- United States

- /

- IT

- /

- NYSE:GLOB

Should Revenue Delays From Cautious Clients Require Action From Globant (GLOB) Investors?

Reviewed by Sasha Jovanovic

- In its recent fiscal first-quarter results, Globant S.A. reported revenue growth that fell short of analyst estimates, primarily due to clients in North America delaying non-essential IT and digital transformation projects amid macroeconomic uncertainty.

- This revenue shortfall highlights persistent caution among enterprises on discretionary technology spending, even as digital transformation remains a major industry trend.

- We'll explore how this revenue impact from delayed client spending shapes Globant's investment narrative and near-term growth outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Globant Investment Narrative Recap

To own shares in Globant, you need to trust in the ongoing global digitization trend and the company's ability to win more high-value generative AI and digital transformation contracts, despite economic headwinds. The recent revenue shortfall, driven by delayed North American client spending, sharpens near-term uncertainty around pipeline conversion and puts added weight on demand recovery as the next big catalyst. Persistent extended sales cycles now stand out as the most immediate business risk.

Among recent company moves, Globant's global partnership with Unity Software stands out. This announcement, while primarily broadening sector reach, also demonstrates the company's focus on expanding its technological ecosystem and training workforce skills, potentially deepening client engagement and building more durable sources of growth if the digital transformation demand rebound materializes.

By contrast, investors should keep in mind just how unpredictable revenue flow can become when deal cycles lengthen and North American clients stay on the sidelines...

Read the full narrative on Globant (it's free!)

Globant's narrative projects $3.0 billion revenue and $242.1 million earnings by 2028. This requires 6.1% yearly revenue growth and a $131.8 million earnings increase from $110.3 million.

Uncover how Globant's forecasts yield a $104.05 fair value, a 79% upside to its current price.

Exploring Other Perspectives

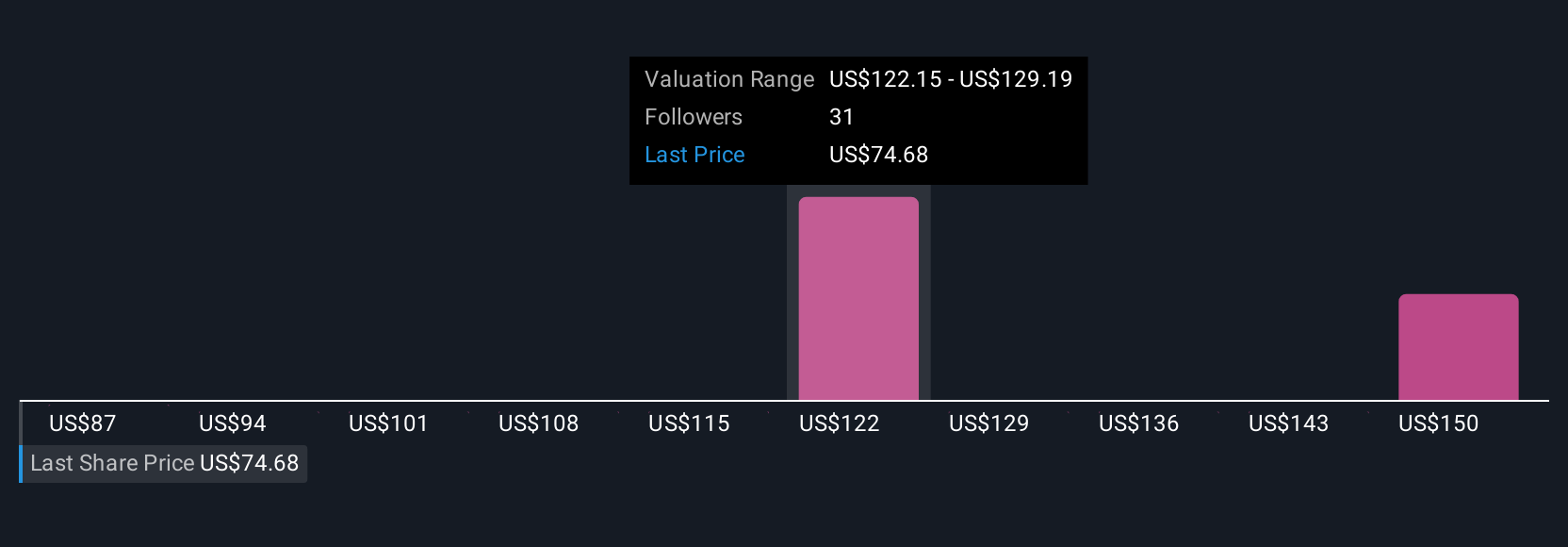

Simply Wall St Community members provided four fair value estimates for Globant ranging from US$68.20 to US$116.87 per share. The persistent risk of drawn-out sales cycles and delayed project conversion could explain why investor outlooks span such a wide spectrum, and you can compare several viewpoints.

Explore 4 other fair value estimates on Globant - why the stock might be worth just $68.20!

Build Your Own Globant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Globant research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Globant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Globant's overall financial health at a glance.

No Opportunity In Globant?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GLOB

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives