review, and case management in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026