- United States

- /

- IT

- /

- NYSE:IBM

Assessing IBM’s Valuation: Is the Share Price Reflecting Recent Momentum and Long-Term Growth?

Reviewed by Simply Wall St

International Business Machines (IBM) shares have moved slightly in recent sessions, sparking conversation among investors who track its ongoing performance. Despite lacking a specific headline event, some are evaluating IBM’s valuation and recent momentum.

See our latest analysis for International Business Machines.

IBM’s share price has cooled in the past week after a strong rally. The bigger story is the impressive momentum it has sustained year-to-date and over the past year, with total shareholder return climbing a remarkable 41.5% in twelve months and more than doubling over five years. This combination of short-term volatility and robust long-term growth has investors debating whether IBM’s current valuation reflects its future potential or signals increased caution as the market’s expectations evolve.

If this kind of market momentum interests you, now’s a great opportunity to uncover See the full list for free.

With IBM's impressive returns defying recent short-term weakness, the key question looms: does the current share price reflect everything the company has achieved, or is there still room for upside as markets anticipate its growth?

Most Popular Narrative: Fairly Valued

IBM’s last close of $289.95 sits nearly in line with the most popular narrative’s fair value estimate of $287.09. This suggests investors are treating recent momentum and future growth projections as mostly priced in. Here is a direct look at what is shaping sentiment right now.

IBM's strategy in hybrid cloud, AI, and strategic acquisitions could drive revenue growth, margin expansion, and client trust in modernizing IT infrastructure. Investments in advanced technologies like the z17 mainframe and generative AI enhance differentiation and pricing power, potentially boosting infrastructure revenue and net margins.

Want to know what propels IBM’s justified price? There is a bold forecast of widening margins and continued tech leadership. The real surprise is how future profitability and transformative bets on cloud and AI stack up against analyst expectations. Find out what numbers are unlocking this valuation.

Result: Fair Value of $287.09 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as a slowdown in key software segments or unexpected macroeconomic headwinds. These factors could challenge IBM’s growth narrative ahead.

Find out about the key risks to this International Business Machines narrative.

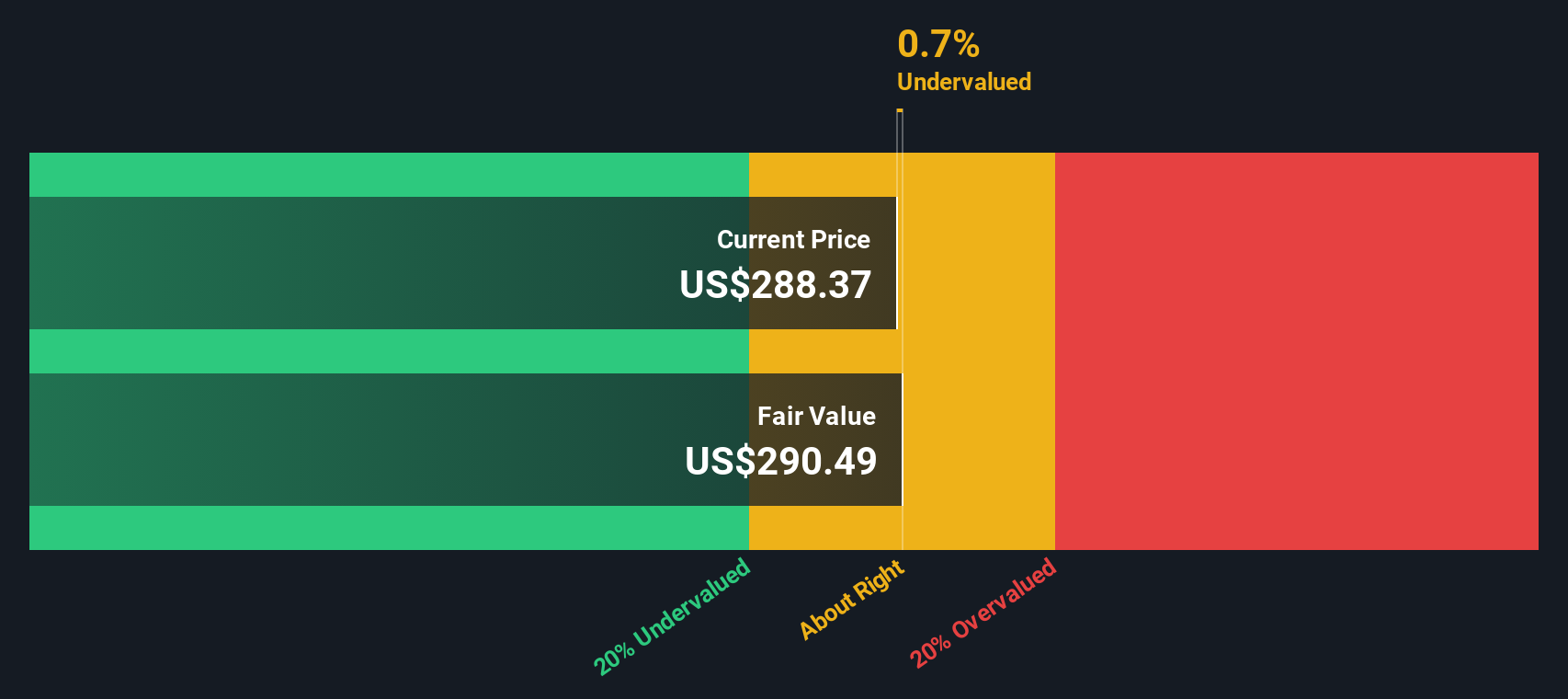

Another View: Our DCF Model Weighs In

Taking a different approach, our SWS DCF model estimates IBM's fair value at $290.62, just above the current share price of $289.95. This suggests that, by factoring in future cash flows, the market may actually be pricing IBM about right. However, could market expectations rather than forecasts end up driving the next move?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out International Business Machines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own International Business Machines Narrative

If you see the story differently or want to dig deeper on your own, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your International Business Machines research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take your investing game further by checking out other high-potential opportunities. There are exciting stocks that could fit your strategy perfectly. Don’t miss out on these:

- Target high yields and steady growth by reviewing these 18 dividend stocks with yields > 3% with proven track records of strong returns.

- Ride the innovation wave when you access these 27 AI penny stocks. Find companies pushing boundaries in artificial intelligence and transforming entire industries.

- Capitalize on value by investigating these 3583 penny stocks with strong financials that boast solid financials and impressive upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives