- United States

- /

- Software

- /

- NYSE:IOT

Samsara (NYSE:IOT) Expands Field Services With AI-Powered Platform For Enhanced Efficiency

Reviewed by Simply Wall St

Samsara (NYSE:IOT) recently announced a standardization on its AI-powered Connected Operations® Platform, targeting enhanced service delivery and efficiency in response to growing demand. Over the past month, Samsara's stock price increased by 13%. This price move occurred alongside the company's expansion of its customer base, including clients like GardaWorld and Roto-Rooter, alongside new product releases and strategic collaborations. These initiatives are designed to improve operational safety, cost efficiency, and asset longevity, which may have supported the stock's upward trend. Meanwhile, the market rose 2% in the past week, aligning with Samsara's performance, reflecting broader positive market movements.

We've identified 2 possible red flags for Samsara that you should be aware of.

The recently announced standardization on Samsara's AI-powered Connected Operations Platform could significantly influence the company's narrative and growth potential. By expanding its customer base with prominent clients such as GardaWorld and Roto-Rooter, along with new product releases, Samsara is poised to enhance operational safety, efficiency, and asset longevity. These initiatives align with projected revenue increases but are tempered by potential risks like long sales cycles and geopolitical uncertainties. Meanwhile, Samsara's shares have surged by a substantial 329.07% over a three-year period, indicating robust investor confidence.

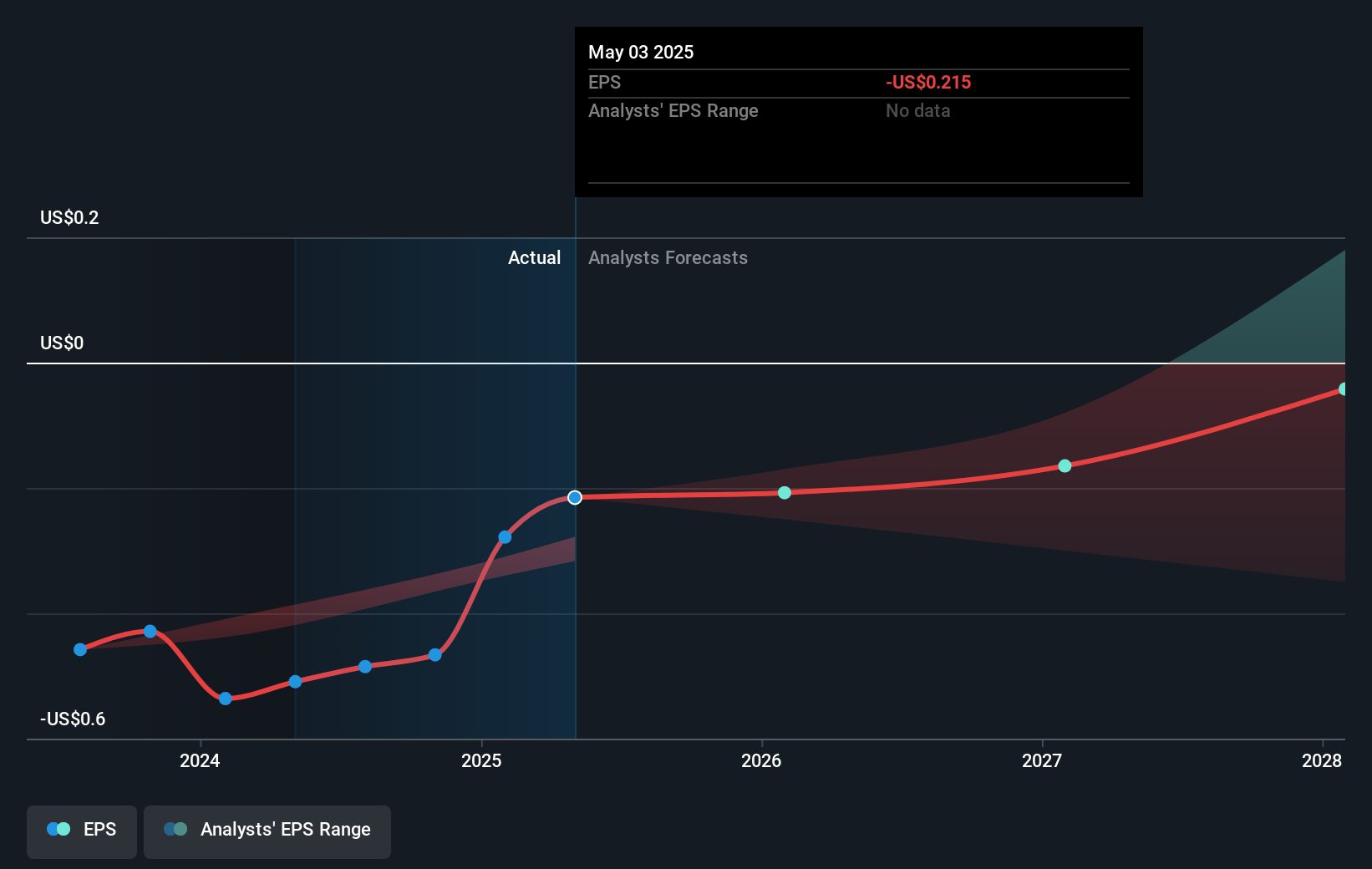

In a broader industry context, Samsara outperformed the US Software industry over the past year with a return of over 23.7%, while also exceeding US market performance of 11.9% during the same timeframe. This reflects strong market positioning, although the company's ongoing unprofitability remains a critical factor for future earnings forecasts. Samsara’s revenue is projected to grow at 16.9% annually, driven by its focus on innovation and international expansion, yet it remains unprofitable with anticipated earnings challenges. Analysts have set a price target of US$47.06, suggesting potential for further growth beyond the current price of US$39.24.

Unlock comprehensive insights into our analysis of Samsara stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions to connect physical operations data to its connected operations platform in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion