- United States

- /

- IT

- /

- NYSE:IBM

IBM (NYSE:IBM): A Cash Generating Machine Showing Tentative Signs of Growth

Key Takeaways from This Analysis:

- IBM’s third-quarter results were slightly better than expected.

- Revenues have increased for four consecutive quarters despite major headwinds from the currency

- The company still has a very impressive cash flow margin and dividend yield.

Q3 Earnings summary:

- Revenue: $14.1 bln, up 6.4% year on year and $550 mln better than consensus estimates.

- Non-GAAP EPS: $1.81, down from $2.52 a year ago and in line with estimates.

- Software revenue up 7% year-on-year.

- Consulting revenue up 5% year-on-year.

- Infrastructure revenue up 15% year-on-year.

- Hybrid cloud revenue up 15% year-on-year.

- All revenue growth numbers are significantly impacted by USD strength.

Full-Year 2022 Guidance:

- The company now “expects constant currency revenue growth above its mid-single digit model.”

- Free Cash Flow: The company continues to expect about $10 billion in consolidated free cash flow.

See our latest analysis for IBM

Is the turnaround for real this time?

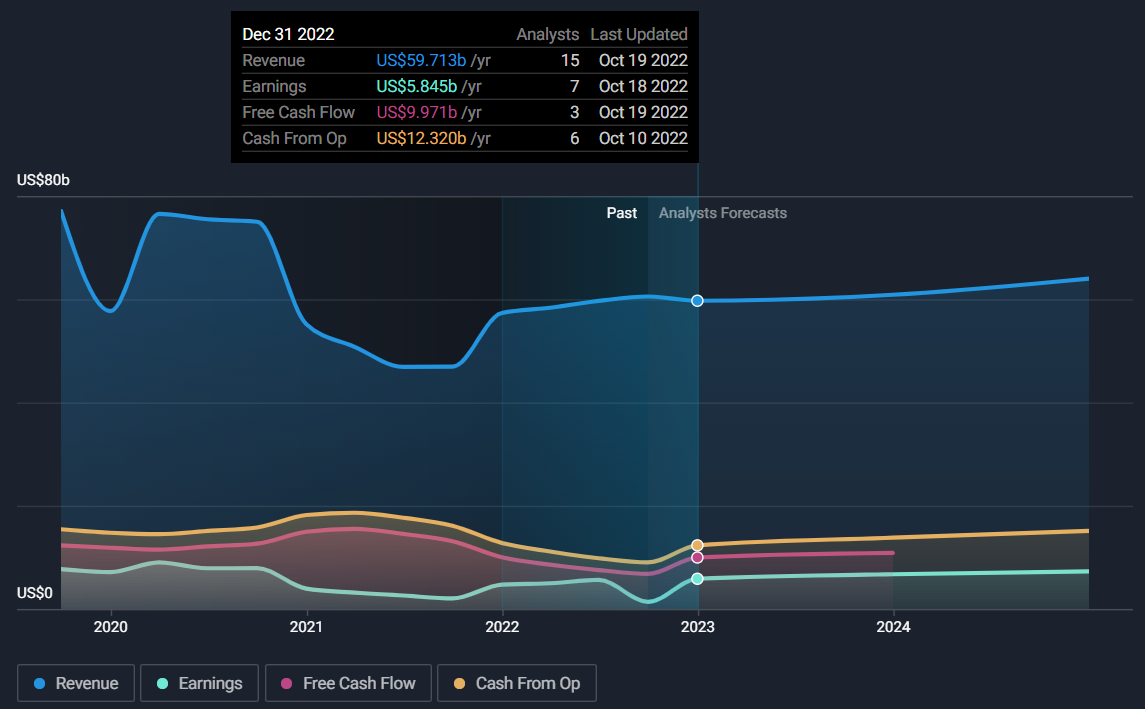

Investors have been waiting for 10 years for IBM’s turnaround strategy to show up as actual revenue growth. During that decade, annual revenue dwindled from $100 billion to $54 billion in 2020.

It’s understandable that investors have become skeptical of a few good quarters of improving growth. Nevertheless, it’s worth noting that trailing 12-month revenue has increased during the last four consecutive quarters.

It’s also worth noting that the strong US dollar impacted revenues significantly during the third quarter. In constant currency terms, hybrid cloud revenue was up 20%.

Cash is King

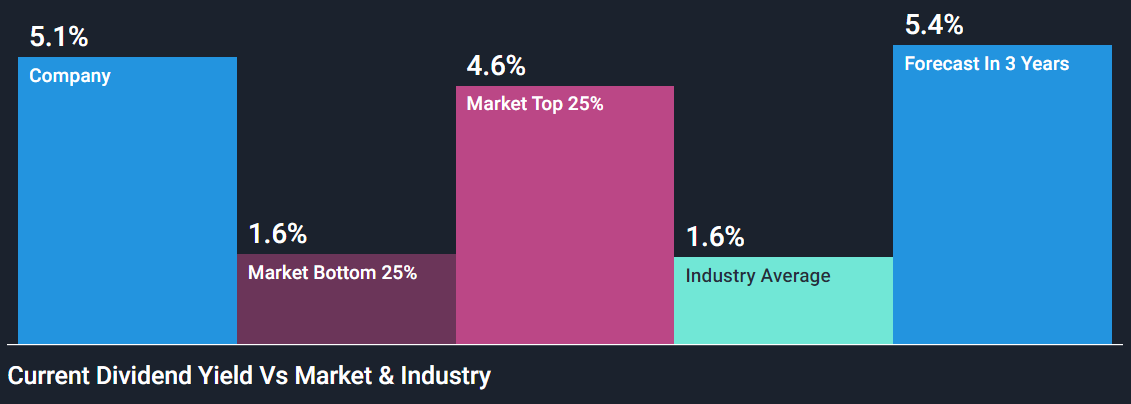

While IBM’s revenues have fallen 40% over the last decade, the cash flow margin has for the most part remained between 10 and 15%. The company still generates large amounts of free cash, most of which is paid out as a dividend, with the yield now at 5.4%. IBM has managed to maintain or increase its dividend every quarter since 2012.

During most of the last decade, investors have favored growth rather than profits, cash flow and dividends, meaning IBM was one of the worst-performing large-cap tech stocks in the market. That’s all changed now, which explains why IBM is one of the few stocks that are up over the last 12 months.

Is the Dividend Sustainable?

If you look at IBM’s dividend coverage based on EPS, you may be alarmed to see it paying out 430% of earnings as a dividend. This number is affected by non-cash items, but the coverage based on free cash flow tells a different story.

The company has generated around $5.5 bln of free cash flow this year but said it still expects to generate around $10 bln for the full year. This isn’t unusual as IBM generates a lot of its cash flow in the first and fourth quarters of the year.

The total dividend payment for the full year will be about $5.9 bln, so there should be adequate coverage.

Some investors would prefer to see the cash flow used for share buybacks - but as far as the current strategy goes, the company’s cash flows seem to cover the dividend adequately.

What this Means for Investors

In the current environment of uncertainty, profits and cash flows have become key attributes for a company - which makes IBM a better prospect than it’s been for a very long time. In addition, there seems to be potential for long-term growth, but we would like to see more confirmation that this is sustainable.

If you would like to learn more about the company and assess the current valuation take a look at our full analysis of IBM . Note: IBM’s recent earnings have been affected by non-cash items, so the price-to-earnings ratio isn’t a fair reflection, but you can use the price-to-sales ratio to compare the company to its peers and industry.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives