- United States

- /

- Software

- /

- NYSE:GWRE

Results: Guidewire Software, Inc. Beat Earnings Expectations And Analysts Now Have New Forecasts

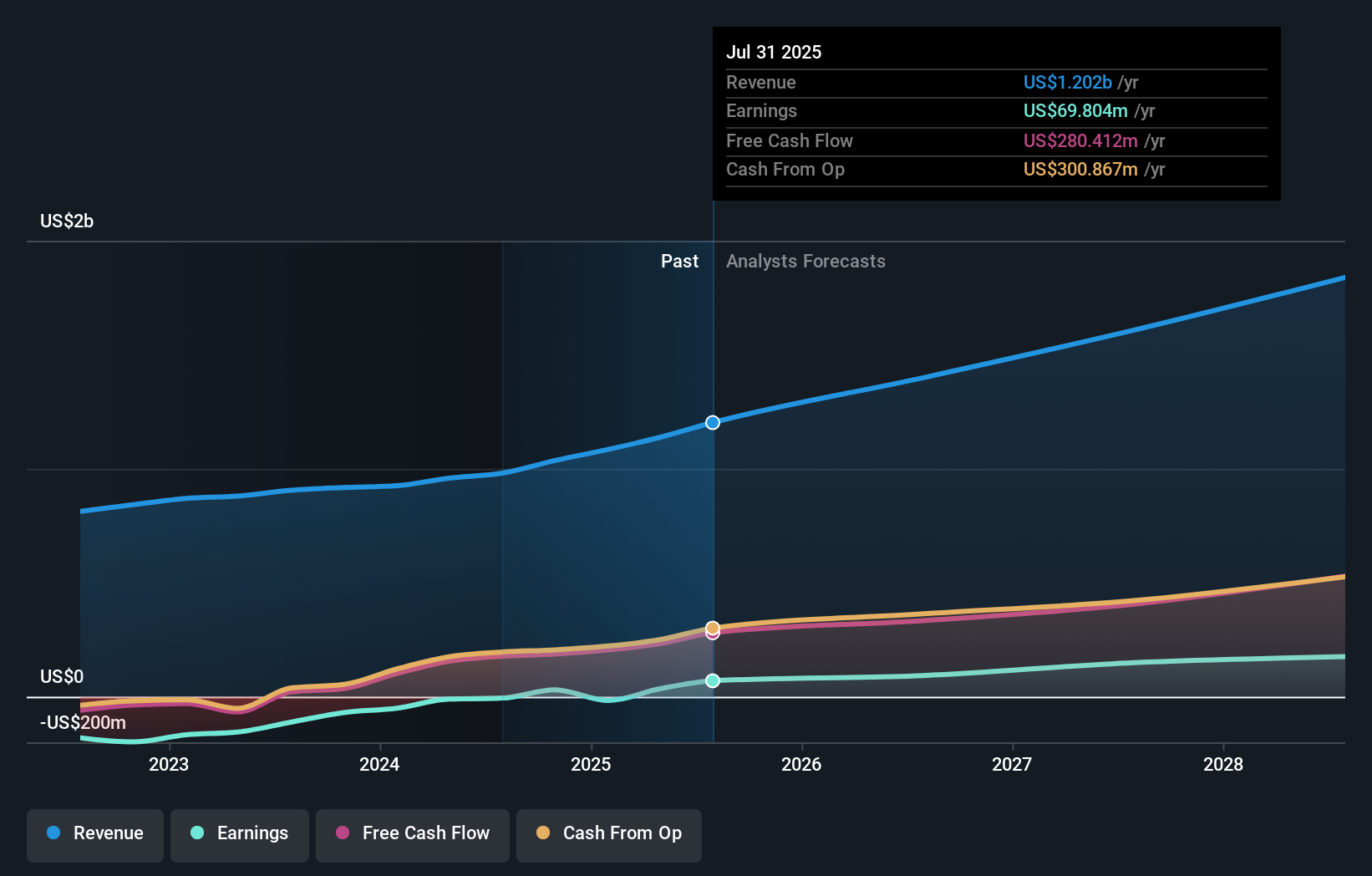

The investors in Guidewire Software, Inc.'s (NYSE:GWRE) will be rubbing their hands together with glee today, after the share price leapt 20% to US$261 in the week following its full-year results. It looks like a credible result overall - although revenues of US$1.2b were what the analysts expected, Guidewire Software surprised by delivering a (statutory) profit of US$0.81 per share, an impressive 100% above what was forecast. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

After the latest results, the 14 analysts covering Guidewire Software are now predicting revenues of US$1.40b in 2026. If met, this would reflect a decent 16% improvement in revenue compared to the last 12 months. Per-share earnings are expected to jump 40% to US$1.16. Before this earnings report, the analysts had been forecasting revenues of US$1.36b and earnings per share (EPS) of US$1.07 in 2026. It looks like there's been a modest increase in sentiment following the latest results, withthe analysts becoming a bit more optimistic in their predictions for both revenues and earnings.

Check out our latest analysis for Guidewire Software

It will come as no surprise to learn that the analysts have increased their price target for Guidewire Software 6.8% to US$267on the back of these upgrades. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Guidewire Software analyst has a price target of US$305 per share, while the most pessimistic values it at US$160. This shows there is still a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting Guidewire Software's growth to accelerate, with the forecast 16% annualised growth to the end of 2026 ranking favourably alongside historical growth of 9.6% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 13% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Guidewire Software is expected to grow at about the same rate as the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Guidewire Software's earnings potential next year. They also upgraded their revenue forecasts, although the latest estimates suggest that Guidewire Software will grow in line with the overall industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that in mind, we wouldn't be too quick to come to a conclusion on Guidewire Software. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Guidewire Software going out to 2028, and you can see them free on our platform here..

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Guidewire Software , and understanding these should be part of your investment process.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GWRE

Guidewire Software

Provides a platform for property and casualty (P&C) insurers worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion