- United States

- /

- Oil and Gas

- /

- NYSEAM:LEU

Undiscovered Gems In The United States For October 2024

Reviewed by Simply Wall St

In the last week, the United States market has remained flat, yet it has experienced a substantial 33% rise over the past year with earnings projected to grow by 15% annually. In this dynamic environment, identifying stocks that are poised for growth involves looking beyond well-known names to uncover lesser-known opportunities that align with these promising market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| United Bancorporation of Alabama | 13.34% | 18.86% | 25.45% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Centrus Energy (NYSEAM:LEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centrus Energy Corp. is a company that provides nuclear fuel components and services to the nuclear power industry across various countries, including the United States, Belgium, and Japan, with a market cap of approximately $1.05 billion.

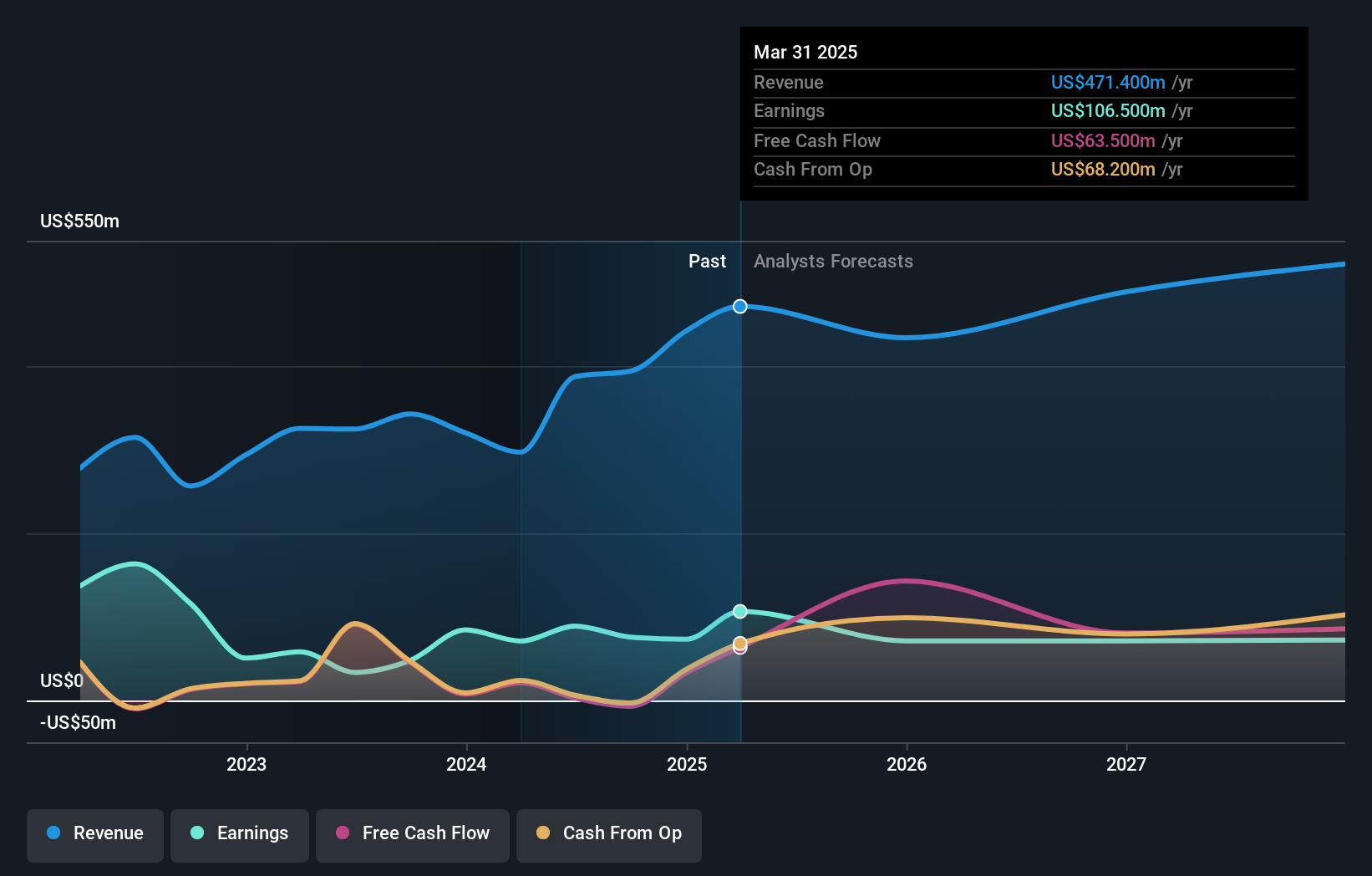

Operations: Centrus Energy generates revenue primarily from its Low-Enriched Uranium (LEU) segment, contributing $320.80 million, and Technical Solutions segment, adding $71.80 million.

Centrus Energy, a small player in the energy sector, has shown impressive financial strides with earnings surging 164.9% over the past year, outpacing the industry average. Their recent quarterly revenue hit US$189 million, up from US$98.4 million a year ago, while net income rose to US$30.6 million from US$12.7 million previously. Despite its volatility and shareholder dilution concerns, Centrus holds more cash than total debt and trades at 60.8% below estimated fair value, suggesting potential undervaluation opportunities for investors seeking growth prospects in an evolving market landscape.

- Dive into the specifics of Centrus Energy here with our thorough health report.

Assess Centrus Energy's past performance with our detailed historical performance reports.

AMTD Digital (NYSE:HKD)

Simply Wall St Value Rating: ★★★★☆☆

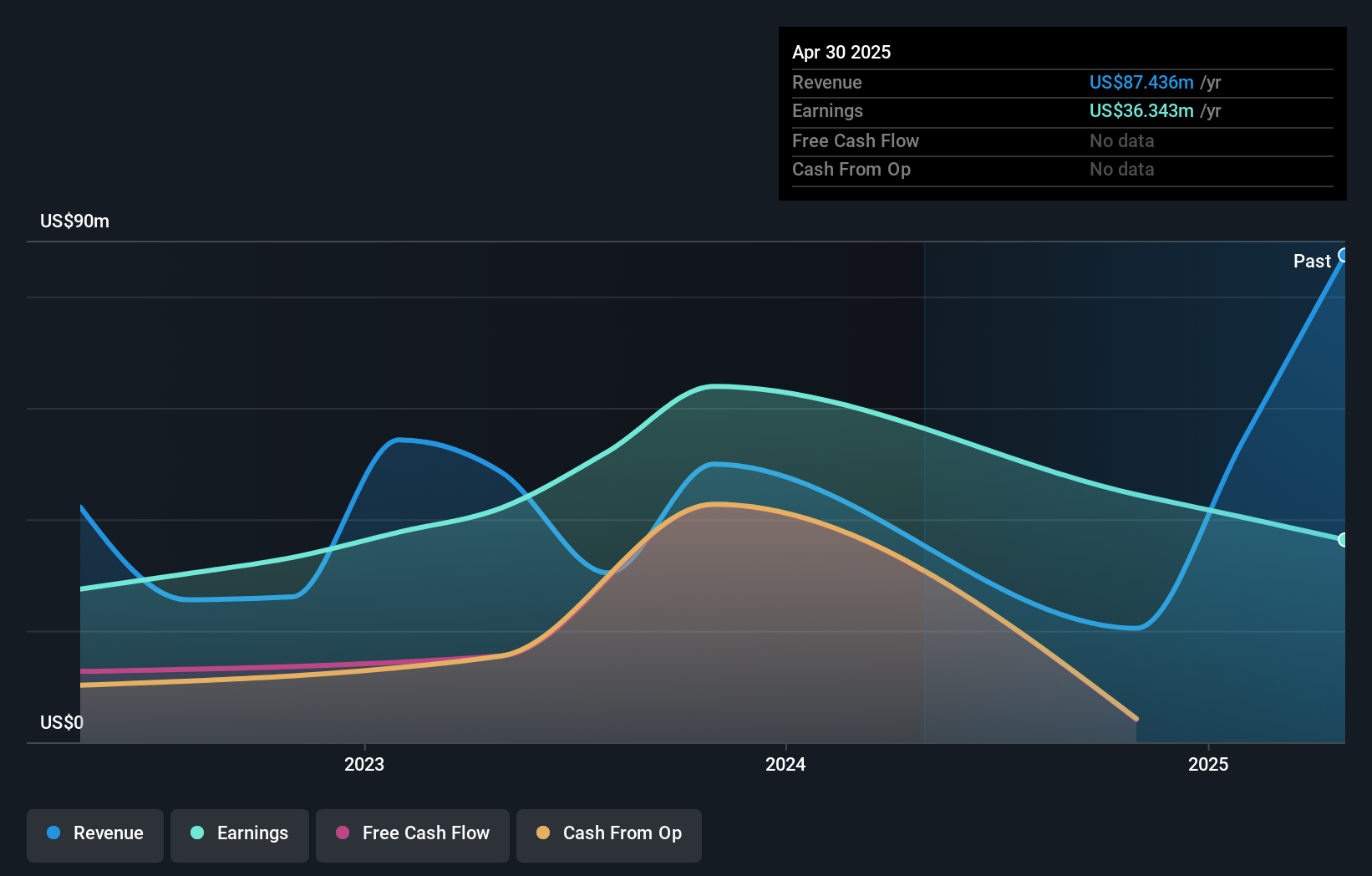

Overview: AMTD Digital Inc. operates through its subsidiaries to provide digital solutions services across financial and non-financial sectors, digital media, content and marketing services, as well as hotel operations and VIP services in Asia, with a market cap of $751.28 million.

Operations: AMTD Digital generates revenue from digital solutions services in both financial and non-financial sectors, along with digital media, content marketing, and hospitality services. The company's net profit margin displays significant variation across reporting periods.

AMTD Digital, a nimble player in the digital space, has shown impressive earnings growth of 88.6% over the past year, outpacing the broader software industry at 23.6%. Its ability to cover interest payments is solid as it earns more interest than it pays, and its price-to-earnings ratio of 16x suggests good value compared to the US market average of 18.3x. A significant one-off gain of US$46M influenced recent financial results, adding complexity to its performance analysis.

- Click here and access our complete health analysis report to understand the dynamics of AMTD Digital.

Examine AMTD Digital's past performance report to understand how it has performed in the past.

Yiren Digital (NYSE:YRD)

Simply Wall St Value Rating: ★★★★★★

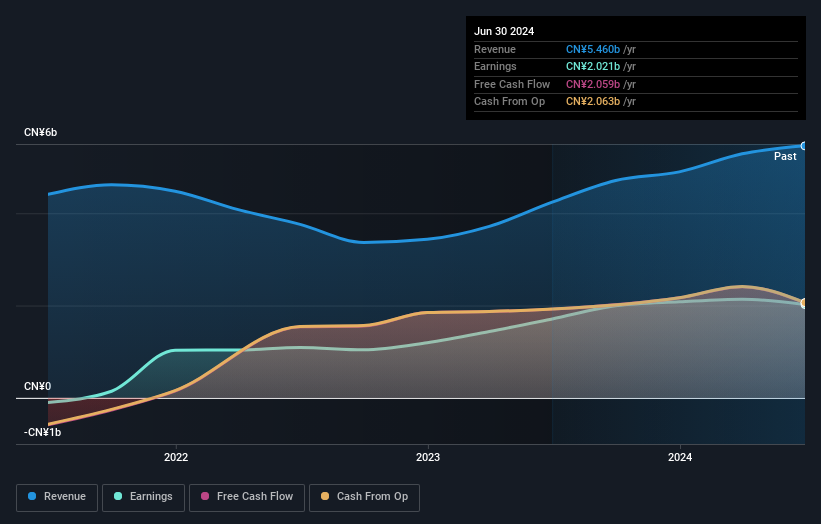

Overview: Yiren Digital Ltd. operates an AI-powered platform offering financial services in China and has a market capitalization of $703.30 million.

Operations: Yiren Digital generates revenue primarily from its Financial Services Business, which accounts for CN¥3.04 billion, followed by the Consumption & Lifestyle Business at CN¥1.84 billion, and the Insurance Brokerage Business contributing CN¥579.22 million.

Yiren Digital, a nimble player in the financial sector, showcases robust growth with earnings climbing 18% over the past year, outpacing the Consumer Finance industry's -8.4%. Trading at 70.5% below its estimated fair value and being debt-free enhances its appeal. The company recently repurchased over 4 million shares for $13.46 million and announced a dividend policy reflecting shareholder value commitment. Leadership changes see Yuning Feng as CFO, bringing extensive investment banking expertise to steer financial operations forward.

- Click to explore a detailed breakdown of our findings in Yiren Digital's health report.

Explore historical data to track Yiren Digital's performance over time in our Past section.

Make It Happen

- Explore the 219 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:LEU

Centrus Energy

Supplies nuclear fuel components and services for the nuclear power industry in the United States, Belgium, Japan, and internationally.

Solid track record with excellent balance sheet.