- United States

- /

- Software

- /

- NYSE:KVYO

Klaviyo (KVYO) Valuation Check After New Co-CEO Structure and Leadership Shift

Reviewed by Simply Wall St

Klaviyo (KVYO) just rewired its leadership structure, with the board greenlighting dual CEO roles and elevating interim executive Chano Fernández to co-CEO alongside founder Andrew Bialecki, a shift investors will quickly try to price in.

See our latest analysis for Klaviyo.

The co CEO move lands just as sentiment may be stabilizing, with a 1 month share price return of 14.42 percent. However, year to date share price performance and 1 year total shareholder return both remain firmly negative, suggesting any renewed momentum is still in repair mode rather than a full rerating.

If this kind of leadership reshuffle has you rethinking your tech exposure, it could be worth scanning high growth tech and AI stocks for other growth names at interesting points in their own narratives.

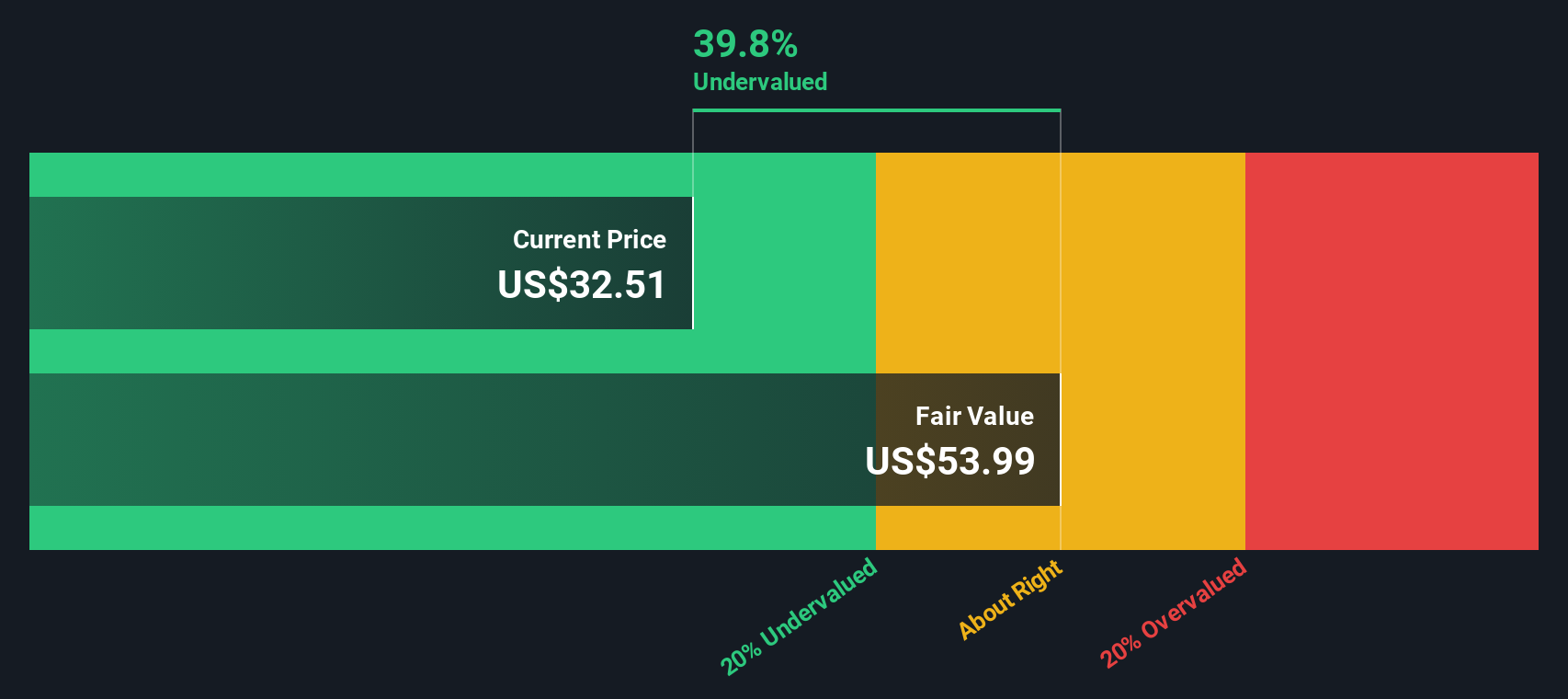

With shares still well below analysts’ targets despite solid revenue and profit growth, investors now face a key call: is Klaviyo trading at a discount ahead of a leadership driven inflection, or is the market already pricing in future gains?

Most Popular Narrative Narrative: 27.6% Undervalued

With Klaviyo last closing at $31.51 against a narrative fair value of about $43.52, the current setup assumes meaningful upside if the story plays out.

The rapid innovation and rollout of new AI first products including Conversational Agent, Helpdesk, and analytics expands Klaviyo's addressable market from just marketing automation into broader B2C CRM and customer service. This sets up significant opportunities for higher ARPU and long term revenue growth.

Want to see how ambitious growth, rising margins, and a bold future earnings multiple fit together in this call? The full narrative spells out the numbers.

Result: Fair Value of $43.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained margin pressure from higher messaging costs and intense competition from AI native marketing platforms could still derail the undervaluation thesis.

Find out about the key risks to this Klaviyo narrative.

Another Angle on Valuation

While the narrative fair value suggests upside, our DCF model paints a far harsher picture. On that view, Klaviyo screens as overvalued, with fair value closer to $11.62 versus the current $31.51. Which story do you trust when cash flows finally matter more than narratives?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Klaviyo Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a personalized Klaviyo thesis in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Klaviyo.

Ready for more investment ideas?

Before you move on, explore your next opportunities with targeted screeners that surface quality stocks, clear stories, and potential mispricings you may want to consider.

- Identify potential multi baggers early by scanning these 3614 penny stocks with strong financials with improving fundamentals and room for sentiment to shift.

- Focus on structural tailwinds in automation and machine learning through these 25 AI penny stocks positioned for multi year growth runways.

- Seek out possibly mispriced opportunities trading below intrinsic worth using these 914 undervalued stocks based on cash flows that the broader market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Klaviyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KVYO

Klaviyo

A technology company, provides a software-as-a-service platform in the United States, other Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion