- United States

- /

- Software

- /

- NYSE:GWRE

Guidewire Software (NYSE:GWRE) Expands Cloud Footprint With Mitsui Direct Partnership In Japan

Reviewed by Simply Wall St

Guidewire Software (NYSE:GWRE) has seen a notable development with Mitsui Direct General Insurance Co. Ltd. opting for Guidewire's ClaimCenter on the Guidewire Cloud Platform, marking the first such migration in Japan. Over the past month, Guidewire's shares increased by 12%, a shift that may be aligned with positive developments within the company and broader market trends. This move coincides with a surge in stock markets, perhaps buoyed by easing U.S.-China trade tensions and overall optimism in tech stocks, which likely added weight to the company's performance and contributed to its robust return trajectory.

Guidewire Software has 1 weakness we think you should know about.

The recent shift of Mitsui Direct General Insurance Co. Ltd. towards Guidewire's ClaimCenter on the Guidewire Cloud Platform could enhance the narrative of accelerating cloud adoption within the insurance industry. This move may support future revenue growth by increasing platform migration, reinforcing Guidewire's strategic objectives in analytics and AI, and potentially improving margins and efficiency over time.

Over the past three years, Guidewire's shares have experienced a total return of 169.42%, indicating strong performance and investor confidence in the company's prospects. In comparison, the company's one-year return has exceeded both the US Market and the US Software industry, which grew by 8% and 14.9% respectively.

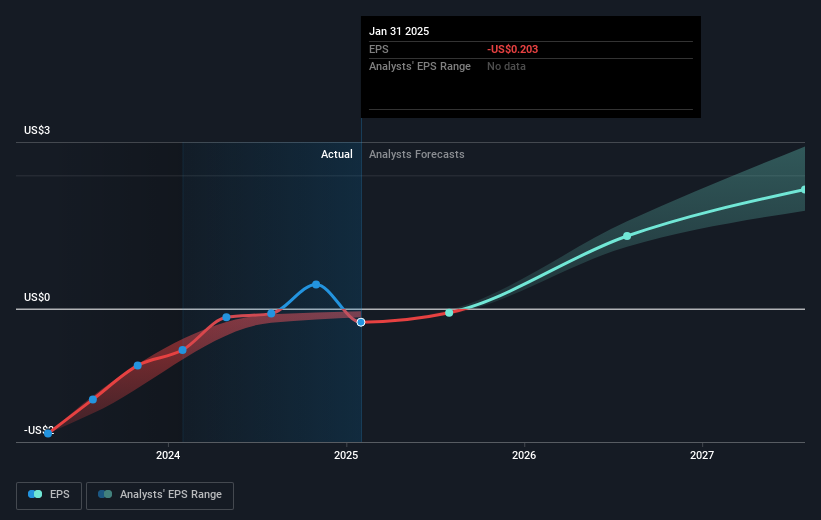

The news could influence revenue and earnings forecasts positively, as ongoing cloud migration may drive long-term revenues, aligned with the forecasted 12.7% annual growth in revenue. However, potential risks related to execution, investment, and exchange rate fluctuations remain.

Guidewire's current share price of US$204.95 shows a minor discount to the consensus analyst price target of US$210.72, suggesting a close alignment with perceived fair value. Observing the company's sustained growth and recent developments might reaffirm investors' confidence and potential for future uplifts in valuation. Nonetheless, the market's forward-looking sentiment must consider underlying risks and uncertainties.

Review our growth performance report to gain insights into Guidewire Software's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWRE

Guidewire Software

Provides a platform for property and casualty (P&C) insurers worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives