- United States

- /

- IT

- /

- NYSE:IT

Gartner (IT): Exploring Valuation After Recent Share Price Declines

Gartner (IT) has recently caught the attention of investors as they analyze its latest performance figures and market returns. With shares down roughly 49% over the past year, many are revisiting its long-term outlook.

See our latest analysis for Gartner.

It has been a challenging stretch for Gartner, with a sharp 24.4% share price decline over the past three months adding to a year-to-date slide of nearly 49%. Notably, the longer-term view is mixed. While the latest 12-month total shareholder return stands at -50.7%, investors who have held on for five years still enjoy a robust total return of 67.8%, highlighting the potential for recovery if sentiment or fundamentals improve.

If Gartner’s turbulent ride has you thinking broader, it might be the perfect moment to discover fast growing stocks with high insider ownership.

With such significant share price declines and mixed long-term returns, the key question becomes clear: does Gartner now represent an undervalued opportunity, or is the market fully reflecting future growth in its current price?

Most Popular Narrative: 16% Undervalued

Gartner’s most up-to-date fair value, according to the consensus narrative, is $295.55, which is substantially above the last close of $248.34. The narrative’s fair value suggests the market may be overlooking some key strengths and future catalysts for the company.

The rollout of AskGartner, a proprietary AI-powered tool, is expected to deepen client engagement, increase user efficiency, and make Gartner's vast research more accessible. This should boost client retention and subscription value over time, contributing to predictable recurring revenues and potentially supporting margin expansion.

Curious how a future shaped by proprietary tech and evolving business models leads to this valuation? Bold financial projections across growth, margins, and earnings fuel the numbers beneath the surface. Discover the full story and see what the narrative reveals about Gartner’s next chapter.

Result: Fair Value of $295.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the rapid rise of generative AI or ongoing corporate cost-cutting could affect Gartner’s subscription growth and earnings stability in coming years.

Find out about the key risks to this Gartner narrative.

Another View: Discounted Cash Flow Model

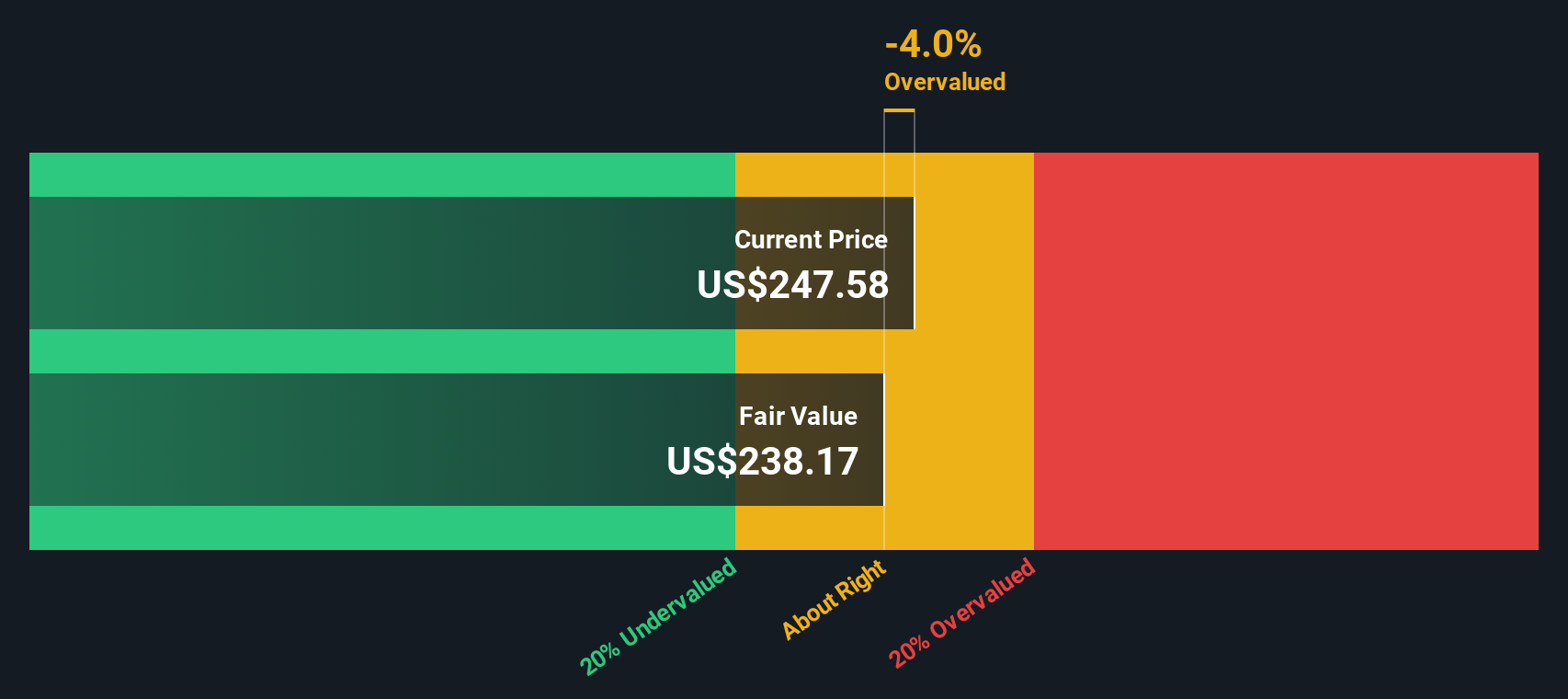

Taking a different approach, the SWS DCF model places Gartner’s fair value at $227.71 per share. This is notably below both the market price and the consensus narrative’s target. This perspective suggests Gartner might actually be overvalued right now. Which valuation approach feels more convincing to you?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Gartner for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Gartner Narrative

If you want to draw your own conclusions or trust your independent research, you can craft your own Gartner narrative in just a few minutes. Do it your way.

A great starting point for your Gartner research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always look beyond the obvious. Widen your watchlist and catch the next big opportunity. These forward-thinking stock ideas could move fast.

- Uncover strong income potential for your portfolio by targeting reliable earners, starting with these 22 dividend stocks with yields > 3% offering yields above 3%.

- Jump on the AI revolution before the crowd seizes the biggest gains by pinpointing opportunities among these 26 AI penny stocks.

- Capitalize on untapped value by spotting hidden gems trading below their true worth, thanks to these 832 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IT

Gartner

Provides business and technology insights for decisions and performance on an organization’s mission-critical priorities in the United States, Canada, Europe, the Middle East, Africa, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Santos: Undervalued After Takeover Fallout

Realty Income - A Fundamental and Historical Valuation

A Structured Counter‑Analysis of "The Leaking Dreadnought"

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks