- United States

- /

- Software

- /

- NYSE:HUBS

Does the Recent Rebound Signal a New Opportunity for HubSpot Investors?

Reviewed by Bailey Pemberton

- Wondering if HubSpot could be a smart buy right now? You are not alone, with investors everywhere debating whether the stock's current price offers true value or hidden risk.

- After a tough year with shares down 29.1% year-to-date and 12.4% over the past twelve months, there has been a recent rebound. Shares are up 9.5% in the last month and 4.8% over the last week, giving signs that sentiment and risk perceptions may be shifting.

- Market chatter has zeroed in on HubSpot's prominent product launches and a series of strategic partnerships announced in the last few quarters, which have helped stir optimism about future growth. These updates have kept the stock in the spotlight even as broader tech valuations continue to fluctuate.

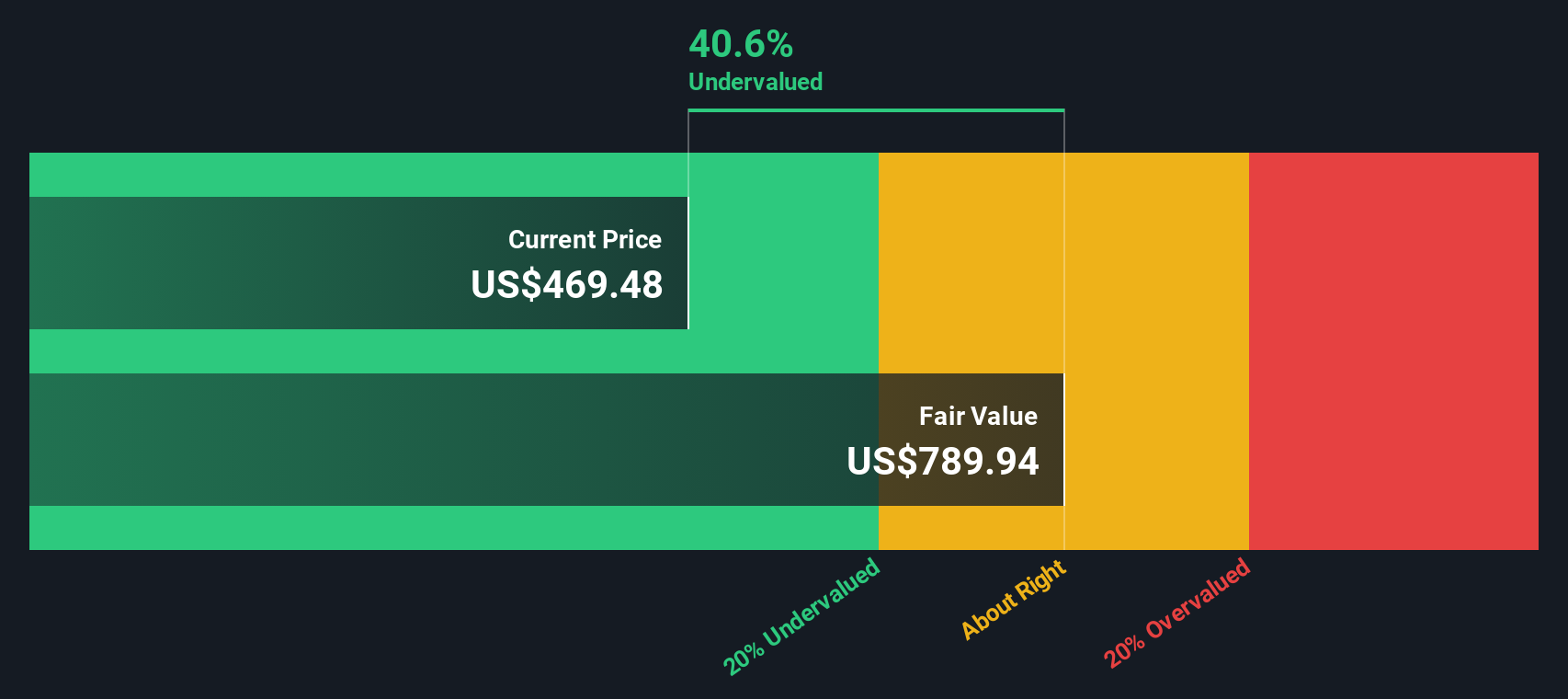

- Looking at the numbers, HubSpot earns a valuation score of 4 out of 6, meaning it stands out as undervalued in most key checks. Next, we will walk through what's behind that score and why a more holistic view of valuation might matter even more for investors. Stay tuned for a deeper dive.

Find out why HubSpot's -12.4% return over the last year is lagging behind its peers.

Approach 1: HubSpot Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today. This approach helps investors gauge what the business is truly worth based on its ability to generate cash.

For HubSpot, the latest reported Free Cash Flow stands at $533.74 Million. Analysts project that HubSpot's free cash flow will continue to increase in the coming years, reaching $1.39 Billion by 2029. While analyst estimates are available for the next five years, Simply Wall St extends these forecasts to provide a ten-year trajectory, suggesting steady growth beyond the analyst horizon.

Factoring in these future cash flows and discounting them to present value, the DCF model calculates HubSpot's intrinsic value at $576.06 per share. Compared to the current price, this implies the stock is trading at a 14.1% discount and may be undervalued.

Based on this robust, cash-oriented analysis, HubSpot's current market price appears to undervalue its long-term potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests HubSpot is undervalued by 14.1%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: HubSpot Price vs Sales

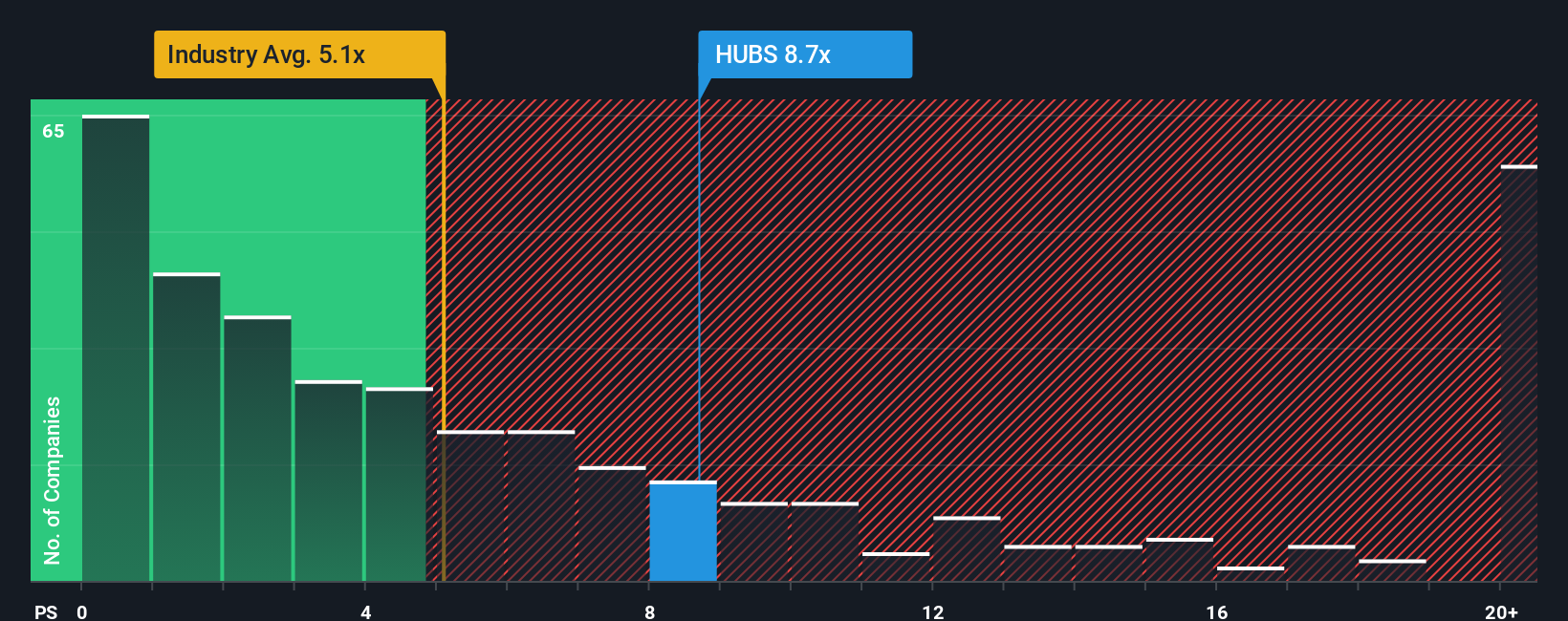

For technology and software companies like HubSpot, the Price-to-Sales (P/S) ratio is often the most relevant valuation metric, especially when profits are limited or inconsistent. The P/S ratio values a company based on how much investors are willing to pay for each dollar of sales. This is particularly important for high-growth businesses that are reinvesting heavily for future expansion.

What constitutes a “normal” P/S ratio depends on factors such as growth potential, historical performance, profitability, and risk. Companies with rapidly rising revenues and strong future prospects often trade at higher P/S multiples. Conversely, riskier or slower-growing firms warrant lower ratios.

Currently, HubSpot’s P/S ratio stands at 9.2x. This is below the industry average of 5.3x, but also below key software peers at an average of 9.7x. On the surface, this might suggest the stock is in line with the broader group, but more richly valued than the industry overall.

Simply Wall St’s proprietary Fair Ratio for HubSpot is 11.8x. Unlike a plain comparison with industry or peer averages, the Fair Ratio accounts for company-specific growth forecasts, profit margins, market cap, and unique risk factors. This provides a more tailored and accurate view of what multiple the stock deserves based on its real prospects and risk profile.

HubSpot’s current P/S is meaningfully below the Fair Ratio, suggesting the market is undervaluing its sales and future potential rather than overpricing it.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your HubSpot Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a smarter, story-based approach that puts your own perspective at the heart of your investment decisions.

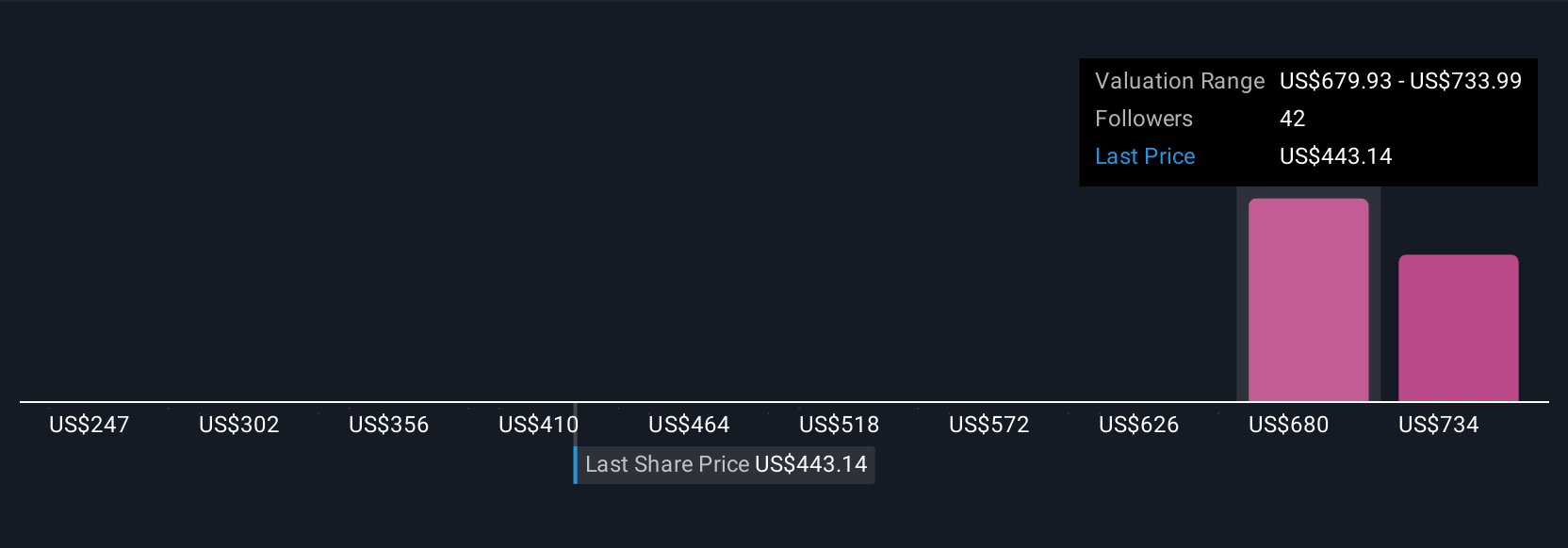

A Narrative is simply your story about HubSpot: what you believe the company will achieve, why, and how those beliefs turn into forecasts for revenue, earnings, profit margins, and ultimately, a fair value per share.

By connecting a company’s story to a real financial model and fair value estimate, Narratives allow you to see the direct line between your beliefs and your investment decisions, helping you answer not just what HubSpot is worth today, but why.

This powerful tool is easy to use and available to everyone in the Simply Wall St Community, where millions of investors build and share their Narratives. These are all dynamically updated as soon as new news or earnings are released.

Narratives empower you to compare your Fair Value calculation to the current price, helping you decide if, when, and why you should buy, hold, or sell.

For example, some investors expect HubSpot’s rapid AI-powered expansion and upmarket growth to justify a fair value above $900 per share. Others, concerned about competition and economic risks, see a fair value closer to $590.

Do you think there's more to the story for HubSpot? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives