- United States

- /

- IT

- /

- NasdaqGS:FSLY

Fastly, Inc. (NYSE:FSLY) May Have Run Too Fast Too Soon With Recent 32% Price Plummet

To the annoyance of some shareholders, Fastly, Inc. (NYSE:FSLY) shares are down a considerable 32% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 26% in that time.

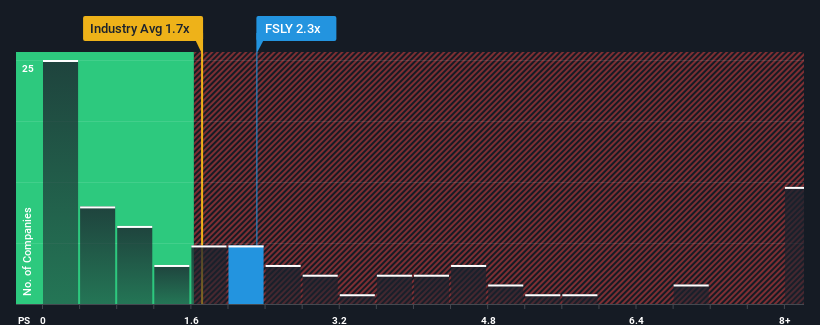

Although its price has dipped substantially, you could still be forgiven for thinking Fastly is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.3x, considering almost half the companies in the United States' IT industry have P/S ratios below 1.7x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Fastly

How Fastly Has Been Performing

Fastly certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fastly.Do Revenue Forecasts Match The High P/S Ratio?

Fastly's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. The strong recent performance means it was also able to grow revenue by 67% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 14% each year as estimated by the twelve analysts watching the company. That's shaping up to be similar to the 12% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Fastly's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Fastly's P/S?

There's still some elevation in Fastly's P/S, even if the same can't be said for its share price recently. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given Fastly's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Fastly you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FSLY

Fastly

Operates an edge cloud platform for processing, serving, and securing its customer’s applications in the United States, the Asia Pacific, Europe, and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion