- United States

- /

- IT

- /

- NYSE:KD

Kyndryl (KD): Evaluating Valuation After New AI-Powered Aviation and Industry Cloud Launches

Reviewed by Kshitija Bhandaru

Kyndryl Holdings (NYSE:KD) has rolled out its Aviation Industry Cloud Solution, an AI-powered platform developed with Google Cloud, along with new sector-focused offerings built on its Agentic AI framework. These announcements highlight Kyndryl’s push into enterprise modernization and industry-specific cloud solutions.

See our latest analysis for Kyndryl Holdings.

Kyndryl’s big push into next-gen AI infrastructure comes as its share price has fallen more than 28% over the past 90 days, even though the 1-year total shareholder return sits at an impressive 12.7% and the three-year figure rises to 222%. While recent launches with Google Cloud have generated excitement, market sentiment has cooled a bit in the short term. However, Kyndryl’s strong long-term numbers highlight the substantial progress from its legacy IT roots toward growth-focused, sector-specific solutions.

If all the cloud and AI action has you wondering where the next wave of fast movers might come from, now is a perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With the stock trading at a substantial discount to analyst targets but recent momentum waning, the key question is whether Kyndryl is now a bargain poised for upside or if the market has already priced in future growth.

Most Popular Narrative: 34.9% Undervalued

With the most followed narrative estimating Kyndryl Holdings’ fair value at $43, well above its last close of $28, a substantial valuation gap is in focus as the company pivots to higher-margin growth initiatives.

The company's focus on expanding AI, data, and cybersecurity services, supported by investments in proprietary initiatives like Kyndryl Bridge and new alliances such as Databricks, is allowing Kyndryl to address rising complexity and security requirements. This supports both higher margins and new revenue streams.

Ever wondered what’s fueling this big discount? The narrative hinges on ambitious, margin-expanding transformation and future profit leaps. Uncover the key numbers the market might be missing.

Result: Fair Value of $43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on legacy contracts and unpredictable timing of large deal renewals could quickly pressure Kyndryl’s revenue growth and margin progress.

Find out about the key risks to this Kyndryl Holdings narrative.

Another View: What Do Valuation Ratios Say?

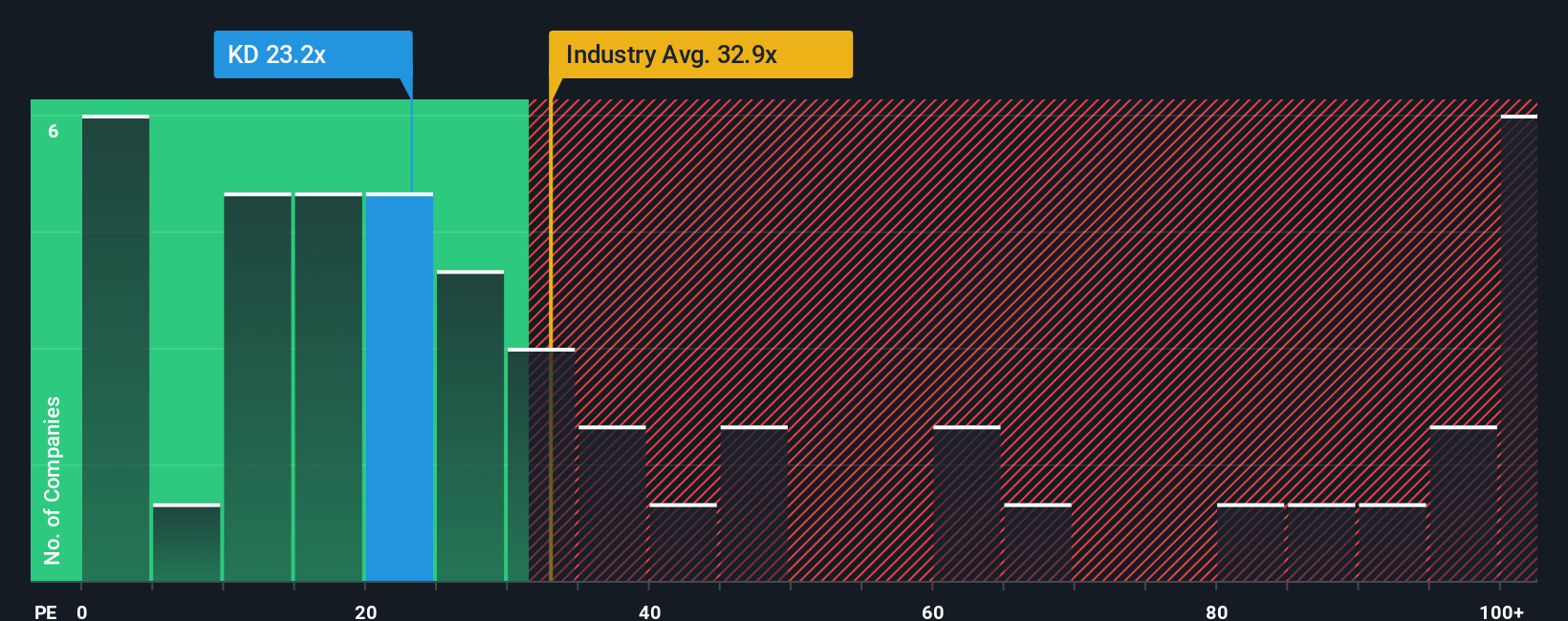

While analyst targets and fair value estimates point to Kyndryl being deeply undervalued, its price-to-earnings ratio of 21.8x sits well below the US IT industry average of 31.7x. However, it remains above close peer averages at 14.4x. Compared to a fair ratio of 53.2x, there appears to be meaningful upside if the market re-rates upward, but also a risk of alignment with peers if confidence lags. Is the gap an opportunity, or caution from the market?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kyndryl Holdings Narrative

If you see things differently or want to dig into the numbers on your own terms, you can easily craft your own story in just a few minutes: Do it your way

A great starting point for your Kyndryl Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their radar up for the next big opportunity. Expand your portfolio’s potential and stay ahead by searching for exciting companies breaking new ground.

- Boost your passive income with strong payers by browsing these 18 dividend stocks with yields > 3% companies that consistently deliver yields above 3% and reward shareholders year after year.

- Tap into the future of intelligence by checking out these 25 AI penny stocks and capitalize on groundbreaking innovations that are reshaping entire industries.

- Spot undervalued gems easily through these 891 undervalued stocks based on cash flows, where you can hunt for stocks trading below their cash flow based value and aim for solid upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kyndryl Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KD

Kyndryl Holdings

Operates as a technology services company and IT infrastructure services provider in the United States, Japan, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion