- United States

- /

- IT

- /

- NYSE:IBM

Is IBM’s 39% Rally Justified After Strategic AI and Cloud Partnerships in 2025?

Reviewed by Bailey Pemberton

- If you have been considering International Business Machines (IBM) and questioning whether the stock presents a genuine value opportunity or is simply benefiting from momentum, you are not alone.

- After increasing 39.0% year-to-date and 36.9% over the past year, IBM’s recent price movement has drawn attention from both optimistic and cautious investors.

- This growth aligns with IBM’s enhanced focus on hybrid cloud and AI services, with recent headlines highlighting strategic partnerships and expansion in key technology markets. Strong enterprise demand and new product launches have contributed to investor interest, offering context for the recent positive trend in the stock price.

- Despite these advances, IBM holds a valuation score of 1 out of 6, suggesting it may only appear undervalued based on a single key metric. Next, we will discuss how this score is calculated and introduce a more comprehensive approach to evaluating whether IBM represents a value opportunity.

International Business Machines scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: International Business Machines Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts back to today’s dollars. This approach helps investors gauge what a firm is truly worth beyond short-term price swings.

For International Business Machines (IBM), the latest reported Free Cash Flow was approximately $11.67 billion. Analyst forecasts predict steady growth in cash flows, with projections reaching $17.31 billion by 2028. Beyond the next five years, further annual cash flow gains are extrapolated, with cash flows continuing to increase through 2035 based on historical trends and broader analyst expectations.

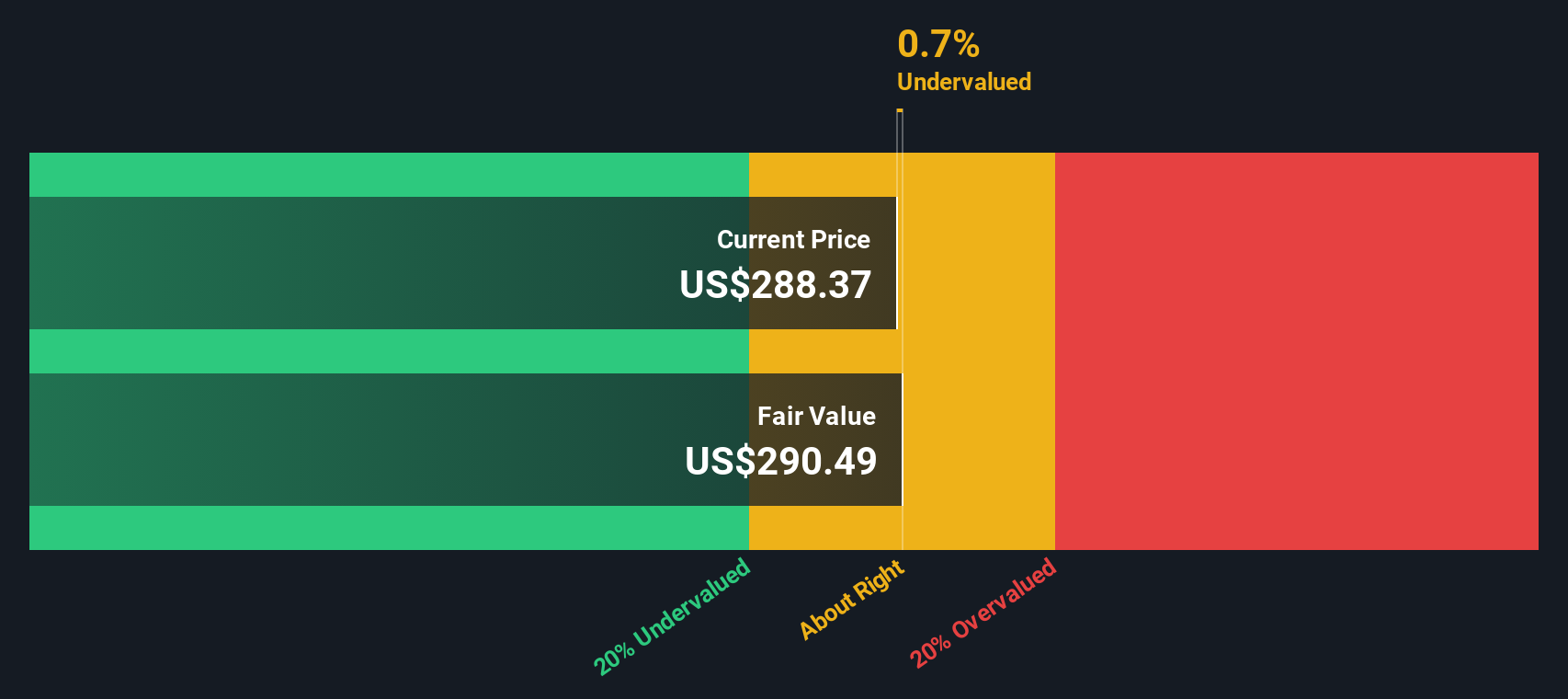

Based on these cash flow projections and discounting them appropriately, IBM’s intrinsic value is estimated to be $284.72 per share. This is about 7.4% higher than the current share price, which means the stock is considered to be slightly overvalued by the DCF analysis, but only modestly.

Result: ABOUT RIGHT

International Business Machines is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: International Business Machines Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for companies with consistent and reliable profits like International Business Machines. It provides investors with a quick way to see how the market values each dollar of earnings. This makes it especially useful for established, profitable firms.

What constitutes a "normal" or "fair" PE ratio depends on several factors. Generally, higher expected growth and lower risk justify a higher PE, while lower growth prospects or elevated risk tend to depress the ratio. Comparing IBM's PE ratio to industry averages and peers can be useful, but these benchmarks may be broad and not fully tailored to a company's unique position and outlook.

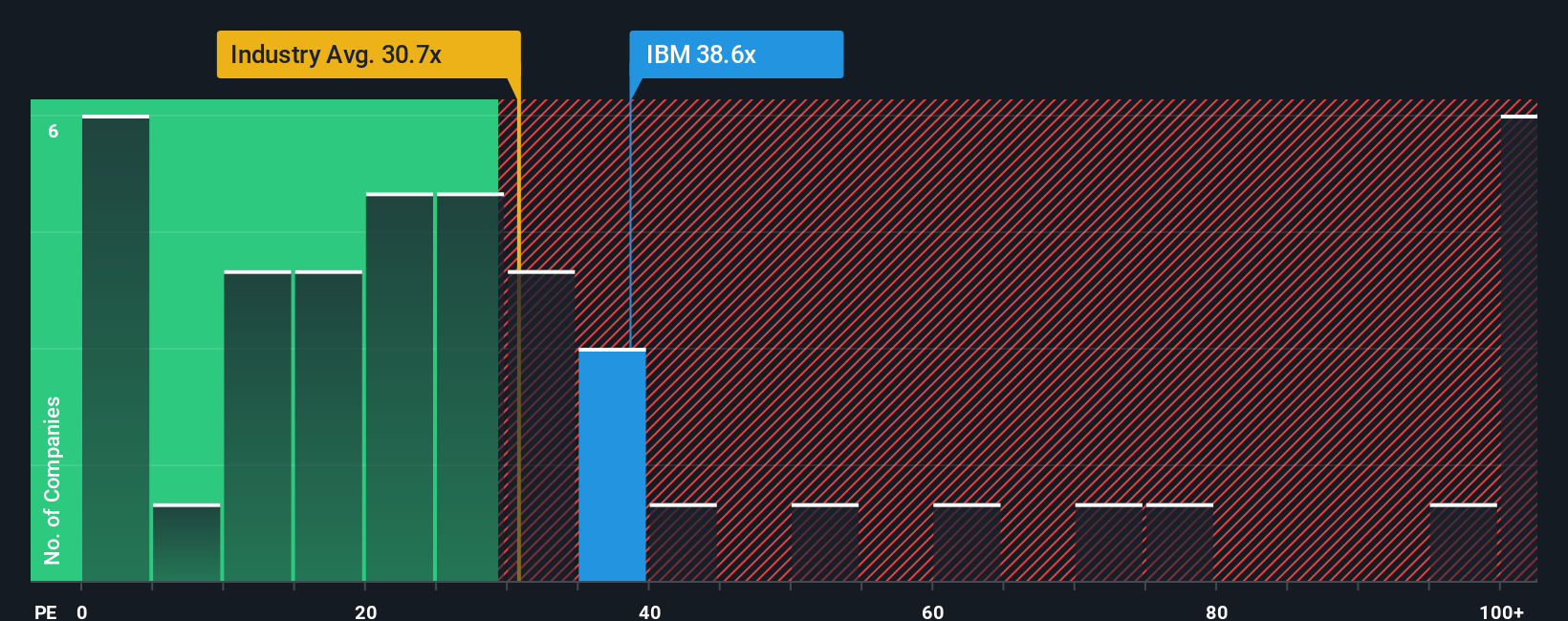

Currently, IBM trades at a PE ratio of 36.1x versus the IT industry average of 28.3x and a peer group average of 21.3x. Simply Wall St’s Fair Ratio for IBM is 39.2x, which is calculated by factoring in earnings growth, industry dynamics, profit margins, market capitalization, and company-specific risk. This proprietary approach goes beyond static peer or industry benchmarks and provides a more comprehensive view of what investors might consider paying given IBM’s individual characteristics.

Comparing the Fair Ratio of 39.2x to IBM’s actual PE of 36.1x, the valuation appears to be in line with expectations. IBM’s share price reflects factors such as its growth, profitability, and the broader IT market landscape.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your International Business Machines Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, accessible tool that lets you connect your personal view of a company's story, such as future revenue, earnings, and margins, to a financial forecast and an estimated fair value. Rather than relying strictly on ratios or formulas, Narratives help you articulate why you believe a stock is undervalued, overvalued, or fairly priced. This approach makes your decision-making much more transparent and tailored to your investment outlook.

Narratives are available directly on Simply Wall St's Community page, where millions of investors share and compare their perspectives. By aligning a company's story to current forecasts and fair value, you can more easily decide when to buy or sell by seeing how your expectations differ from the market price. Narratives also update dynamically as new information, like earnings reports or breaking news, comes in. This ensures your view remains relevant and evidence-based.

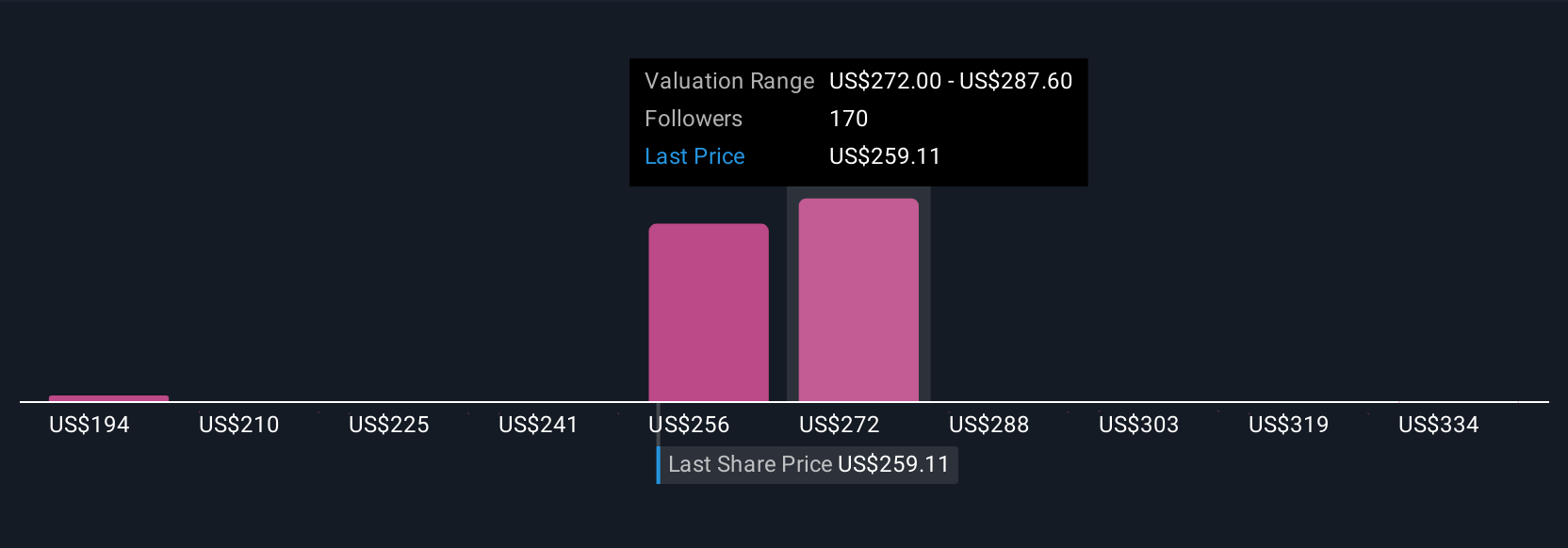

For example, while the most optimistic Narrative values International Business Machines at $350 (assuming rapid growth and strong margins), the most cautious Narrative sits at $198, reflecting concerns about competition and long-term profitability. This demonstrates how different stories drive different fair values and decisions.

For International Business Machines, we will provide previews of two leading International Business Machines Narratives:

🐂 International Business Machines Bull Case

Bull Narrative Fair Value: $350.00

IBM is trading at approximately 13% below this fair value ((350.00-305.67)/350.00 = 12.7% undervalued).

Expected annual revenue growth: 6.14%

- Optimistic analysts point to accelerated adoption of AI, hybrid cloud, and modernization in regulated sectors, which could drive long-term profitability and increase IBM’s share of digital transformation budgets.

- Integration of Red Hat, HashiCorp, and innovation in quantum computing and automation are expected to grow high-margin software revenue and expand margins, leading to a premium valuation.

- Key risks include declining legacy revenues, competition from hyperscalers and SaaS firms, challenges from open-source disruption, and balance sheet constraints due to high debt.

🐻 International Business Machines Bear Case

Bear Narrative Fair Value: $287.09

IBM is trading at approximately 6% above this fair value ((305.67-287.09)/287.09 = 6.5% overvalued).

Expected annual revenue growth: 5.14%

- This narrative highlights that IBM’s execution in quantum and software, amid continuing restructuring, is crucial for justifying growth and margins.

- Positives include solid adoption in hybrid cloud and AI as well as recent mainframe launches that bolster infrastructure revenue, but these are counterbalanced by macroeconomic risks and currency volatility.

- Analysts are cautious about decelerating performance in key software segments, competitive pressures, and potential headwinds for sustained revenue and earnings growth.

Do you think there's more to the story for International Business Machines? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026