- United States

- /

- IT

- /

- NYSE:IBM

International Business Machines (NYSE:IBM) Unveils Ambitious Quantum Roadmap With 'Starling' Initiative

Reviewed by Simply Wall St

International Business Machines (NYSE:IBM) announced its plan for the IBM Quantum Starling, marking a major leap in quantum computing by 2029. This ambitious project aligns with IBM's broader technological advances, potentially influencing investor sentiment. Over the last quarter, IBM's share price increased 9%, demonstrating a strong performance. The increase in dividends and announcements of strategic product launches and partnerships played significant roles in this upward momentum. Despite the competitive tech landscape, as reflected by market-wide indices reaching new highs, IBM's developments likely reinforced its position, sustaining gains against broader market movements.

We've spotted 4 possible red flags for International Business Machines you should be aware of.

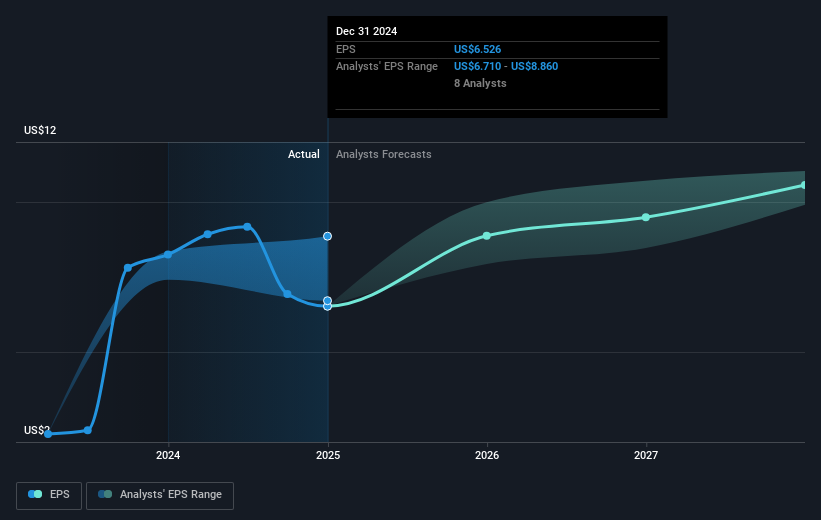

IBM's announcement of the IBM Quantum Starling project represents a significant venture into quantum computing, potentially altering how investors view the company’s growth strategy. The focus on technological advancements such as this aligns with IBM's emphasis on expanding its hybrid cloud and AI sectors, which are crucial for driving long-term revenue and earnings growth. However, reliance on economic stability and consulting services poses challenges, particularly if broader market conditions falter. The potential slowdown in hybrid cloud and AI adoption, as indicated in the narrative, could directly impact revenue projections and net margins.

Over a five-year period, IBM's total shareholder return, including share price appreciation and dividends, was 192.41%, providing a substantial gain for investors. This performance places it favorably compared to recent one-year returns where the company also outpaced both the US IT industry and broader US market indices. Such a robust long-term return might encourage investor confidence, despite current market volatility.

IBM's current share price of US$253.37 remains close to the consensus price target of US$253.27, indicating limited immediate upside as per market analyst expectations. The bearish consensus suggests a fair value closer to US$183.83, presenting an opportunity for adjustment if earnings fail to meet forecasted growth and if the competitive pressures in the tech industry are underestimated. The company's extensive engagement in innovative projects like the Quantum Starling could influence upward revisions in earnings forecasts if successfully implemented and adopted across key sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the United States, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives